Dr Paul Docherty is a senior lecturer at Monash University and one of Australia's foremost experts on asset pricing. Outside academia, he is a consultant to the funds management industry. In his interview with ETF Stream, Dr Docherty explains that factor investing can and does work in Australia, but current smart beta ETFs appear mostly interested in dividends.

ETF Stream: How robust are French and Fama's original factors in Australia? Some have argued they never really worked here.

Dr Paul Docherty: The majority of the academic research indicates that over long time periods the Fama and French factors are highly robust in Australia, as are other factors such as momentum. But it's important point to note that this evidence relates to long-run averages - an important feature of factor investing is that you need to have a long-term horizon.

Take the value factor for example. An investment strategy that goes long in value stocks and short in growth stocks with annual rebalancing has generated an average return of approximately 50 basis points per month since 1990. This means that value stocks have outperformed growth stocks by, on average, 6% per annum. However, there are periods where value significantly underperforms. A recent example of this in Australia was from January 2014 to December 2015, when value underperformed growth by around 1% per month.

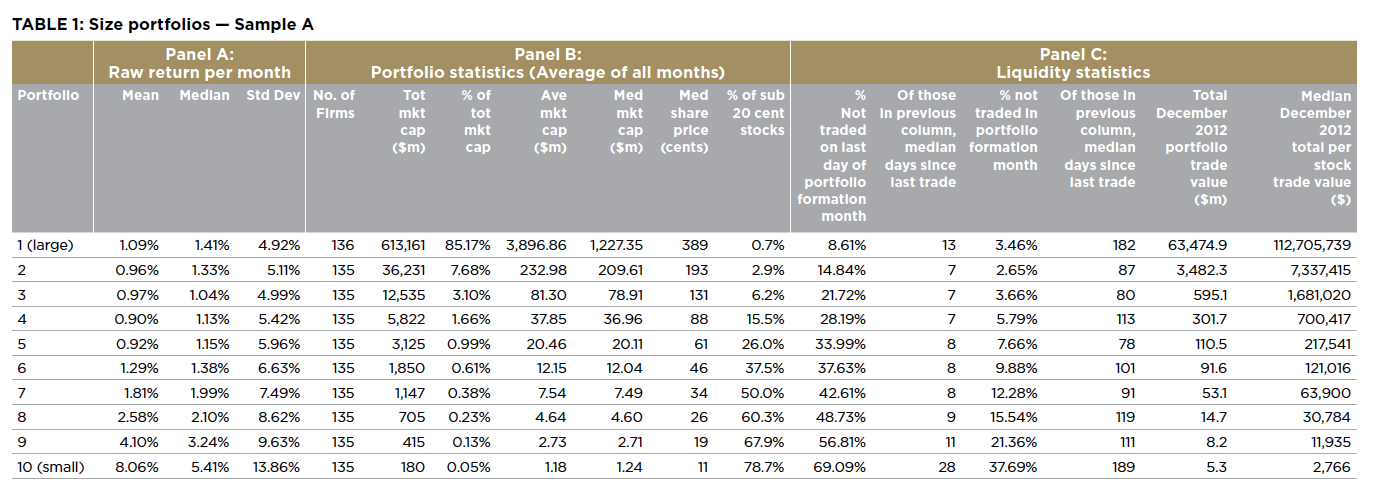

Table 1: The higher returns but lower liquidity of small and micro caps:

[caption id="attachment_3758" align="alignnone" width="627"] Source: Dr Clive Gaunt.[/caption]

The size factor is a more interesting proposition in Australia. While a number of academic studies demonstrate that small firms outperform large firms on a risk-adjusted basis, these are often "statistical" tests that ignore transaction costs and include a number of very small cap stocks that are outside the investable universe of Australian institutional investors. Evidence in favour of the size factor in Australia tends to disappear if you constrain your analysis to only looking at those "investable" stocks. For example, the ASX100 has outperformed the ASX Small Ordinaries Index (which is the ASX300 ex top 100) over the past decade. A potential reason for this is that most of the evidence relating to the size effect suggests it is largely driven by micro-cap stocks, which are not investable in the Australian market.

Momentum has been the strongest performing factor in Australia over the past thirty years. Since 1990, stocks that are past winners have subsequently outperformed stocks that are past losers by more than 1% per month. Interestingly, despite the strong performance of this factor, Australian asset managers tend to be less inclined to invest in momentum compared with other factors, particularly value. This may be because momentum investing seems counterintuitive - i.e. buying stocks that have recently gone up in value - but the very fact that investors are behaviourally inclined to see momentum as counterintuitive is potentially why it works so well.

Small cap Aussie fund managers are often touted as proof that active management works. Why, in your experience, are small cap active managers able to beat their benchmarks?

The Australian market is highly concentrated - the top 10 stocks comprise nearly 50% of total market cap and it is often not feasible for institutional investors to take large positions in stocks outside the top 200 or 300 without a significant price impact. Given small cap stocks in Australia are highly illiquid and often have limited analyst coverage, this segment of the market is less efficient compared with the larger cap space. These inefficiencies provide opportunities to active investors.

Why do small cap ETFs fail to beat large cap ETFs in Australia? Small cap ETFs beat their large cap counterparts in the US and Germany.

The academic evidence suggests that the size factor is predominantly driven by the returns of micro-cap stocks. Small cap ETFs in Australia still invest in stocks that are quite large in terms of their size ranking. For example, ETFs that track the Small Ordinaries Index invest in the 101st to 300th largest stocks out of a total of more than 2250 listed companies. It is simply not feasible due to illiquidity and transactions costs for these ETFs to invest in stocks that are much smaller. So it is really a question of whether a passive exposure to the size factor is feasible in Australia.

Chart 1. US small cap ETFs outperform

Australian small cap stocks are also more exposed to illiquidity risk compared with other larger markets - which means a passive exposure to small firms in Australia can be particularly affected by periods of market crisis where liquidity dries up. For example, Australian small caps underperformed large caps by nearly 30% in 2008.

Value tends to be the most popular factor with investors. Yet constructing a value index is notoriously difficult and definitions differ. What, in your opinion, is it the most important metric for building a workable value index (cash flow, price to book, P/E)?

The weight of evidence suggests that the price-to-book ratio is the single best measure for capturing value. Australian studies that use low price-to-book ratio as an indicator of value find strong evidence that this ratio is related with future returns. For example, Gharghori et al. (2013) compared several different measures of value in Australia and found that the price-to-book ratio was the best.

In terms of the earnings based measures, I prefer cash flow-to-price rather than P/E. My personal opinion is that net cash flows are a more pure indicator of economic performance compared with profit as it is harder for management to manipulate. Earnings, by contrast, include an accruals component that has been shown to be negatively related with returns.

When you look at the academic literature on factors, then look at investment products claiming to offer factor exposures (like smart beta ETFs) how good a job do you think asset managers have done of building products that stay true to the academic literature?

There are a number of differences between factor construction in academic research and the processes used by smart beta ETFs. However it is important to note that the academic studies generally report statistical evidence - that is, the performance of a trading strategy in a frictionless market without transaction costs. Therefore, a key reason for the difference is that many of these strategies developed in academic research are not really implementable in practice or may be subsumed by transaction costs.

Further, many ETFs need to be conscious of tracking error so they will not screen as aggressively as what we see in the academic research. For example, academic studies might screen the universe into deciles based on some factor characteristics and then examine the performance of a strategy that buys the top 10%, whereas a smart beta ETFs tend to be more widely diversified and tilt towards the factor of interest through their weighting of assets.

As an aside, it is interesting to note that there are very few factor-based ETFs in Australia compared with other markets around the world and the majority of "strategy-based" ETFs that are listed on the ASX are dividend-based investment strategies rather than the traditional factors identified in academic research. While this might be a function of the imputation tax environment, broadly speaking there is very limited evidence of a relationship between dividend yields and subsequent stock returns.

Thank you for this interview.