Vanguard's diversified ETFs created a splash when they listed late last year.

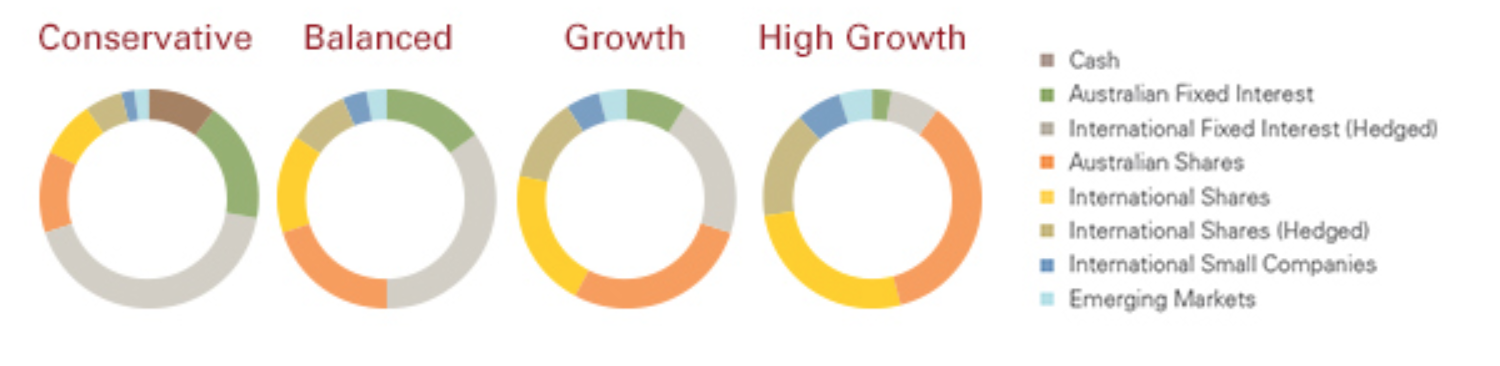

The four funds - conservative, balanced, growth and high growth - were the first Aussie ETFs to provide one-stop-shop portfolios and opened a new frontier in ETF product innovation: multi-asset.

The listings gave unprecedented access to professionally managed portfolios and allowed Aussie investors to buy into a professionally managed portfolio for as little as $50.

The market quickly took note, and almost a year later the funds have $200 million assets under management between them, making them some of the fastest growing Aussie passive funds ever.

But with the dust now settled many investors are wondering: which ETF is the best? Is it the Vanguard High Growth ETF, with its cult following on internet forums like Reddit? Or could it be the Conservative ETF, which is among the most low-risk beta products available?

Those wondering now have an answer, and from Vanguard itself: the balanced fund.

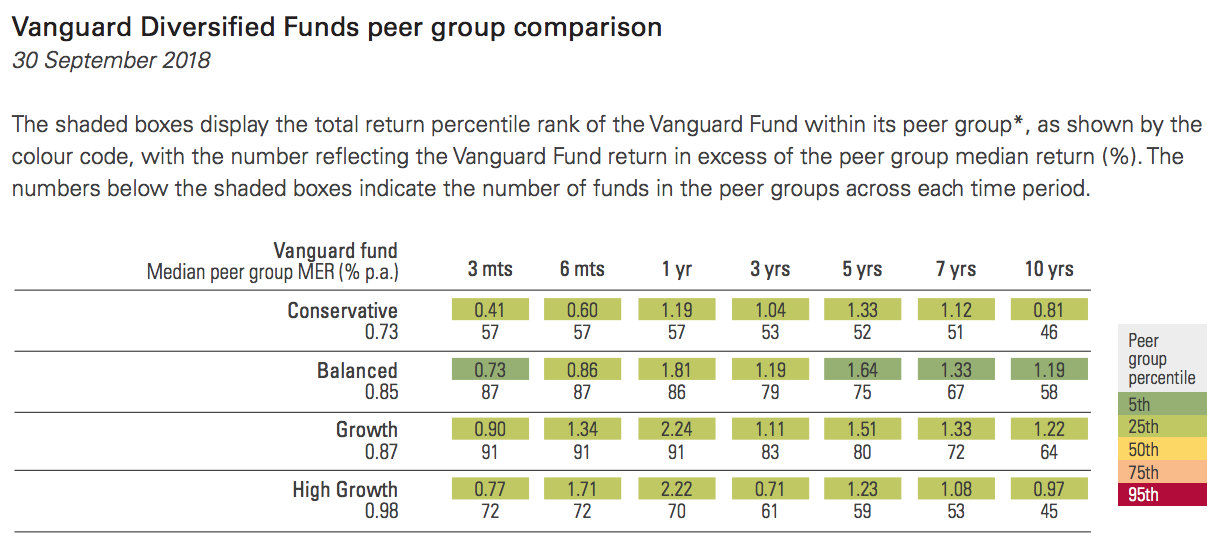

According to Vanguard's newly published quarterly results, the Vanguard Balanced fund, which invests 50/50 in shares and bonds has been in the top 5% of performers among balanced funds the past 10-years. It has delivered a return 1.2% a year higher than its competitors -- which is a significant margin of outperformance considering its level of risk.

The fund's success comes despite the fact that its popularity has been relatively muted (at least in ETF form) compared with its high growth peer. According to Vanguard, $50m sits inside VDBA, compared with the $93m sitting in the high growth index fund (VDHG).