Exactly as expected, this year's SPIVA card put Aussie fund managers to the sword.

Most Aussie stock pickers and fund managers failed to beat their benchmarks in 2017, suggesting investors would have been better off in low-cost ETFs than in actively managed funds, the latest SPIVA scorecard has found.

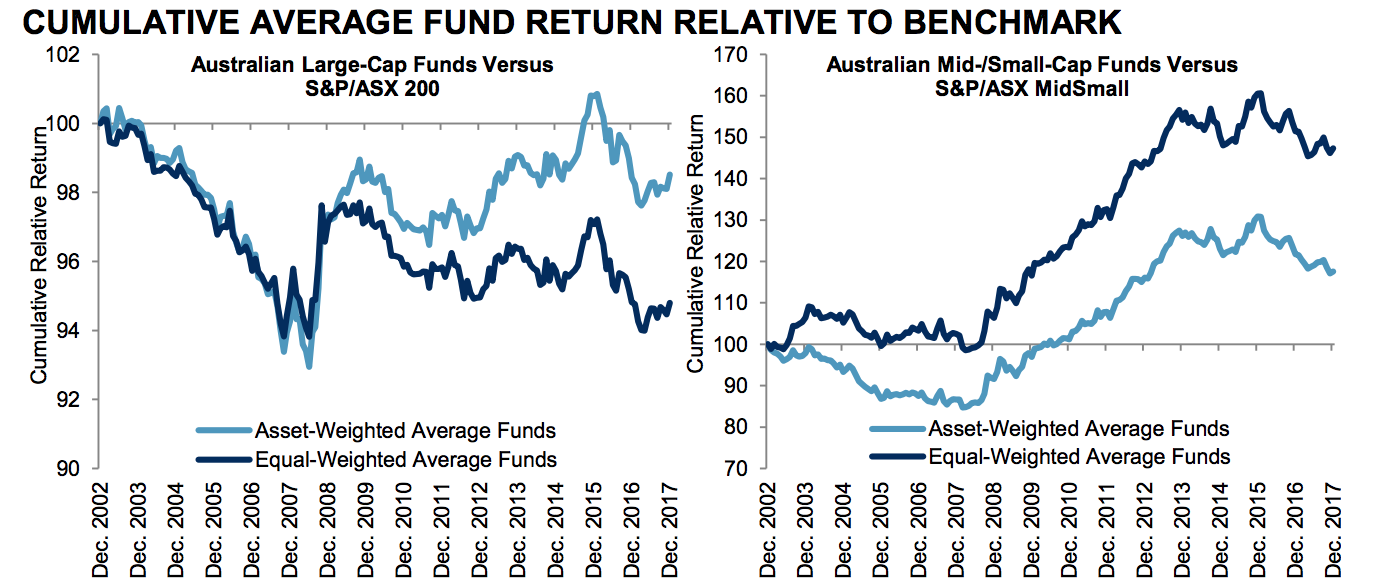

A mere 41% of Australian equity fund managers beat the ASX 200 last year. The worst performers were bond funds, which overwhelmingly lagged their benchmarks - and by the widest margin. The best performers were A-REIT funds the majority of which managed to beat their index in 2017.

"Evidently, the vast majority of A-REIT funds tended to be more defensive than their benchmark over the past five years, as most of them recorded less volatile returns over the one-, three-, and five-year periods, said Prascilla Luk, a research director at S&P.

"This characteristic seems to be unique to funds in the A-REIT category and has not been observed in other Australian fund categories."

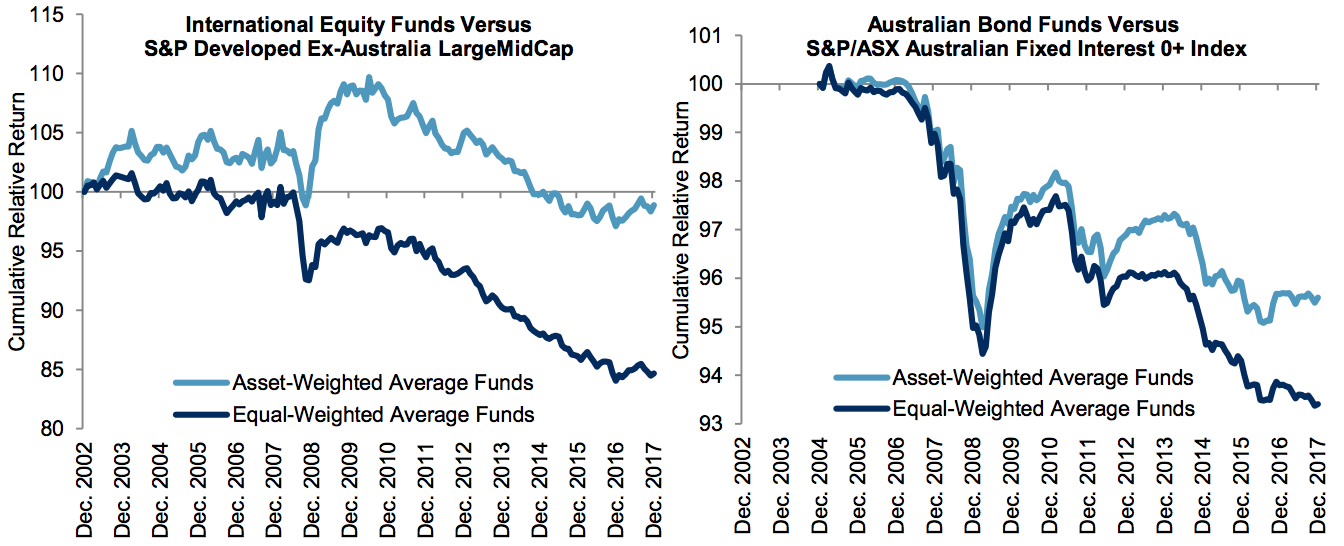

On a 10-year basis, the picture for active managers was even dimmer. Over the past 10 years, more than 85% of international equity and Australian bond funds and more than 70% of Australian general equity and A-REIT funds underperformed their respective benchmarks, SPIVA found.

As well as underperforming, most active funds died young, SPIVA found. Over the last 15 years, Australian bond funds had the lowest survival rate of 33%, while Australian mid- and small-cap funds had the highest rate of 59%. Funds across all categories had an overall survivorship rate of 51% over the 15-year period.

SPIVA, also known as the S&P Dow Jones Indices Versus Active, measures how active fund managers perform compared to their benchmark indexes. Active managers typically benchmark themselves against a famous index - like the ASX 200 - which they try to beat.

At stake in the measurement is whether the high fees charged by fund managers - usually around 1.5% of assets managed - are justified. If fund managers fail to beat the benchmarks investors can switch to ETFs, which deliver the same performance as their indexes but at a fraction of the cost.