Exchanges are critical for Exchange Traded Funds. (It's in the name).

But in Europe, getting ETFs to trade on exchange has proved a trying task.

Europe's ETF market is different from North America and Australia's in that it is almost entirely institutional. This means most ETF buyers are institutions: pension funds, multi-asset managers, insurance companies, and the like.

And big institutions do not necessarily trade ETFs on exchanges. They sometimes prefer to execute some of the orders away from regulated markets directly with banks and brokers (a practice known as "over the counter" trading).

But Euronext, Europe's third-biggest exchange group by number of ETF listings, is trying to change that.

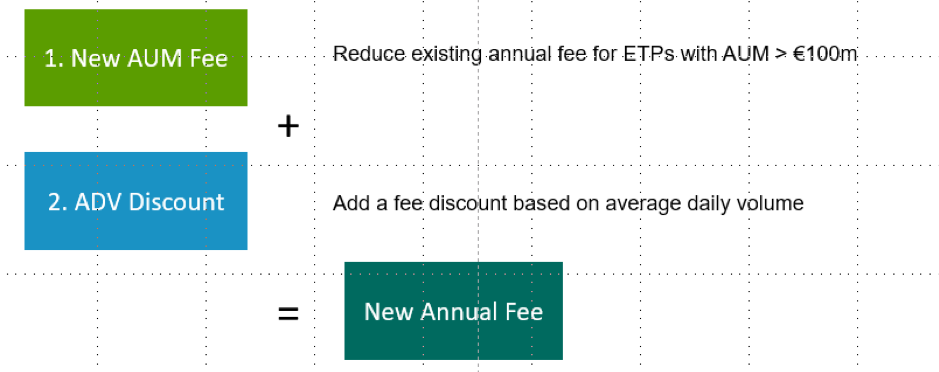

In an effort to boost ETF trading and bring North American-style ETF activity to Europe, Euronext has lowered its annual listing fees and introduced an issuer incentive scheme based on trading activity at the beginning of this year.

Two components of the new fee scheme

Source: Euronext

More on-exchange trading is beneficial to investors as it provides more transparency, improves execution quality, and builds confidence in ETFs as an investment vehicle.

"Exchange volumes are going up - but slightly and too slowly," Isabell Moessler, a business development specialist manager at Euronext, told ETF Stream.

"The big hope was that Mifid II would bring more ETF trading back onto exchanges, but most trading is still over the counter. Unfortunately, the intention of Mifid II didn't translate into the kinds of benefits the industry was looking for."

Under its new fee schedule, Euronext has lowered its annual listing fees for providers. Euronext already incentivizes ETF market makers via special fee schemes.

These market makers play a crucial role in the livelihood of ETFs, as they facilitate price discovery, a process that determines the prices at which ETFs are bought and sold. They also provide most of the liquidity throughout the trading day, ensuring that when investors want to trade ETFs on exchange, there is a counterparty ready and willing to trade.

While lowering fees is one incentive for ETF take up, Ms Moessler says it won't be a silver bullet.

The European ETF market faces further challenges that go beyond product costs, namely fragmentation and inefficiencies in post-trading processes.

Lastly, investor education plays a significant role in the future development of the European ETF market.

"In comparison to the US there is also the broader problem of financial literacy. Often retail investors are not informed what products are out there. For example in Germany many investors still get exposure to financial products through their high street bank. In France it is often through insurance companies. We need to raise more awareness for different options."

What effect the discounts will have on ETF trading we'll have to wait and see. But for the time being, they'll likely be welcomed.