Key points from Stockspot's 2018 ETF industry report:

Vanguard was the industry leader, seeing 45% asset growth

VAS, IOZ the most popular kids on the block

Every active manager was a dud

ETFs the weapon of choice for attacking the global tech boom

**

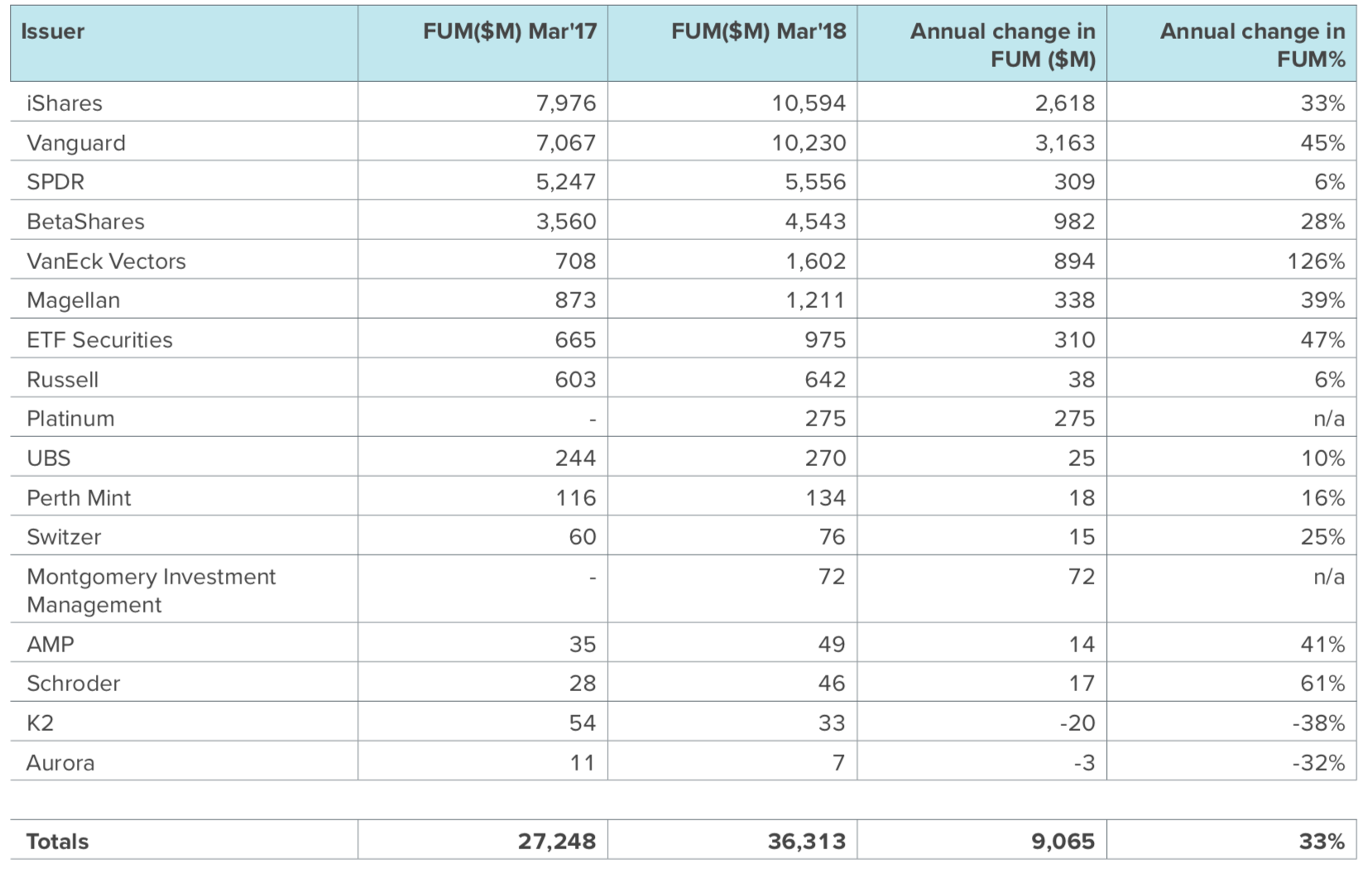

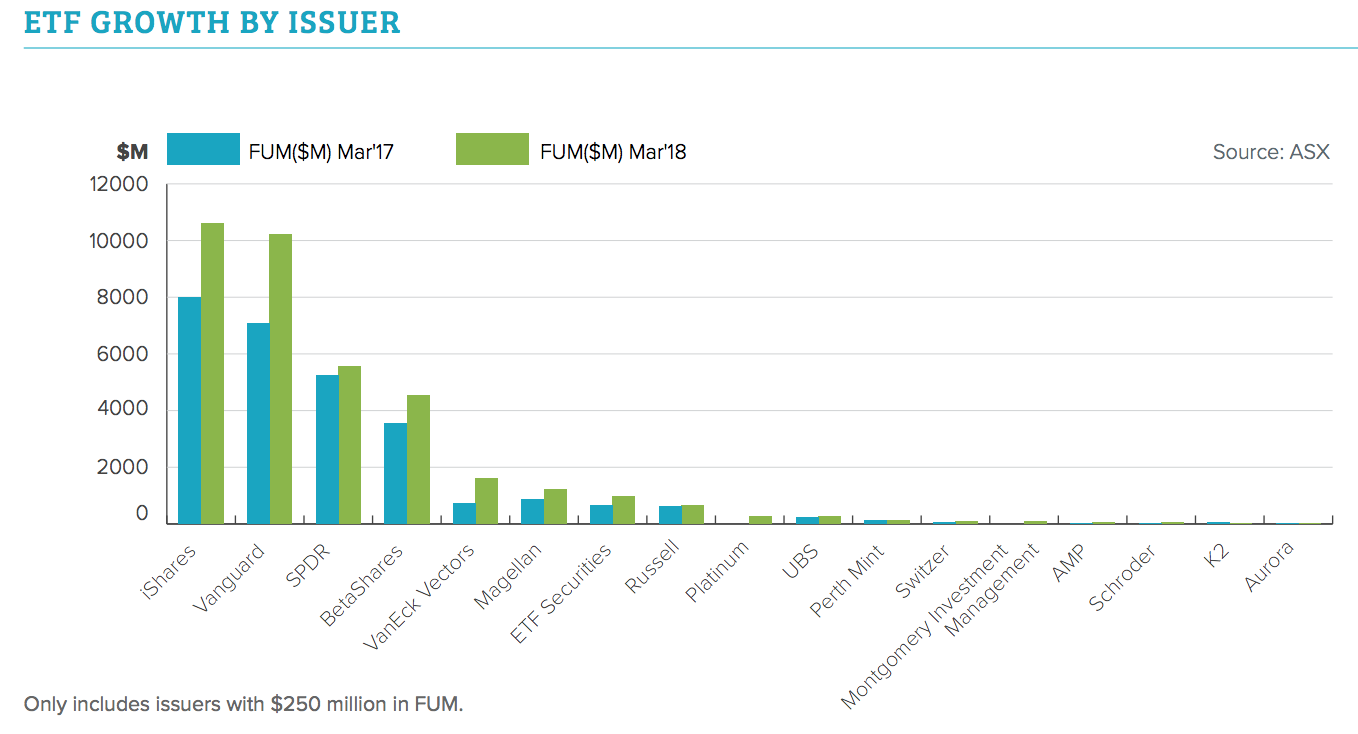

Money stashed inside Aussie ETFs grew 33% to hit $36.2 billion the past year, as Australians ploughed $9bn into ETFs.

The rising tide is lifting all boats, with most ETF issuers growing out their assets by $300 million or more, a new report from Stockspot, the Sydney-based robo-advisor, has found.

The three pure play ETF providers - BetaShares, ETF Securities and Van Eck - all saw significant asset growth, illustrating why ETF companies around the world are being acquired at such high premiums. But among issuers, the clear winner was the Melbourne-based not-for-profit Vanguard, which devoured one-third of new ETF money all by itself. The bumper year meant Vanguard's ETF business grew 45%, putting it hot on the heels of BlackRock's iShares, the largest ETF issuer in Australia.

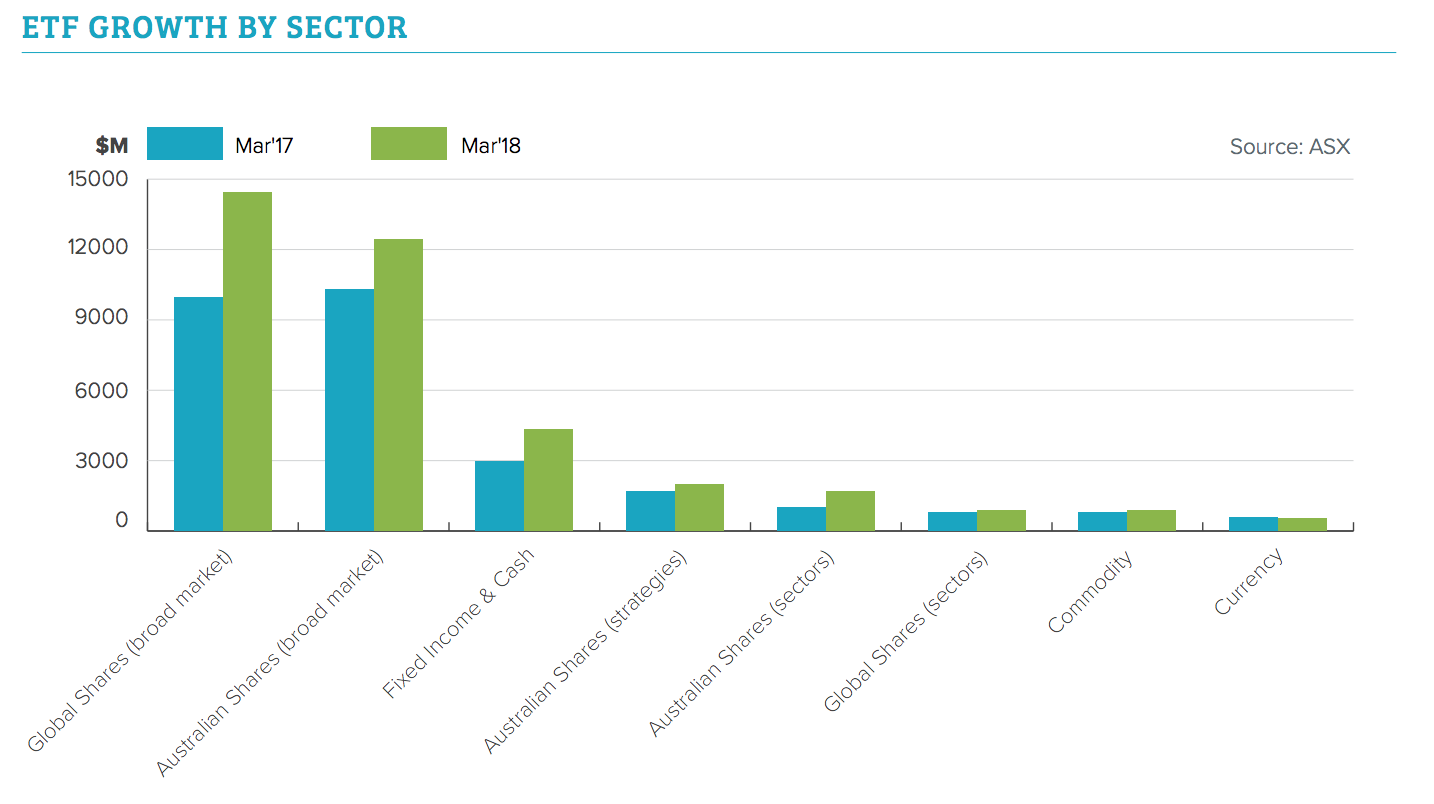

Australian ETFs still the most popular

Australian index trackers remain the biggest and most popular ETFs with Australian investors, the report found, with ASX 200 and ASX 300-tracking funds continuing to form the centrepiece of the industry.

"The broad Australian sharemarket ETFs remained popular with Vanguard Australian Shares Index ETF (VAS) and iShares Core S&P/ASX 200 ETF (IOZ) taking the top two places," the report found.

"This continued popularity of Australian share market ETFs is likely coming from switching out of direct shares and underperforming active funds… Vanguard and iShares have cemented their place and built up a strong reputation for offering low cost, broad market index ETFs."

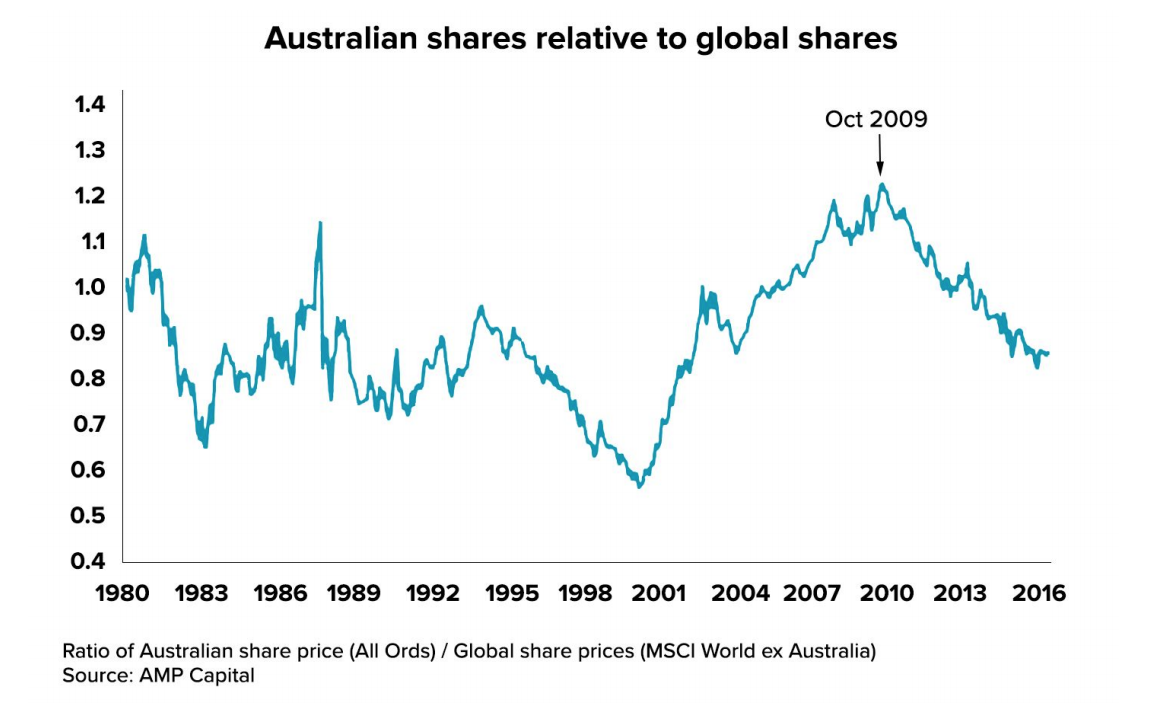

The results suggesting that Australian investors - like investors almost everywhere - have a pronounced home bias.

Global ETFs and the tech boom

The ETF boom has also, crucially, been driven by a broader migration to ETFs as the choice vessel for attacking overseas markets.

The past several years, Aussie investors have looked with pie-eyes on the global tech boom - particularly the FANGS in the US (Facebook, Amazon, Netflix and Google) in the US, and the BAT in China (Baidu, Alibaba and Tencent). Most inflows into global ETFs have offered some form of exposure to these two countries and their swelling tech sectors.

"Global share ETFs had an outstanding year in terms of returns and FUM increases to overtake Australian shares and become the largest sector," the report said.

"In particular, they benefited from high exposures to the high growth technology sector, with giants Tencent and Samsung leading the way in Asia.

"US share ETFs have exposure to [the FANGS] - which are now also some of the largest companies in the world by market capitalisation."

The stampede to global ETFs has also shaped the product offerings of the main issuers, with most new listings the past year focussing on overseas markets and fixed income. The new listings have meant there are now more equity ETFs with global exposure than Australian exposure available on the ASX.

Performance: Asia and passive

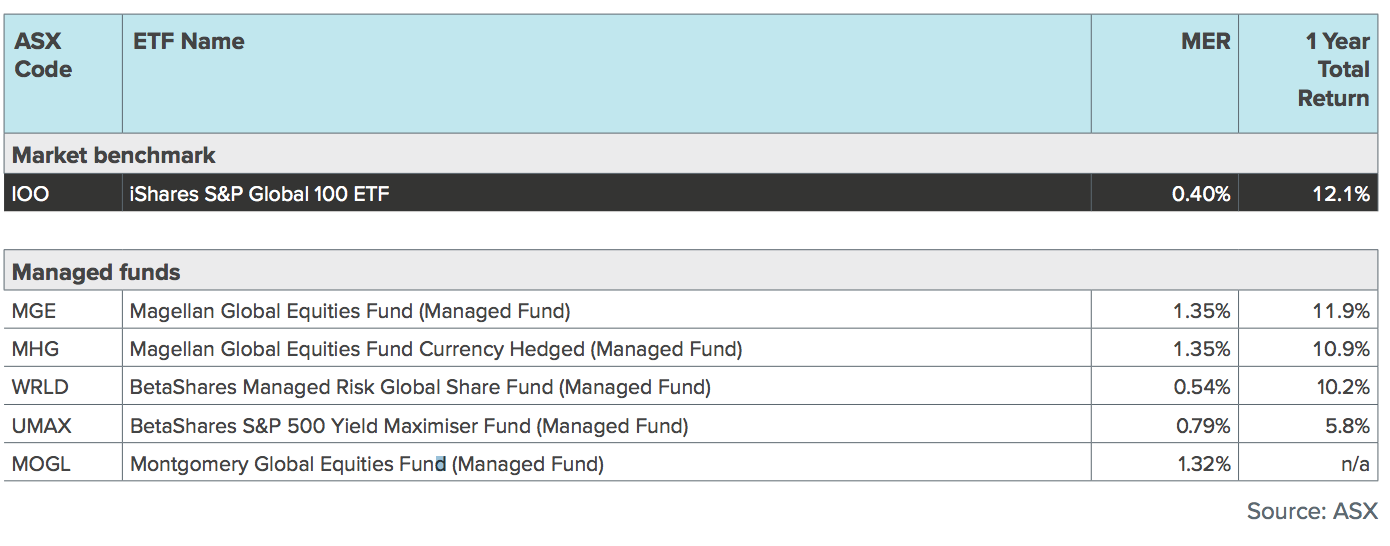

Every single active ETF delivered lower returns to their investors than broad market tracking ETFs, Stockspot found. Some active managers did outperform the index, such as Magellan Global Equities Fund (MGE). But once their high fees were subtracted (MGE charges 135 basis points, more than 3x iShares' IOO), investors would have been better off in plain vanilla ETFs.

"While it is unusual for not a single active manager to outperform the broad market, we would expect the average return of active managers to be below their indexed counterparts over longer periods of time due to the impact of fees," the report said.

"This year the unhedged Magellan Global Equities fund would have beaten index funds if it weren't for its fees."

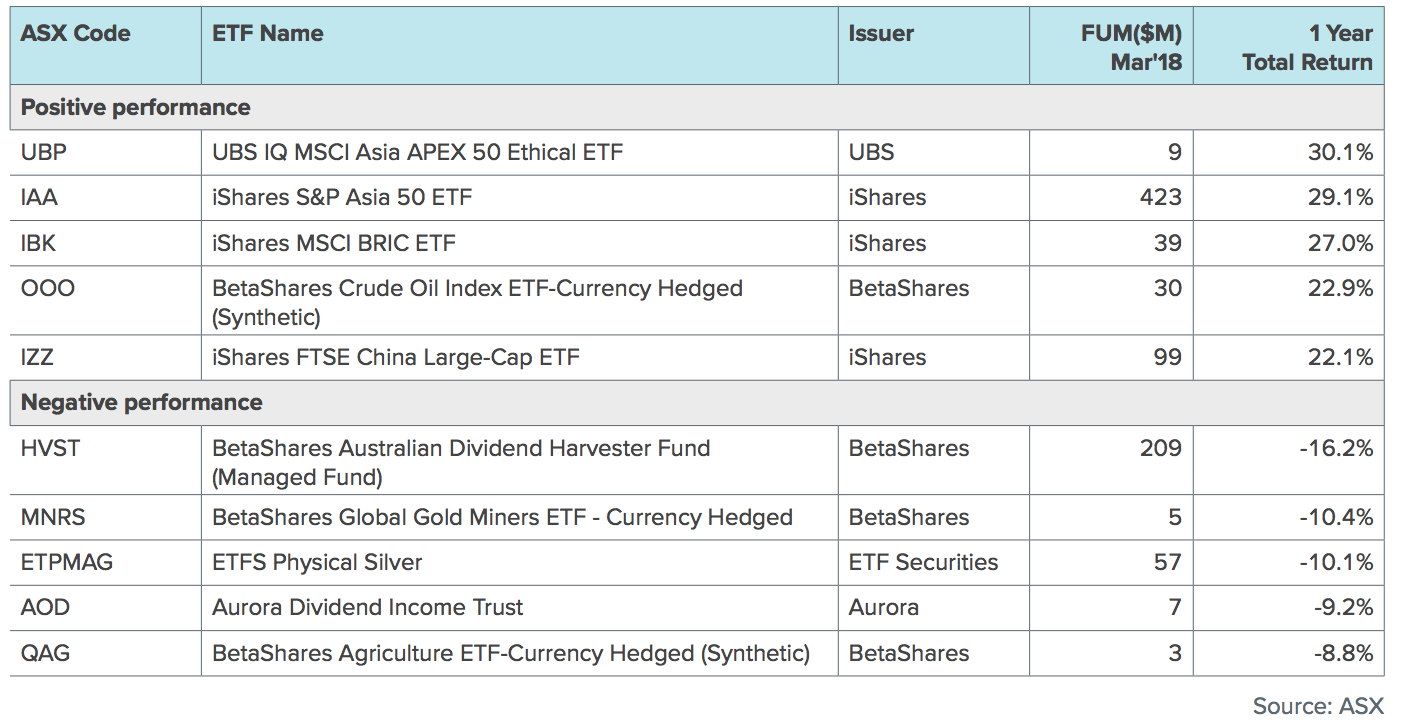

The best performing ETFs were UBS IQ MSCI Asia APEX 50 Ethical ETF (UBP) and iShares S&P Asia 50 ETF (IAA), both of which track Asian large caps, both of which have a heavy exposure to the tech sector.

Within Australia, interestingly, the top performers were resource sector and multi-factor ETFs, which strongly outperformed plain vanilla funds. Their outperformance largely owed to the Royal Commission into banks, a comparison with the underperformance of Aussie banking sector ETF would suggest. The ASX 200 gets 30% of its weight from the big five banks.

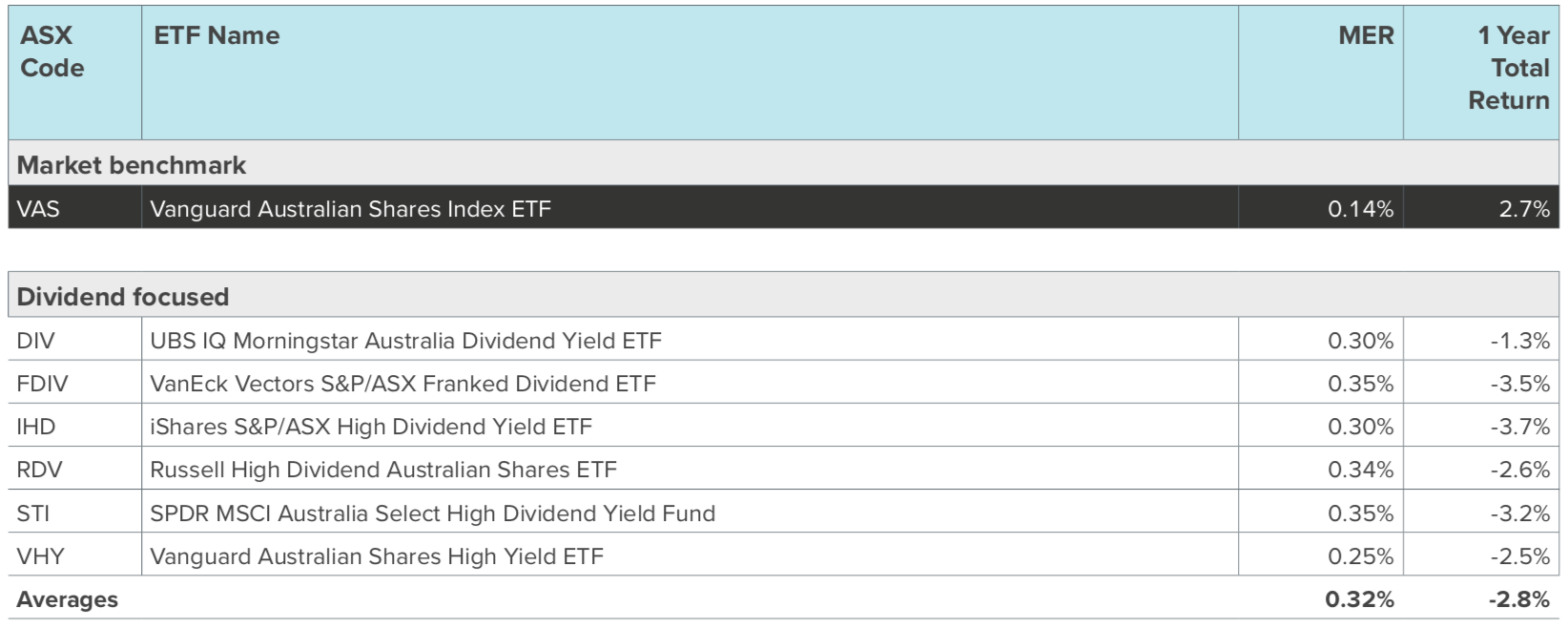

Criticism: smart beta and dividends

On the critical side, the report took exception to dividends-focussed products, all of which underperformed plain vanilla ETFs. It singled out the BetaShares Australian Dividend Harvester Fund (HVST), which invests in large ASX shares that are about to pay dividends while selling futures to reduce risk. HVST had an annual return of -16.2% and saw more than $200 million in outflows, making it strongly underperforming.

Smart beta approaches, in general, were also criticised, claiming they were untested and relied heavily on index backtesting, which can be rigged by index providers.

"Think of an index like a deck of cards. Backtesting lets you shuffle a deck of cards thousands of times until a favourable "shuffle" emerges to match the order you want to show. In essence, backtesting lets the smart beta strategies and ETFs 'stack a deck' of stocks in a way that outperformed the index in the past," the report said.

"But there's no guarantee that the same strategy will work going forward. As a result, many smart beta strategies could have simply worked in the past by chance."

Smart beta funds, particularly equal weighting and multi-factor, had outperformed this year, the report also noted.