A mere 3% of SMSFs understand the basics of ETFs, with most believing owning 30 direct shares provides better diversification than any ETF.

There are a great many mysteries that can baffle self-managed superannuation funds. Why can electrons appear in two places at once? Why does the universe have the same radius as a black hole? When will George RR Martin finish A Game of Thrones?

But another great mystery for SMSFs is ETFs.

A mere 3% of SMSFs understand ETFs, a new survey from research house Investment Trends has found. With the vast majority of SMSFs believing that owning 30 companies' shares provides better diversification than any ETF.

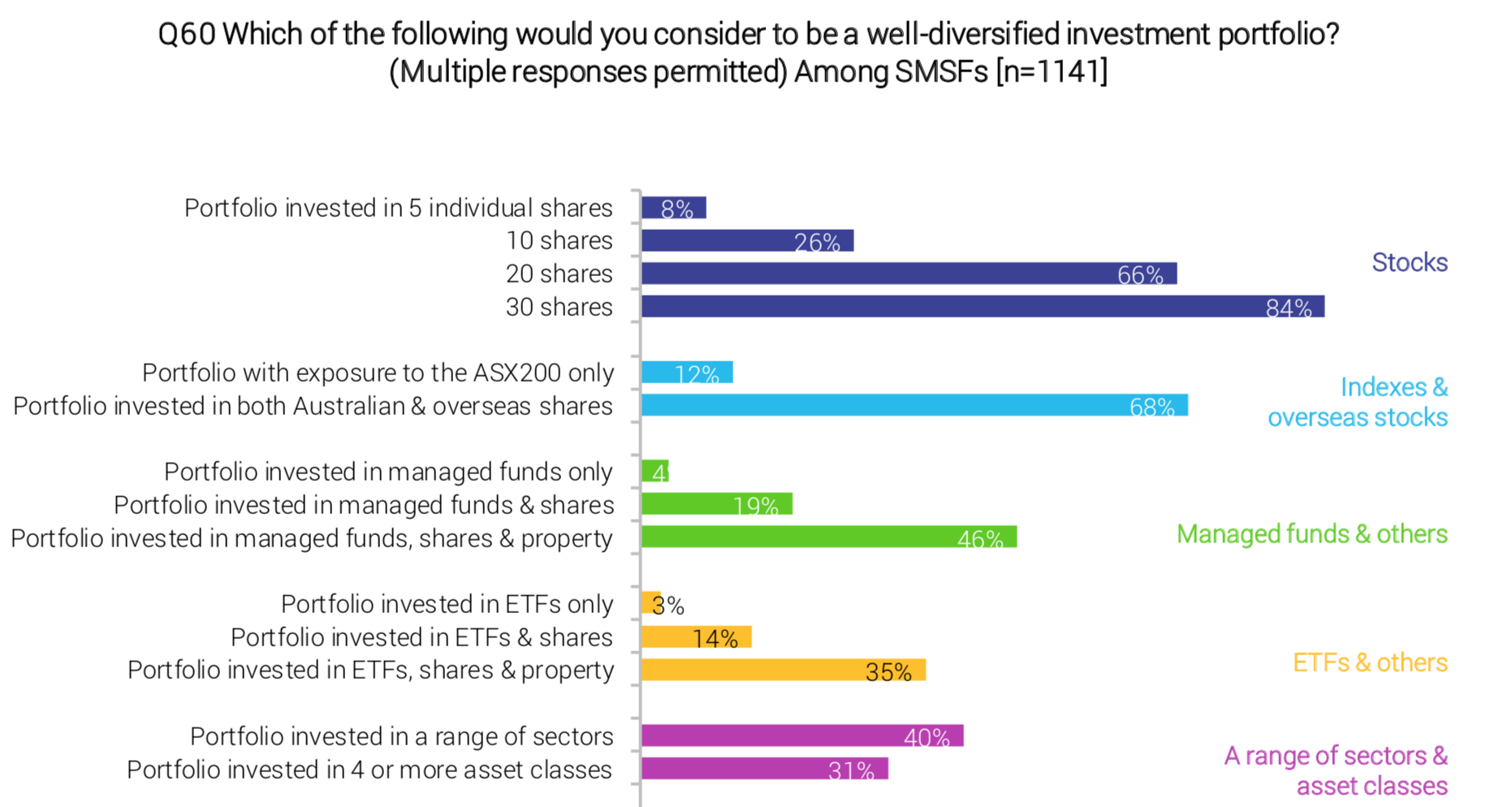

The survey, which polled more than 1,100 SMSFs, found that only 3% considered a portfolio of ETFs sufficiently diversified. This compared with 84% who believed a portfolio with 30 companies' share was sufficiently diversified.

The result suggests only 3% of SMSFs understand that most ETFs own more than 30 companies' shares. And most fail to understand that owning an ETF implies ownership of more than 30 companies.

"SMSF trustees seek more education on ETFs," Recep Ill Peker, research director at Investment Trends, told ETF Stream.

"There are nearly 600,000 SMSFs out there, but only 107,000 use ETFs. So while this number is growing every year there is still a lot of room for growth. There is also, obviously, a lot of room for educational work."

Only a minority of SMSFs considered there to be any diversification benefits to ETFs at all, the report also found. With only one-third of SMSFs polled believing ETFs conferred diversification benefits, even when they come as part of a mixed portfolio that included property and shares.

SMSFs also thought actively managed funds were better diversified than ETFs, despite data suggesting index funds (and ETFs) are better diversified than actively managed funds.

"The results indicate SMSFs have a better understanding and usage of managed funds than of ETFs, but that is starting to change," Mr Peker said.

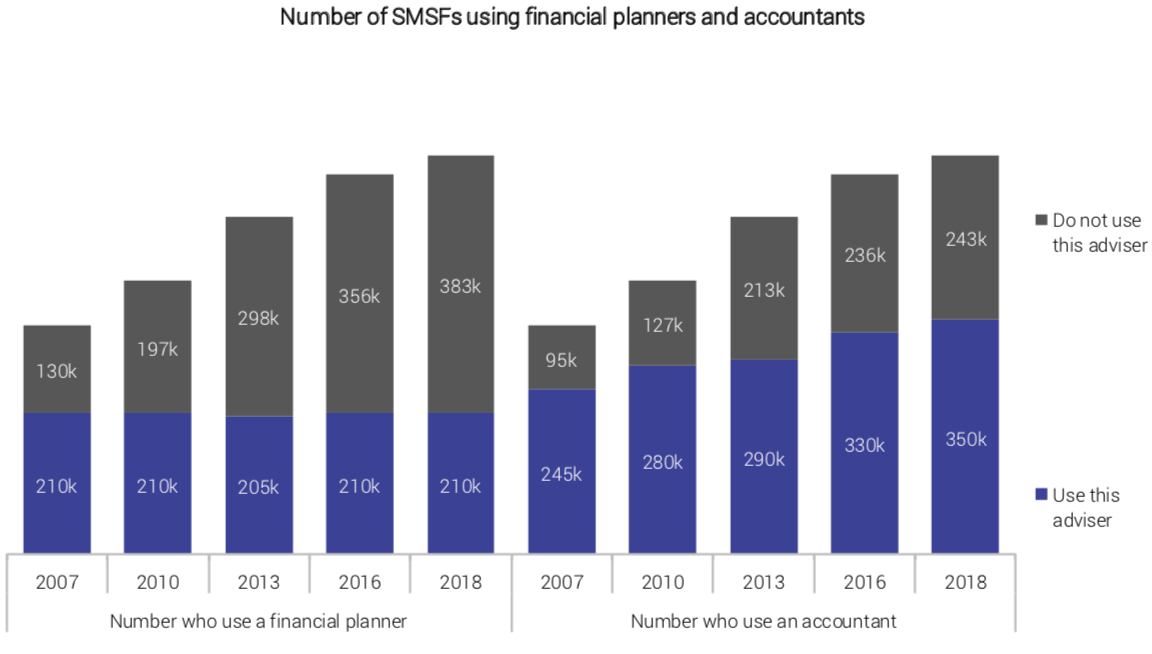

Those inclined to think that advisers might come to the rescue, given that most high net worth SMSFs are acting under advice, were also in for a rude surprise. The report found that advisers played a small role in pushing SMSF assets into ETFs, finding most SMSFs were unadvised and were increasingly taking counsel from accountants.

"Where SMSFs use a financial planner, planners on average influence 74% of the SMSF assets. With 210,000 SMSFs using a financial planner, the overall role of advisers is meaningful but relatively small," Mr Peker said.

"Of the SMSF money financial planners provide advice on, the share going into ETFs went from 3% in 2012 to 11% in 2018 -- it's grown quite substantially. Managed accounts have also grown, and many advisers recommending ETFs via the managed accounts structure."

In what may be a silver lining, the report found that once the education work was done, many SMSFs were happy to invest, precisely because of the diversification benefits they provide.