New research shows a tiny sliver of companies, with ExxonMobil at the front, have carried the stockmarket for 90 years. While the average American company is just a dud.

A mere 0.3% of American companies have accounted for almost half the stock market's gains since 1926, and almost all of the stock markets gains are accounted for by a mere 4% of companies new research has found.

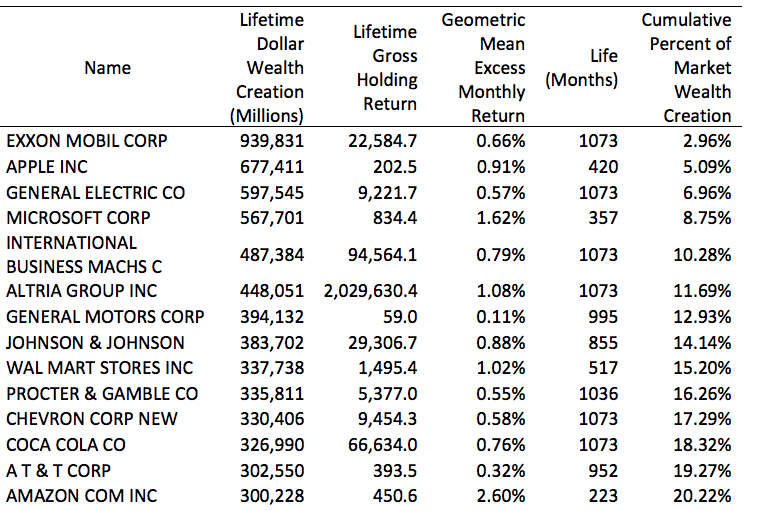

According to a new study by Hendrik Bessembinder, a professor of finance at Arizona State University, ExxonMobil is the most successful company in the history of corporate America, having generated almost $1 trillion in lifetime dollar wealth creation. Exxon's exorbitant outperformance put it almost 30% ahead of second place Apple, which had generated around $677 billion.

Source: Hendrik Bessembinder

The bottom 96% of American companies, Prof Bessembinder found, provided a similar long-run return to government debt but at a higher level of risk.

"Most common stocks do not outperform Treasury Bills over their lives," Prof Bessembinder wrote.

"The fact that the broad stock market does outperform Treasuries over longer time periods is fully attributable to… the relatively few stocks that generate large returns, not to the performance of typical stocks."

Making matters worse, the average publicly listed company only survives seven years with a median lifetime return of -3.7%. Meaning that if investors invested in the median stock, they'd be losing money.

Contrary to the claims of some quants, the study found little evidence supporting the idea that smaller companies do better (what is sometimes called the "small cap premium"). Finding, if anything, that larger companies and familiar franchises drive more of the market's gains.

"At the decade horizon, only 43.1% of stocks in the smallest decile have holding period returns that are positive... In contrast, 80.0% of stocks in the largest decile have positive decade holding period returns."

How to make money from the stock market

Prof Bessembinder offered no explicit recommendations for how investors can gain from the rise and rise of the stock market. He did however provide a warning for active money managers.

"The results help to explain why active portfolio strategies, which tend to be poorly diversified, most often underperform their benchmarks," he wrote.

"Underperformance is typically attributed to transaction costs, fees, and/or behavioral biases that amount to a sort of negative skill.

"The results here show that underperformance can be anticipated more often than not for active managers with poorly diversified portfolios, even in the absence of costs, fees, or perverse skill."

And his data provided two helpful suggestions about how investors can capture more of the stock market's gains. The first suggestion, which comes through clearly in the data, is to use equally-weighted indexes which allow better diversification than their more popular market-weighted peers.

"I find that the single stock strategy underperformed the value-weighted market in ninety six percent of the [time], and underperformed the equal-weighed market in ninety nine percent of the [time]."

The second suggestion is that companies with little or no debt have been better bets historically - although no explanation is offered as to why.

"Unlevered firms on average deliver strong stock market returns," he found.

"The mean annual holding period return for unlevered firms is 27.23%, compared to 14.72% for the entire sample."

The findings are in keeping with other studies that have found it is more important for investors to capture the winners than avoid the losers when picking stocks.