Today's new ETF listings from around the world.

USA

Virtus lists actively managed preferred stock ETF

New York-based Virtus ETF is listing a new actively managed preferred stock ETF that looks like a traditional actively managed fund. The Virtus InfraCap US Preferred Stock ETF (PFFA) will swallow up the preferred stock of US-listed companies while performing cool tricks like borrowing money from banks and buying and selling options.

Preferred stock (called "hybrids" elsewhere) are something of a halfway house between bonds and shares. They are like shares in that they pay dividends and are subordinate to bonds (they are called "preferred" because they get paid out before ordinary shares). But they are also like bonds in that their payments can be at a fixed rate and preference stock owners receive zero voting rights.

PFFA will invest in preferred stock of any kind so long as it is listed in the US. To qualify, the stock must be issued by a company with a market cap above $100 million.

When picking which stocks to invest in, PFFA will look at companies' competitive positions, ability to earn a high return on capital, the projected stability of profits, ability to generate cash in excess of growth needs and its access to additional capital, the prospectus says.

PFFA will also use an options strategy. This will involve writing put/call options in order to make more money while buying them to reduce risk.

The fund can also borrow up to one-third of its total assets in order to create leverage.

Analysis: active management and leverage can add value to preferreds

Preferred stock ETFs are not new and have existed in the more familiar passive index-tracking form since 2007 (iShares PFF has raked in $16bn). But it has been the great failing of preferred stock ETFs that they have lost to their actively managed counterparts.

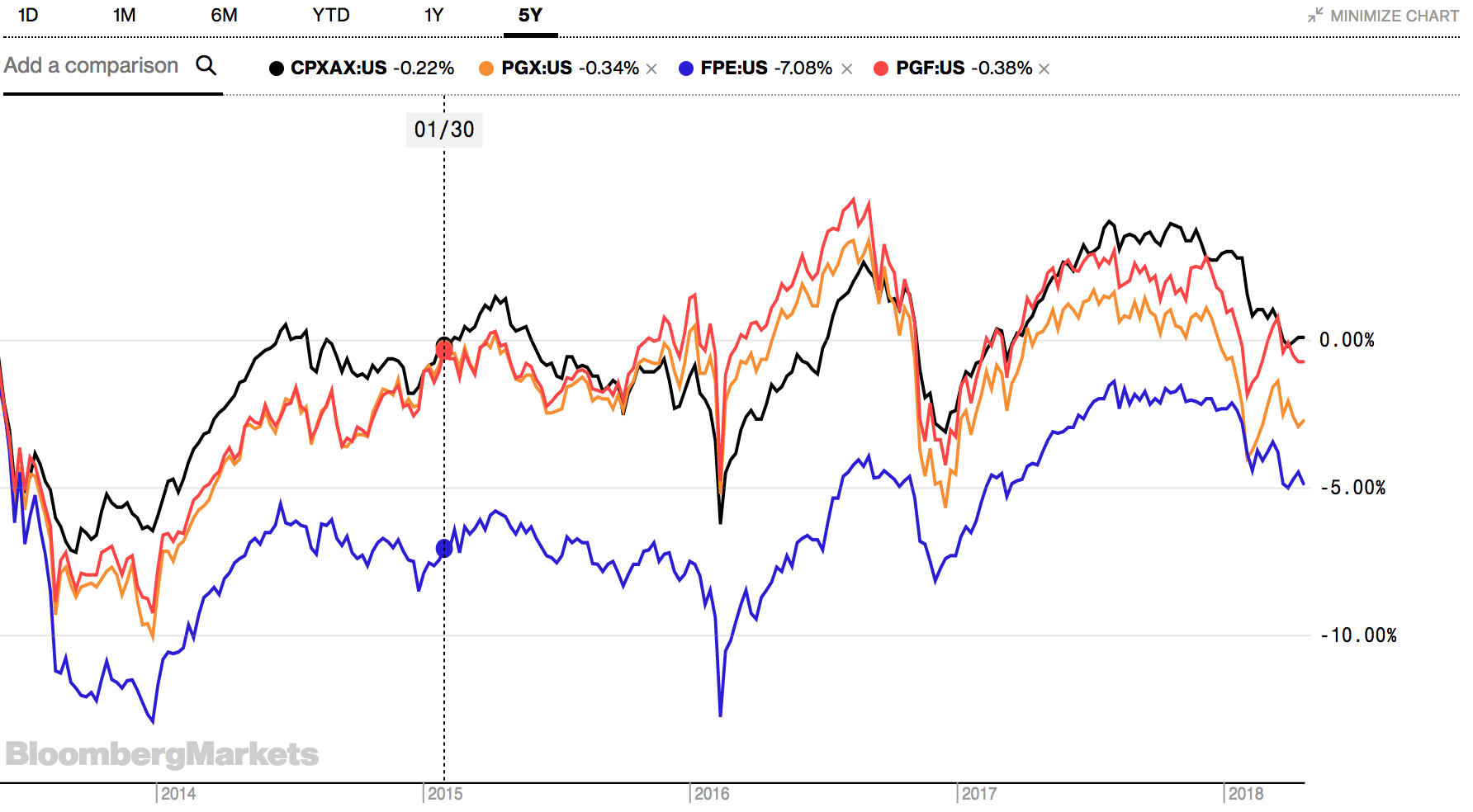

Actively managed mutual fund Cohen & Steers Preferred Securities & Income Fund (CPXAX) has beaten every passive preferred stock ETF on a total return basis for which there is 5 years of data. CPXAX outperformance comes despite having significantly higher (more than double) fees than the passive ETFs it competes with.

Why does CPXAX outperform? Largely due to its use of leverage. While one might be inclined to think leverage increases risk, CPXAX has actually been less volatile than leverage-free passive ETFs. In theory, using leverage on preferred stocks is less risky than with ordinary shares as preferred stocks sit higher on the capital structure. But investors should also remember what happened to preferred ETFs during the 2008 financial crisis, when they sunk even more than junk bond ETFs.

The listing of an actively managed and leveraged preferred stock ETF might just give ETFs the chance to beat mutual funds on performance. And because the fund is crammed into an ETF structure, the major pitfall of these types of mutual funds - loading fees - is avoided. Our feeling in the air, however, tells us that PFFA will carry a high management fee.