Asset flows are falling short of their monthly averages, according to the latest

by Société Générale.

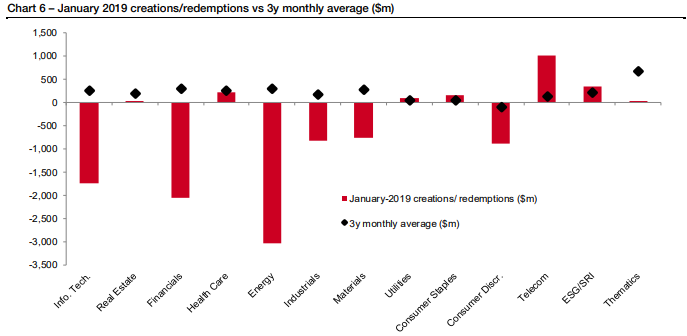

Majority of the main ETF sectors and thematic strategies' creation/redemption (flows) figures for January are significantly lower than their three-year monthly averages. The Information Technology, Financials and Energy sectors faced outflows in excess of $1.5bn for the first month of the year. The energy sector alone saw outflows of over $3bn.

In most cases when it comes to closed-ended funds, the price of a fund can shift depend on the supply and demand. As there is a limited supply, the price of the fund will trade at a premium if the demand also rises. Similarly the fund will trade at a discount if the demand falls to try and get rid of it. This isn't the case with ETFs however.

Due to creation and redemption, it ensures the demand is always satisfied and the investor can buy or sell the fund at its true value. An "authorised participant" can create or destroy an ETF depending on the market.

Source: Société Générale

As shown in the graph above, 6 out of the 13 sectors and thematic strategies faced outflows in January. The consumer discretionary sector has had a three-year monthly average of negative net flows and continues to face outflows of $895m for the month, $882m of which came from US-listed ETFs.

Not all sectors are feeling doom and gloom. The telecommunication sector had inflows in excess of $1bn. This is a 20 per cent increase to the its Assets Under Management.

Amid the major selloffs, ESG (Environmental, Social and Governance) and SRI (Socially Responsible Investing) ETFs saw a total inflow of $336m in January. However it would appear the US and the European market have conflicting interests in the investment products. The US-listed ESG/SRI ETFs saw outflows of $92m whereas the European-listed ETFs saw inflows of $429m. There have been a few reports recently suggesting ESG factors are underperforming.