At the beginning of the last week media reports circulated that the Bank of Japan (BoJ) was considering changing its interest rate targets. It prompted the 10-year government bond yield to rise to 0.09% on Monday while Japan's flagship equities index, the Nikkei fell over 1%.

It once again reminded us how how the BoJ's policy decisions can trigger serious volatitliy. The BoJ's regular policy meeting is now due at the end of this month and investing in Japan has left market watchers on the fence.

Ben Seagar-Scott, at Tilney Best Invest says: "Reports that the Central Bank is poised to scale back some of its loose monetary policy mechanisms (subsequently denied) have caused some excitement in the market, but that mostly seems to be noise. The economy is particularly sensitive to global trade, and the recent free trade agreement with the EU is a positive - but how the global trade war develops is such an unknown that it's difficult to invest on the back of."

The mixed economic signals coming from Japan include inflation still being far below the bank's 2% target. The BoJ hasn't started monetary tightening yet and the country has also been hit by Trump's steel tariffs.

However, economic growth is expected to pick up and the contraction earlier this year is described as being merely a bump in the road. Bloomberg reported that Takeshi Minami, chief economist at Norinchukin Research Institute said of the contraction: "This will not be a turning point -- but is temporary."

There are also other supportive factors for Japan and this could be the reason to be more optimistic.

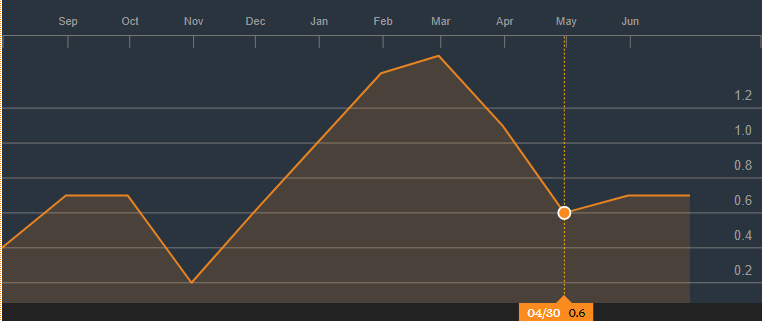

While inflation is yet to pick up, a lift in domestic demand should mean higher growth ahead. Japans Consumer Price Index (CPI) is steadily rising again this year after it came off at the end of April. Consumer prices are the measure of prices paid by customers for a market basket of consumer goods and services.

(The CPI Index over the last year in the table below)

Source: Bloomberg

Consumer prices in Japan increased 1% year-on-year in December 2017. This pick up in prices is likely to help boost the country's equities.

Exports from Japan are also doing well.

According to Trading Economics, exports from Japan rose by 6.7% year-on-year in June 2018, just shy of the 7% expected gain. This was largely driven by exports to the US declining by 0.9%, the first drop in 17th months, which could possibly be explained by global trade tensions with the US. Shipments of cars, semiconductor manufacturing equipment and aircraft to the US declined.

Japanese Exports (table below)

Source: Trading Economics

Investors wanting to benefit from Japanese exporting can look to the Invesco STOXX Japan Exporters UCITS ETF which has returned a 3.05% over the last three years and 4.8% over the last month.

Trading Economics also forecasts that the country's GDP will grow by 0.3% in the third quarter of the year and 0.7% in the fourth.

Finally, according to a report from MUFG Bank, "the financial statements of corporations by industry published by the ministry of finance reveals resilience to adverse business conditions is steadily increasing due to improvements in management. Corporation's break-even point improved reaching 79% as of FY2016 and the ratio of net worth was 40%. The Japanese economy is expected to continue to grow gradually on the back of resilient across business sentiment, labour market and wage growth, yet it is perhaps too soon to be optimistic."

Japan's equities are also interesting from a value perspective. It's still the case that many companies are not run to maximise shareholder returns but to maximise social utility for all stake holders (employees, suppliers, related companies, banks, customers, government and shareholders perhaps last of all). It means that profitability is low when compared to western companies, but as international competition filters in this is slowly changing.

Investor demand for exposure to Japan also continues. According to ETF consultancy ETFGI, assets invested in ETF and ETPs listed in Japan reached a record high of $312bn at the end of June. YTD assets increased 13.1% from $276bn at the end of last year. ETFGI's report states that investors in Japan have tended to invest in core, market cap and lower cost ETFs providing equity exposure to Japan during 2018.

ETF

1 Year

Return

INDEX

(Xtrackers)

TICKER TER WISDOMTREE JAPAN EQUITY UCITS ETFDXJG0.40%6.97%WisdonTree Japan Equity IndexFIRST TRUST JAPAN ALPHADEX UCITS ETFFJPU0.70%n/aNASDAQ AlphaDEX Japan IndexAMUNDI INDEX MSCI JAPAN DRCJ1G0.45%1.42%MSCI JapanAMUNDI JAPAN TOPIXTPXG0.20%9.33%TOPIX Total Return Euro Daily Hedged IndexLYXOR CORE MSCI JAPAN (DR) UCITS ETFLCJD0.12%n/aMSCI Japan Net Total Return IndexLYXOR JAPAN (TOPIX) - DIST $JPNU0.45%10.01%Topix IndexUBS ETF - MSCI JAPAN UCITS ETF(JPY)A-DISUC650.35%10.31%MSCI Japan IndexVANGUARD FTSE JAPAN UCITS ETFVDJP0.19%10.66%FTSE Japan IndexX MSCI JAPANXMJD0.30%10.32%MSCI Japan Net Total Return IndexHSBC MSCI JAPAN UCITS ETF $HMJD0.19%10.42%MSCI Japan IndexUBS ETF MSCI JAPAN (JPY) A-DISUB020.35%9.43%MSCI Japan IndexINVESCO JPX-NIKKEI 400 UCITS ETFN4000.19%9.62%JPX-Nikkei 400 IndexLYX ETF JPXNIKKEI400(DR) ACC THJPX40.25%9.66%JPX-Nikkei 400 IndexNOMURA NIKKEI 225 EUR-HEDGED UCITS ETFNXKE0.60%12.6%Nikkei 225 TR EUR-hedged IndexAMUNDI JPX-NIKKEI 400JPNY0.18%8.86%JPX-Nikkei 400 IndexISHARES MSCI JAPAN SRI UCITS ETFSUJP0.30%10.79%MSCI Japan SRI IndexSPDR MSCI JAPAN UCITS ETFJPJP0.30%9.46%MSCI Japan Index

This is a non-exhaustive list of exposures to Japan; there are other leveraged, currency hedged, inverse and smart beta ETFs that can be used to access it.

Peter Sleep, senior portfolio manager at 7IM: "Even though Japanese companies are not very profitable Japanese corporates are still capable of providing equity-like returns by way of dividend and capital growth. They also have an important role to play for a Sterling investor because they offer very good diversification to the UK equity market. A good part of this diversification comes from the yen. At times of crisis the yen tends to rise and sterling tends to fall. This phenomenon helps offset the volatility an investor might experience with a UK-only portfolio. For instance in 2008, the FTSE dropped 33% whereas the TOPIX fell by 3% in sterling terms (in yen terms it dropped 42%)."

Hedged exposure seems to have worked over the last year. Nomura's Nikkei 225 Euro hedged ETF has returned 12.6% over the last year, but hedging will cost investors slightly more, the expense ratio of the fund is 0.60%.

However, Seagar-Scott advises that while "the yen often acts as a ‘natural hedge' I would be wary of taking hedged equity exposure unless I had particularly strong conviction."