It would appear the US has a different investment strategy compared to that of Europe and Asia following Amundi Asset Management's global ETF market net flows for October.

The net flow for Europe, Asia and the US for last month was just shy of €7.5bn but only 35 per cent coming from Europe and Asia. This means the US accounted for 65 per cent of the net inflow for all three regions. Clearly the US is far more active and accepting of ETFs than the rest of the world, but this could soon face a swing in momentum according to Moody's recent forecast.

Amundi's report shows both Europe and Asia saw significant outflows from Equity ETFs in tandem with large inflows in fixed income ETFs. In contrast, the US had inflows in equity and outflows from fixed income, but on a much larger scale it must be said.

EuropeAsiaUSEquity€-415m€-656m€7,349Fixed Income€816m€2,669m€-1,447m

Europe's fixed income ETF space has only just begun according to James Phillips of Citywire. The European bonds' market is worth €25tn but less than one per cent of that accounts for ETFs. Active funds are noticeably starting to struggle to compete with passive funds' low fees and is likely to persuade more investors to turn passive or at least include them within their portfolios. As more fixed income products become available on the market, the ratio of ETFs within the bond market will most likely change.

In comparison to the rest of the year, Amundi's report shows October was relatively slow for the European ETF market. The mere €7.5bn accumulated over the month seems insignificant compared to the €315bn total over all three regions in 2018 so far.

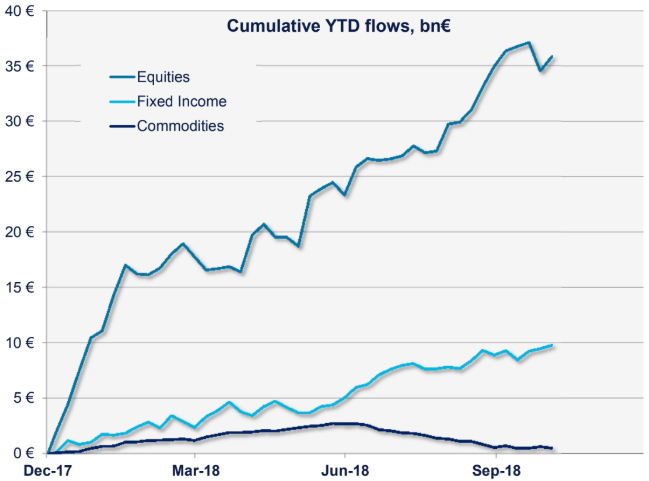

The graph above shows the cumulative flows for the European ETF market for this year so far. Q1 and Q3 saw strong inflows for equity ETFs and likewise for fixed income ETFs in Q3. The AUM over Q3 doubled what was accumulated over the first two quarters of 2018. Although the gap is still large between equity and fixed income ETFs, it does appear to be gradually slimming.