When investing in overseas unhedged ETFs, your returns could take a hit depending on the current exchange rate. At a time where both the US dollar and the pound have had their ups and downs due to US trade wars and Brexit, profits are likely to take a hit depending on if you do or don't hedge and what currency you use to hedge with.

To simplify, a UK investor could invest in an ETF tracking the S&P 500, an index comprised of the top performing US-based companies. The underlying index could produce a return of three per cent, but the dollar could fall four per cent meaning the investor is facing a loss due to the forex rate crushing a potentially strong performing ETF. This is where a currency hedged ETF can protect the investor from currency risk.

To avoid currency risk, investing in a currency hedged ETF enables the investor to take a short position on the currency if they expect it to decline in the future. This requires a forward currency contract which is an agreement to trade the currency at a specific rate on a specific date. Therefore if the currency was to slide, the losses will be nullified by the positive performance of the underlying index.

GBP/USD

The graph above from DailyFX.com shows the GBP/USD price for 2019 so far. In nearly four weeks, the value of the dollar has fallen significantly from GBP/USD 1.25 to GBP/USD 1.32 at the time of writing. Besides a dip on the 3rd January, the pound has become increasingly more valuable.

Hedged vs unhedged

The equity market had a rough time in Q4 2018 but annual reports and performances from the big names that comprise the S&P 500 has been a factor which has helped the market recover. The S&P 500 entered the new year on 2,510 pts and has had an upward trend, sitting around 2,645 pts today.

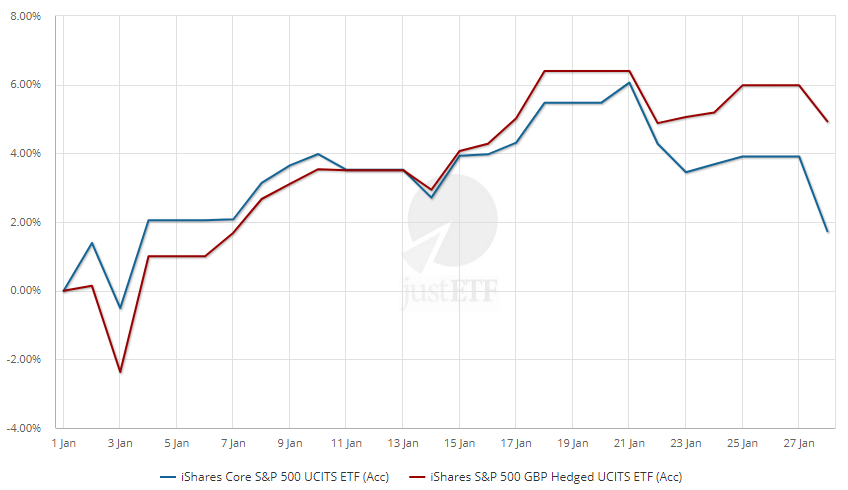

Looking at the largest ETF in terms of Assets Under Management, the iShares S&P 500 UCITS ETF, you are able to visualise how the returns are affected by choosing a hedged or unhedged ETF. The graph above from JustETF shows the returns for both the iShares S&P 500 unhedged ETF (Blue) and the GBP hedged ETF (Red).

From the previous graph, the value of the dollar strengthened on the 3rd January and then had a continuous slide for the remainder of the month. Both ETFs produced a loss for the first three days of the year, but the GBP hedged version produced greater losses due to the pound depreciating.

After the 3rd January, the dollar begins to depreciate which causes the two plots to switch places as the GBP hedged ETF produces greater returns. This is a result of the investor benefiting from the positive performance of the S&P 500 and the domestic forex rate.

In the current situation of an unclear Brexit deal and a US government just coming out of a shutdown, the state of both currencies is a difficult one to predict.