Xact Kapitalförvaltning AB, a Swedish-based fund company which specialises in index management, has launched the first ETF to be listed on the Nasdaq Copenhagen Stock Exchange.

The Xact C25 ETF (XACT25) listed yesterday and tracks the OMX Copenhagen 25 Index. The index is comprised of the 25 largest and most traded equities on the Copenhagen Stock Exchange. Distributed by Handelsbanken Denmark, the ETF has an expense ratio of 0.2 per cent.

Back in 2000, Xact Kapitalförvaltning AB launched Sweden's and the Nordic region's first ETF. Now one of the leading ETF providers for the region, the firm has launched 15 ETFs with a net Assets Under Management of SEK 30bn.

Pär Nürnberg, CEO of Xact Asset Management, said in a statement: "I am very proud that Xact is the first to list an ETF on the Nasdaq Copenhagen Stock Exchange. It allows investors to easily buy and sell a basket with the 25 largest and most traded Danish listed shares in real time. It is a cost-effective investment for investors because of low administrative costs."

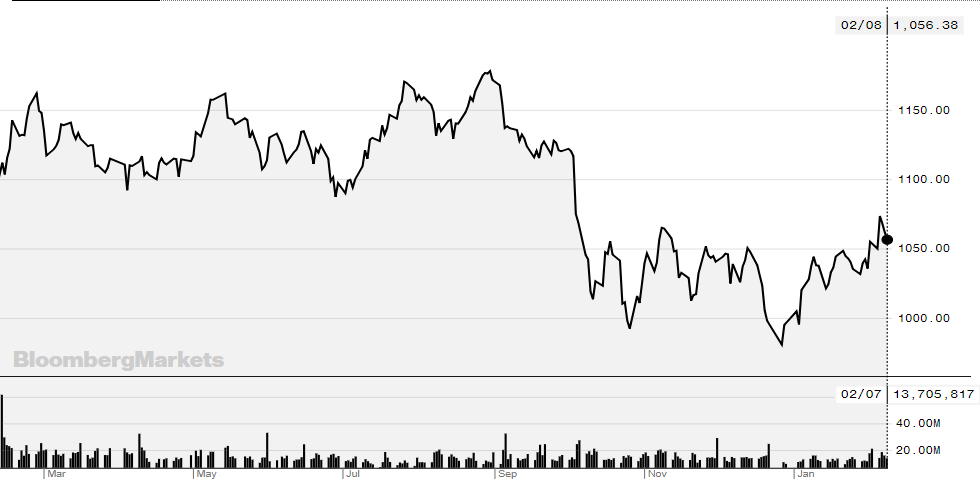

Index Performance

The OMX Copenhagen 25 Index, XACT25's benchmark, like the rest of the world's market struggled in Q4 2018.

Source: Bloomberg

Throughout 2018, the index slipped 12.37 per cent but has since recover 5.2 per cent YTD. These gains however only resolve the losses the index faced in the last two weeks of December.

A significant factor for this downward trend is the likes of Danske Bank, the fourth largest stock in terms of turnover, which comprises the index. Over the last 12 months, the share price has halved in a consistent downward trend.

Since the market's Q4 volatility calmed, a number of the index's shares have looked promising. Such examples include Vestas Wind Systems and Novo Nordisk B which share prices have increased 3.96 per cent and 7.55 per cent for YTD, respectively.