Junk bond ETFs have the largest percent of AUM short sold, new data reveals.

Junk bond ETFs are by far the most short sold of any kind of ETF with more than one quarter of HYG and JNK, the most popular US junk bond ETFs, on issue being short sold.

A whopping $6.7bn worth of HYG and JNK are out on loan, new data from FIS Astec Analytics reveals. Every junk bond ETF borrowed will be used by short sellers to bet against the market, as junk bond ETFs are not accepted as collateral - the only other major reason investors borrow ETFs. The $7bn borrowed represents more than one-quarter of the total $25bn market cap of the two funds.

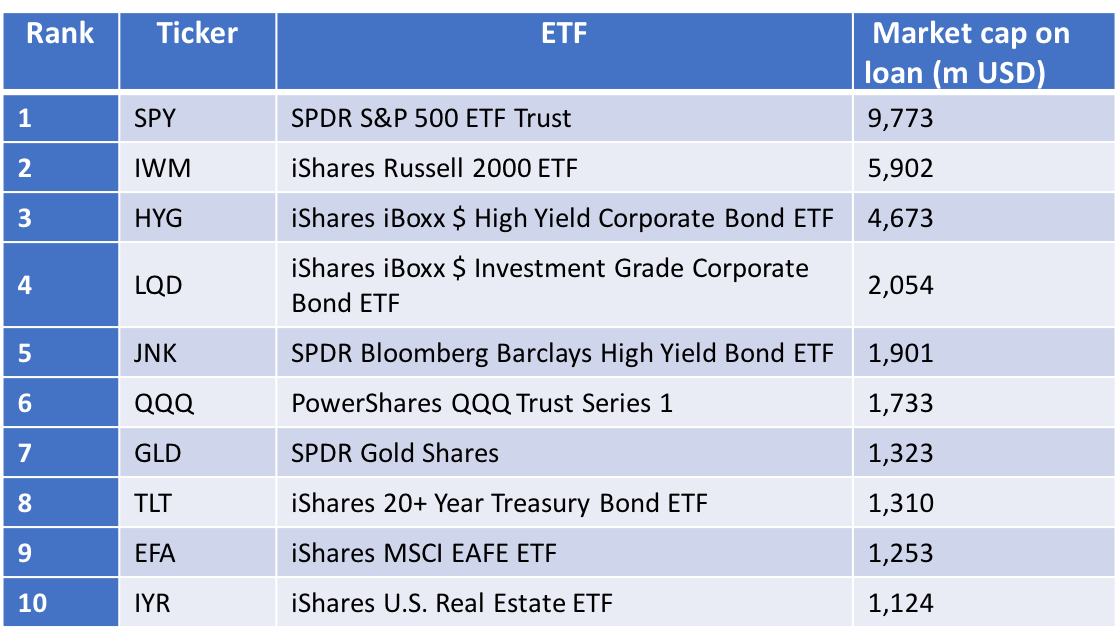

Only two other ETFs - State Street's SPY and iShares IWM - were more borrowed than HYG, with $9.7bn of SPY and $5.9bn of IWM out on loan. But in these cases, it is unclear how much is being borrowed by short sellers as they can be accepted as collateral. It also represents a much smaller fraction of SPY's $270bn and IWM's $41bn asset bases.

Commenting on the data, David Lewis, a director at FIS, said: "Not all ETFs are made available for lending. The data may reflect the fact that some ETFs issues are more lendable than others as not all investors choose to lend their securities.

"That said, technically, there are very few ETFs that are not lendable, it is just that lending is an entirely optional activity which tends to be undertaken only by the largest funds."

He imagines that most ETFs on loan will be borrowed to be sold short, although there are some being used increasingly for collateral.

The short selling data gives body to an argument popular on online forums that junk bond ETFs are popular with professional credit investors only because they want to short sell them.

"What seems pretty clear to me is that credit investors are getting long the "smart" way by selling [credit default swap] protection in a low volatility environment," wrote the Heisenberg Report, a popular finance blog.

"And then they're hedging that long position by shorting the dumbest, most illiquid HY instrument available: your ETFs. If you own those ETFs that should give you pause."

Heisenberg argues that junk bond ETFs are dangerous because they give an illusion of liquidity. This illusion arises because the junk bond ETFs are much more liquid than their underlying assets. This is problematic because junk bond ETFs are popular with retail investors, and the ability of mum and dad investors to sell their junk bond ETFs on the secondary market depends on primary market liquidity. This liquidity mismatch is not unique to junk bond ETFs, but in the case of junk bond ETFs it's particularly acute.

But not everyone agrees. Writing in Bloomberg, former ETF trader Jared Dillian wrote: "If the market "crashes,"… my guess is that there is the potential for a high-yield bond ETF to trade at a 5 percent to 10 percent discount to its NAV. Through arbitrage, the underlying bonds will eventually "catch up" with the ETF, but it may take several hours".