Institutional investors are warming ETFs. They are trading ETFs more often, in larger chunks and with a greater degree of confidence - a new survey has found.

Institutions are also increasingly open to using ETFs for purposes other than passive exposures. These other reasons include active management as well as tools for hedging and liquidity management.

The survey, Institutional ETF Trading, was conducted by Jane Street, a leading ETF market maker. It surveyed more than 220 institutional investors globally and took six months to complete.

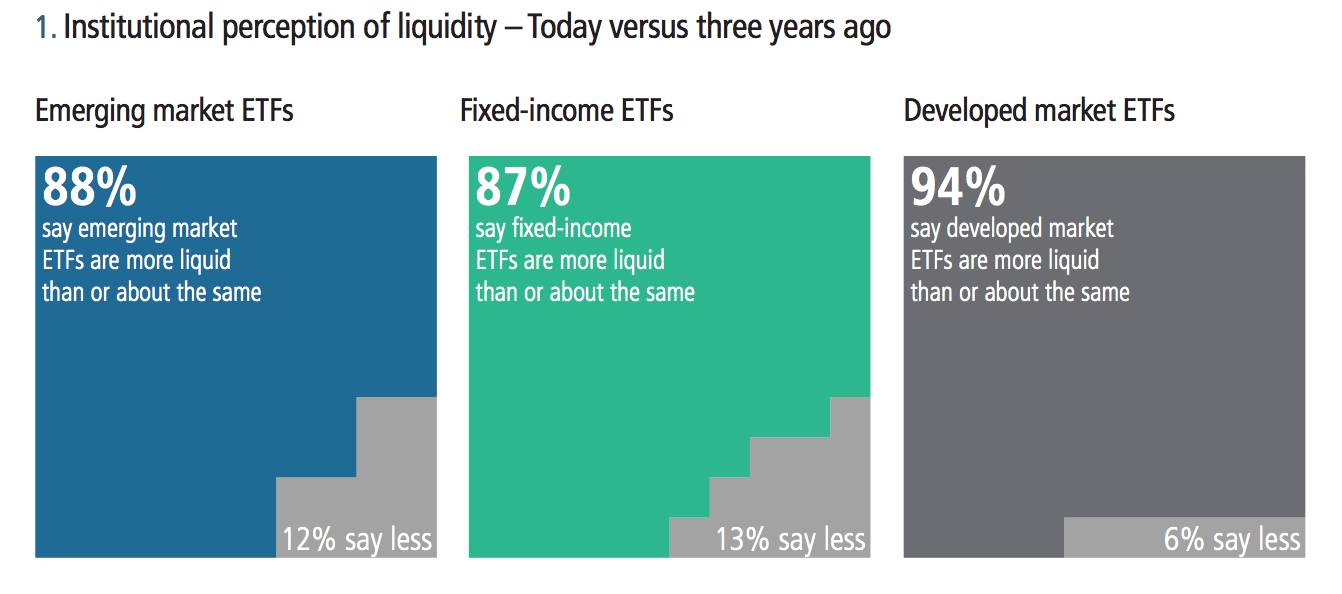

It found that perceptions of ETFs have improved across the board. But perceptions of ETFs' liquidity have changed the most sharply, with almost 90% of institutional investors now believing ETFs are getting more liquid. Institutional investors thoughts ETFs were getting more liquid in every asset class - fixed income, emerging markets and developed, it found.

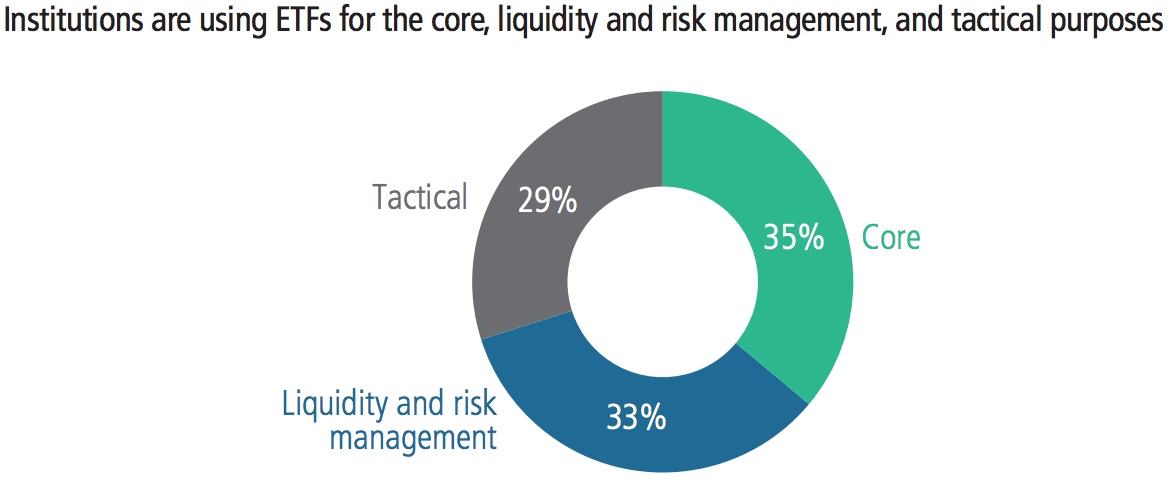

Interestingly, almost one-third of respondents said their institution used ETFs for core asset allocation purposes, shattering perceptions that institutions mostly use them for risk management and tactical exposures.

"[There has been] a year-on-year increase in the percentage of institutions reporting the use of ETFs as part of their core asset allocations: from 25% to 35%… ETFs have become more central to buy-side firms' investment strategies," it found.

With increased confidence, the average size of ETF trades have grown, with "24% of global institutions reported[ly] executing a trade over $100 million compared with 21% in the year prior," Jane Street found. Somewhat remarkably, in the US more than 4% of institutions had executed an ETF trade worth more than $1 billion.

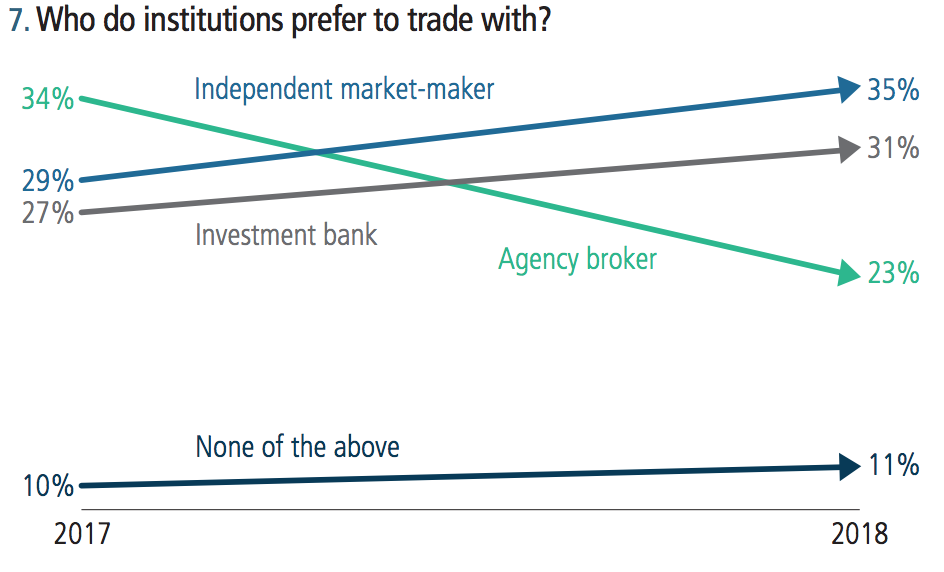

When considering which ETFs and which counterparty to use, the most crucial of all considerations to institutions was cost, Jane Street found. When asked what the most important factor trading counterparties were chosen on 55% said cost mattered most. Cost sensitivity was particularly acute in Europe, owing to Mifid II being implemented this year.

What this means in practice, the report said, is that counterparties that focus on competitive pricing tend to get selected more. Independent market makers have seen an increase in popularity largely for cost reasons, while agency brokers have declined sharply.

"Their capacity to execute trades in complex and/or thinly traded ETFs was also cited by US/Americas-based interviewees as reasons for independent market makers gaining popularity," the report added.