Vanguard's funds have the reputation of lobster traps: investors who go in do not come out. Whether it's the GFC, the Eurozone crisis or the Shanghai flash crash, Vanguard's investors buy and hold, as Jack Bogle would have recommended.

This discipline was on display again during the week-long correction last month. According to Vanguard, during the correction, 97% of Vanguard-owning US households did not trade. Even when the stock market was at its most volatile, trading rarely exceeded 1% of households.

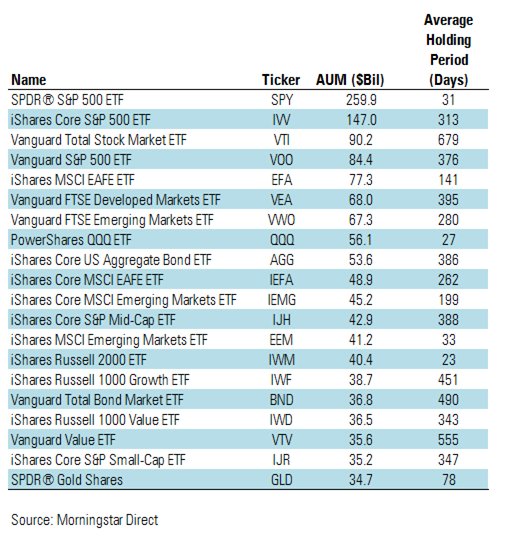

[caption id="attachment_3095" align="alignnone" width="511"] Source: Ben Johnson, Morningstar[/caption]

To get a taste of what this looks like, Morningstar's

a list of the biggest ETFs and compared how long they're held for on average.Vanguard's banner ETF, the $93bn Vanguard Total Stock Market ETF, is held on average for almost two years. Other famous funds, like State Street's SPY, PowerShares' QQQ and iShares' EEM are held on average for one month. (This, however, may be an unfair comparison, as SPY, QQQ and EEM are popular as trading tools and targeted more at institutional investors, who tend to trade more frequently. SPY, for instance, was explicitly created as a trading tool).

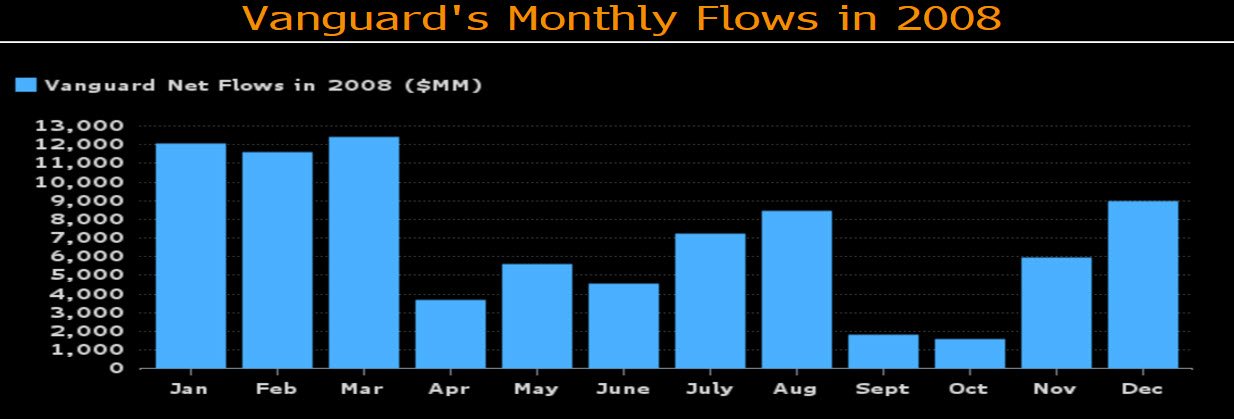

But we've been here before. In 2008, as global stock markets crumbled, Vanguard saw inflows every single month, as Bloomberg's

.

[caption id="attachment_3097" align="alignnone" width="1024"] Source: Eric Balchunas, Bloomberg[/caption]