ETFs provide a refuge for novice investors, which makes it harder for active managers to exploit them, a new report from Credit Suisse has found.

ETFs are providing a refuge for weak investors and in so doing are making it harder for active managers to achieve alpha, a study by Credit Suisse has found.

Alpha can be something of a zero-sum game. Every trade requires a buyer and a seller - only one of which can win. If the price of whatever is purchased rises after a trade, the buyer wins; if it falls the seller wins. For this reason, money managers and professional traders like it when novice investors play the market, as it gives them with a pool of beginners at whose expense they can potentially profit.

But by providing a safe-haven for the inexperienced, ETFs are undermining this dynamic, Credit Suisse found. And by restricting the supply of weak investors, ETFs are making it harder for active managers to achieve any alpha.

"The rise of passive investing may appear to make active management easier. But that is unlikely for two reasons," the report said.

"First, it is probable that the investors who are moving their funds to passive vehicles are relatively unsophisticated. That means that the average skill for the remaining active managers is rising, making it more difficult to beat the market.

"Second, because alpha is a zero-sum game, fewer weak players means it is harder to find a corresponding loser if you intend to win."

The report likened this dynamic to a game of poker. At any poker table, if you're a strong player, you want to be surrounded by weaker players whose cash you can clean up. By surrounding yourself with weak players, poker is easy and profitable. But if the weak players head for the exit, leaving only other strong players at the table, the game gets harder and less profitable.

"Say that I invite you to my house for a game of poker on Friday night. If you play to make money, your first question should be, "Who else will be there?" If I tell you that some rich players who have poor skills will attend, you will put the date on your calendar. If I say that the other players are better than you are, you will make alternative plans," the report said.

As weaker investors become more aware that the table is set against them, their flight to passive will only accelerate, the report found. And such flight will be particularly acute during bear markets, like 2008, when those losses are sharpest.

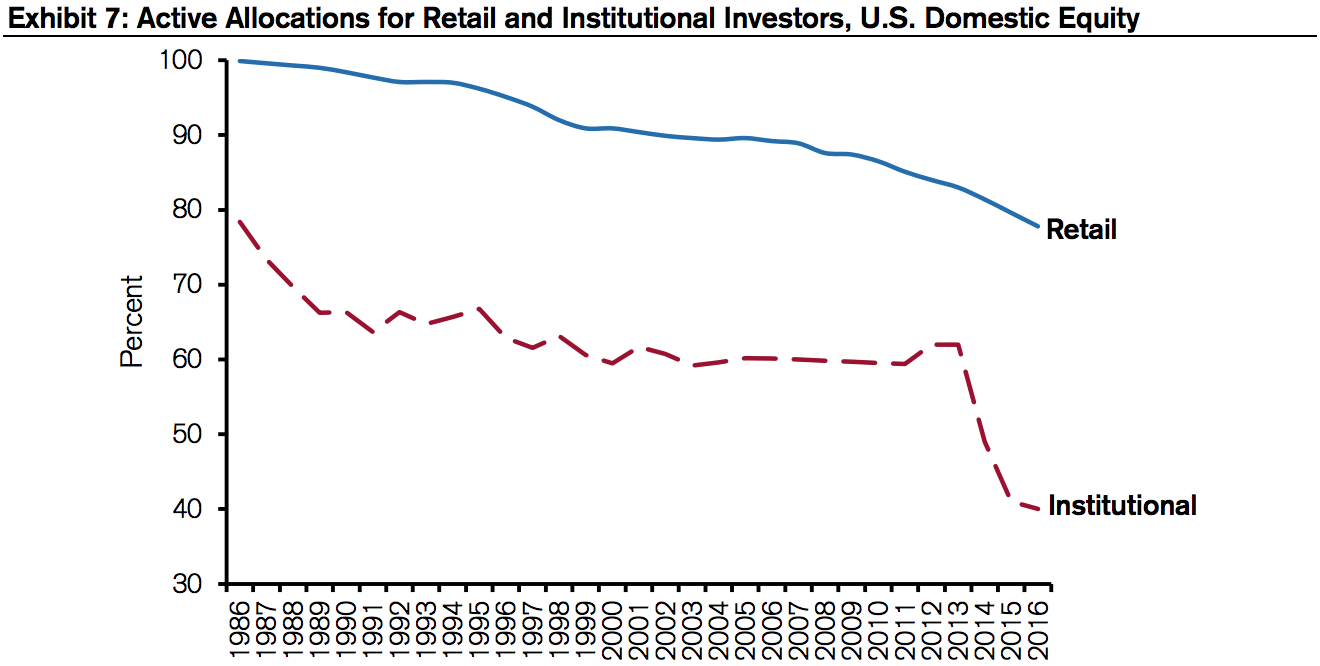

Looking over the data, the report found that the flight to passive in the US has been more pronounced among institutional investors - with retail investors staying more loyal to active managers and direct shares. The slower pace of uptake among retail comes despite their having more to gain by switching. Retail investors by all accounts tend to be worse traders, the report found.

"Individual investors can be a good source of excess returns for institutional investors. A survey of the behaviour of individual investors noted that "the evidence indicates that the average individual investor underperforms the market—both before and after fees,'" the report said.

"Individuals are generally overconfident, causing them to trade too much. Institutions generally have better information and analytical skills than individuals do."

While passive will continue to attract flows, there are structural limits to how much passive could takeover, the report said. It argued that a market dominated by active managers, like the US equity market at present, create opportunities for passive trackers to freeload.

But a market dominated by passive managers, who do not research or take an active interest in value, creates inefficiencies which active managers can exploit. The result was a dynamic equilibrium.