The breaks could soon be pumped on US big tech’s impressive run as US policymakers endorse a G7 global minimum taxation initiative that would have an outsized impact on America’s silicon behemoths.

In the recent global equities scorecard from Gina Martin Adams, chief equity strategist at Bloomberg Intelligence, US stocks were at the bottom of the rankings for second-half performance, with concerns around new tax measures among the key considerations for the downgrade.

Large-cap US tech and healthcare companies are expected to see the strongest downward pressure on earnings from the Group of Seven’s planned global minimum tax of 15%, the report said.

Although more than a quarter of the companies in the MSCI ACWI index paid less than this amount in effective taxation in 2020, the new G7 initiative is focused on the largest and most profitable companies – a combination of metrics that does not bode well for the US growth darlings of the past decade.

Bloomberg Intelligence identified the US is among the countries with the lowest market-cap-weighted effective tax rate in the world, accounting for two-thirds of companies globally that paid under 15% in effective taxes in 2020.

This, Adams said, has a lot to do with US large-caps’ propensity to attribute intangible sources of income to international jurisdictions – and vice versa for costs incurred by intangibles – with many overseas domiciles having combined federal and local statutory rates well below that of the US.

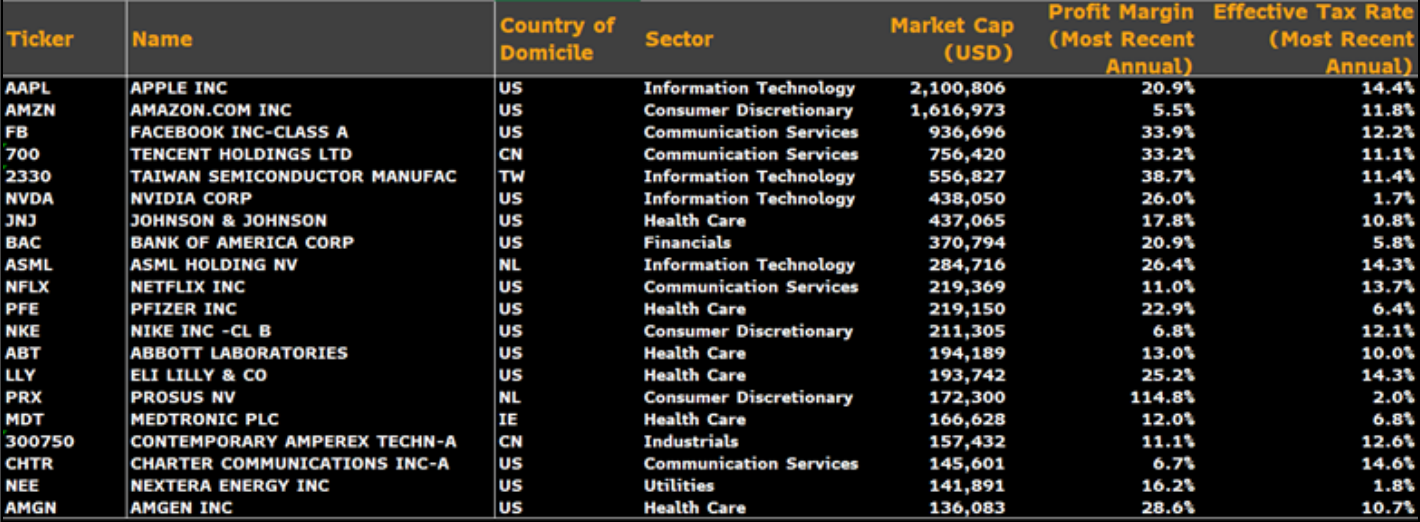

Though the details of the G7’s initiative had yet to be made public by the time of publication of BI’s scorecard, the research provider predicted the minimum tax would begin by targeting the world’s 100 largest and most-profitable companies – 56 of which are headquartered in the US and 41% of this headcount are in tech or healthcare.

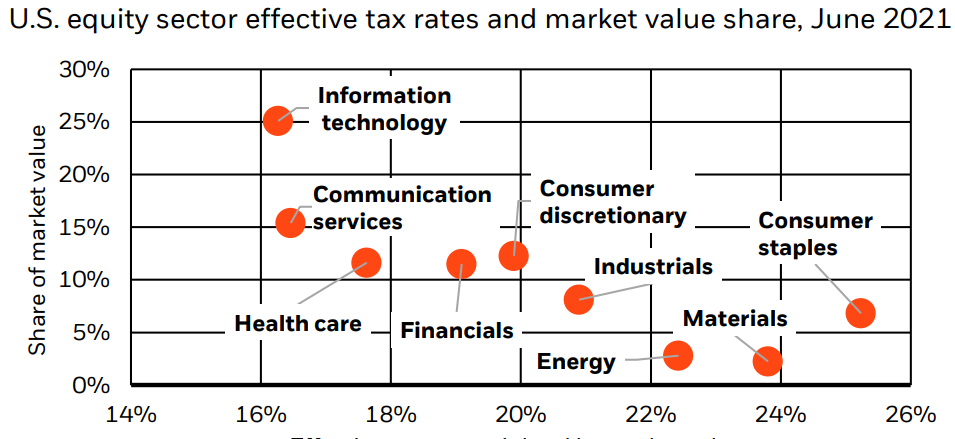

Of the top 100, 26 paid less than 15% in effective tax last year and 65% of these culprits are US-based. Furthermore, while a third of US domiciled MSCI All-World index constituents paid less than 15% effective tax in 2020, the tech sector paid scant contributions more often than other sectors.

Michael Casper, small cap equity strategist at Bloomberg Intelligence, added: “Based on companies' latest annual filings, the median S&P 500 member paid an effective tax rate of 19.5%, but 116 of 388 stocks with identifiable rates paid less than the new minimum.

“A quarter of those are information-technology businesses. The median S&P 500 tech stock paid 16.2% effective tax, though nearly half – 29 of 60 – paid less than 15% last year.”

Of the FAAMG grouping of the five largest stocks in the index, only Microsoft and Alphabet paid an effective tax rate above the 15% threshold in 2020.

Given the breadth of large cap tech firms falling short of the mark, it is clear to see why effective enforcement – or at least the discussion – of a 15% minimum rate might cause headaches for US big tech.

Speaking on the potential impact of the initiative, BlackRock said in its weekly market commentary that the ongoing shift in momentum away from growth equities, overlaid with the possibility of a global minimum tax, tempered the firm’s near-term enthusiasm for US large-cap equities.

The world’s largest asset manager added US President Joe Biden may be particularly keen to support this kind of initiative out of practicality, given the generous – if diluted – fiscal spending packages his government have announced since coming into office.

It added the regions set to enjoy the full pace of their own economic recoveries during the remainder of the year, such as Europe and Japan, also happen to have higher taxes and more stringent regulation than the US, limiting the scope of impact to be felt by the G7’s plans.

“Uncertainties around potential tax increases are making it hard for investors to position for the potential impact for now,” BlackRock’s commentary noted. “We see U.S. equities potentially coming under pressure from higher taxes and other factors, but still like small- and medium-cap US companies as tax increases and regulations targeting large multinational companies are less likely to affect them.”

The asset manager also said it believes structural shifts to remain favourable for large-cap tech firms and would perhaps offset some of the impact of tax hikes with further revenue increases.

However, another structural point to note is discussions around environmental, social and governance (ESG) classifications, with the point being raised in a recent report by Vincent Deluard, director of global macro strategy at StoneX group, that big tech firms which perform relatively well on environmental metrics should be penalised for their shortcomings on social considerations – such as low tax contributions, monopolistic behaviour and low employee headcount.

As ESG continues to evolve, and data on these areas readily available, it will be interesting to see whether one of the market’s most free-flowing source of capital uses its power to position tax contributions more centrally on the agenda.