It's a nervous time for property investors as Brexit and the rise of online shopping make a big impact.

On the residential side of things, owners are struggling to sell their homes as the market sits in limbo until a Brexit deal emerges. Indeed Halifax has announced that annual house price growth has fallen to 1.5%, its lowest rate in over five years.

On the commercial side, we're seeing substantial discounts on several REITS - that's where the share price is much lower than the stated value of the assets held by the REIT. These big discounts are mostly down to worries about the future strength of the high street as well as leading shopping malls.

But it isn't all bad news. Halifax reports that house prices are still up in London - albeit by only 0.2% - in spite of Brexit fears.

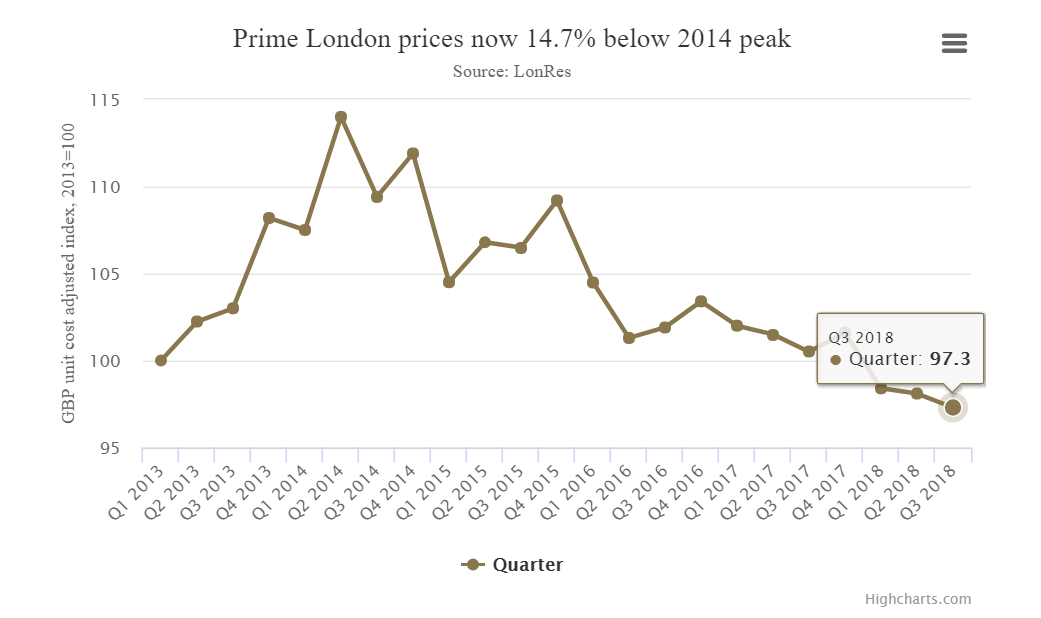

Also, with London as a financial centre of excellence - it ranks second (only to New York) in the Global Financial Centres Index - house prices have historically recovered their value after any dip. With prices and sales slowing - see chart below - the market could be nearing a bottom suggesting a good time to get in.

Source: Coutts

And the strength of the City as a financial centre should maintain values for office accommodation in London.

If you want to invest in UK commercial property, there's only one ETF that focuses purely on the UK market: the iShares UK Property ETF (IUKP). It's returned -0.55% over the last three years but 5.21% in the last year.

Again, the last three months have been bad for the ETF, returning -1.37%. However, the dividend indicated gross yield on the ETF is 3.37%.

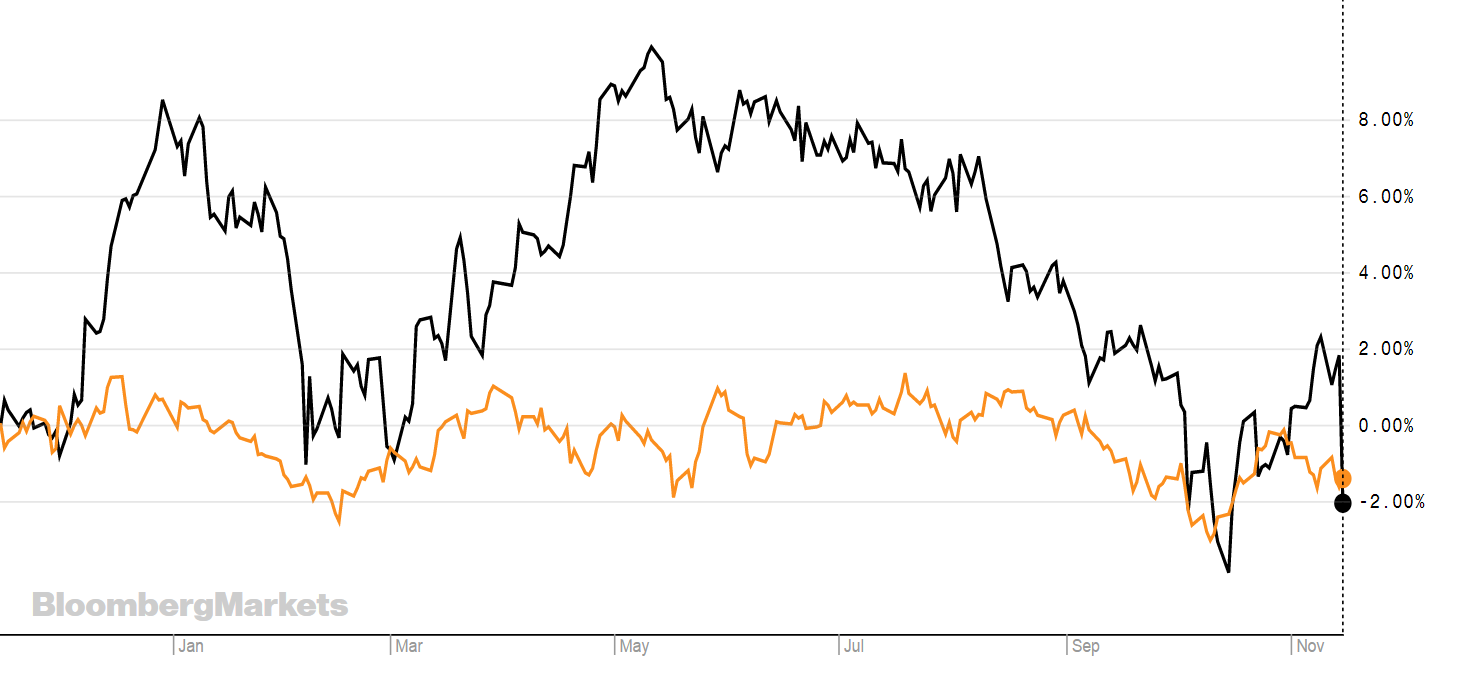

When compared to a UK gilt ETF - the iShares Core UK Gilts ETF (IGLT) - which has returned -0.27% in the past year, -2.14% in the past three months and has a dividend indicated gross yield of 1.33%, the property market suddenly starts looking a bit more interesting.

The graph below compares the performance of IUKP (in black) and IGLT (in orange) over the last year.

Source: Bloomberg

For those who can't afford to buy actual bricks and mortar, REIT ETFs offer investors a way to get broad exposure to the real estate markets.

REITs were launched in the UK in 2007, since then more than 80% of listed property companies in the UK that could convert to REIT status have done so, according to BFP.

A 2017 report from EY also finds that global real estate and investment trust (REIT) markets have continued to expand and now surpass a total market capitalization of approximately US$1.7t. The number of countries now offering REITs as an investment vehicle has almost doubled in the last 10 years to 37, with 7 new country entrants in the past 4 years and 2 more on the cusp of new REIT legislation.

While there seems to be only one UK focused REIT ETF on the London Stock Exchange some of the others incorporate the UK through the underlying index. The FTSE/NAREIT Developed index includes some UK stocks, but is largely made up of US stocks.

The HSBC FTSE EPRA/NAREIT Developed UCITS ETF (HPRO) has returned over 11% in the last three years - despite performing negatively (-3.14%) in the last three months. The dividend yield is 2.72%.

In the US - the largest REIT market - REIT performance has steadily improved, gaining 1.4% in the first six months of the year, according to Lazard Asset Management. Its report states that the latest second quarter earnings season seems to confirm that real estate pricing remains firm, REIT balance sheets are arguably in the best shape since the start of the modern REIT era, and the REIT merger and acquisition (M&A) environment is providing a strong mark-to-market. This continues to create a solid foundation for property stocks, but not necessarily a good launch pad for outsized returns, until the sentiment shifts in favour of value and more "risk-off" categories.

In order to qualify as a REIT at least 75% of profits must come from property rental, and 75% of the company's assets must be involved in the property rental business. REITs must also pay out 90% of their rental income to investors and dividends are treated as property income and therefore taxed in the same vein. They can be held in ISAs and are generally liquid investments due to being listed and transparent.

One thing to be aware of when investing in REITs is how leveraged the companies are. This is because 90% of the company's income is paid out, it makes it hard for the companies to then reinvest in new properties from their own profits. In this case they will take on new shares or debt. Therefore, it's a good idea to keep an idea on the level of debt/leverage REIT companies have.

Below is a list of some of the REIT ETFs listed on the London Stock Exchange.

HPRD

EPRA

EPRE

IUKP

DPYA

EURL

EURE

ETF1 YR RTNTERDIV YIELDINDEXHSBC FTSE EPRA/NAREIT Developed UCITS ETF HPRO1.83%0.40%2.72%FTSE EPRA/NAREIT Developed IndexHSBC FTSE EPRA/NAREIT Developed UCITS ETF1.05%0.40%2.73%FTSE EPRA/NAREIT Developed IndexAMUNDI INDEX FTSE EPRA NAREIT GLOBAL UCITS ETF1.07%0.24%n/aFTSE EPRA NAREIT GLOBAL IndexAmundi Ftse Epra Europe Real Estate UCITS ETF2.14%0.35%n/aFTSE EPRA/NAREIT Developed Europe IndexiShares UK Property UCITS ETF5.21%0.40%3.37%FTSE EPRA/NAREIT UK IndexiShares Developed Markets Property Yield UCITS ETFn/a0.59%n/aFTSE EPRA/NAREIT Developed Dividend+ IndexSPDR FTSE EPRA Europe EX UK Real Estate UCITS ETF1.22%0.30%n/aListed real estate market in Europe excluding the UKSPDR FTSE EPRA Europe EX UK Real Estate UCITS ETF (€)4.48%0.30%n/aListed real estate market in Europe excluding the UK