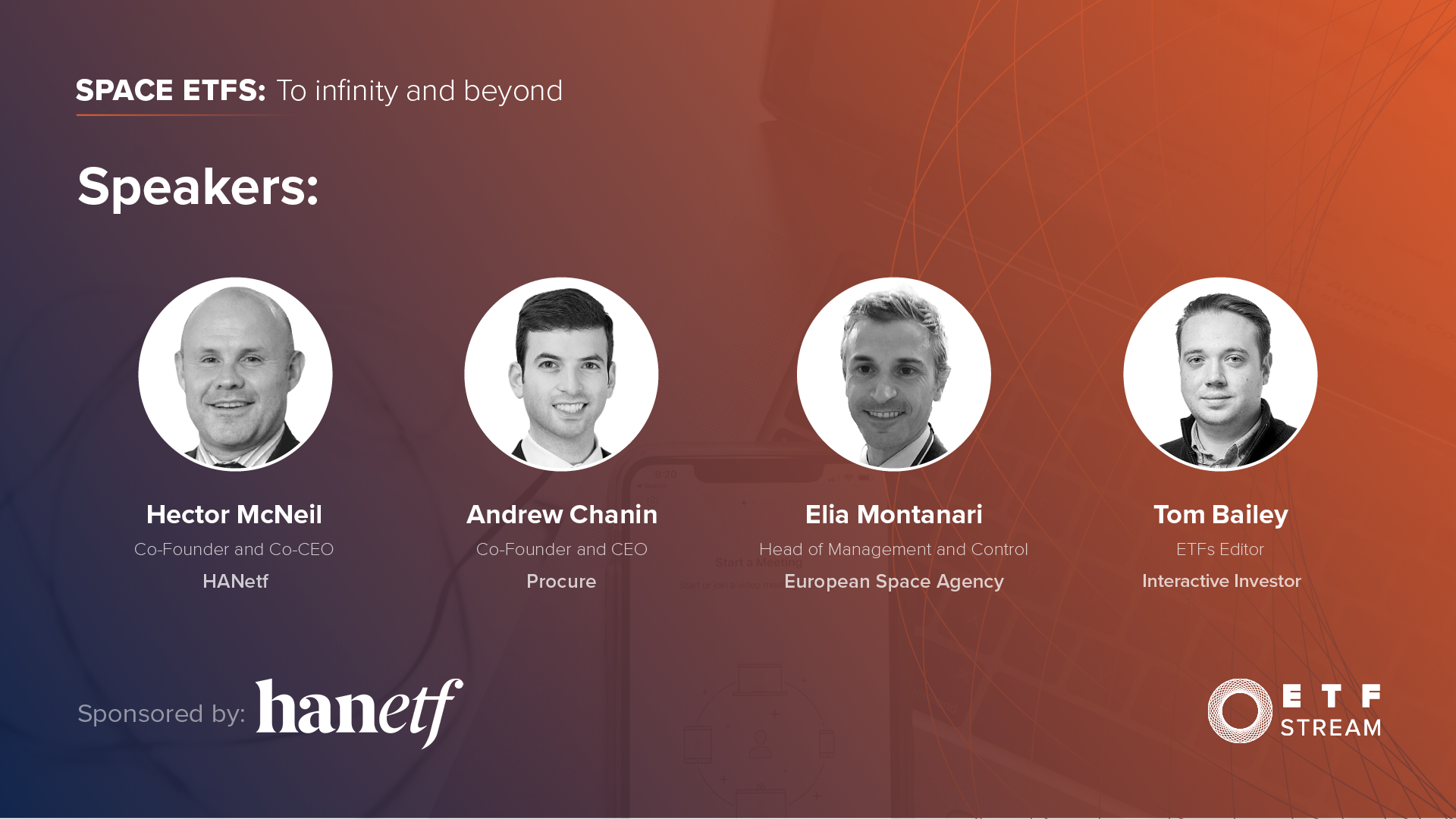

The commercialisation of space, the future of the space industry and new thematic opportunities were discussed at ETF Stream’s webinar on space ETFs.

The webinar, titled Space ETFs: To infinity and beyond, started by looking at the paradigm shift from space exploration as a political power play, to increasingly profitable activities driven by private enterprise.

Andrew Chanin, co-founder and CEO of Procure AM, which created an investable space index, said government funding made up the vast majority of early capital backing for space programmes.

However, today this funding makes up around 20% of the total, Chanin said, with the remainder coming from disruptive companies and the world’s wealthiest businesspeople.

More whales than white elephants

“You can see the commercial side of the space industry has significantly increased and filled in the gap not just where the government-to-government agencies were but driving those numbers higher,” Chanin added.

Among the shifts furthering involvement from non-state actors include technological advancements – such as reusable rockets making space travel more affordable – and organic demand driving investment in space-related businesses via government and military contracts, private capital backing and public listings of space-related businesses.

The pace of uptake and anticipated expansion of space activities have also led to some stratospheric predictions for off-planet business.

Morgan Stanley has predicted the space industry could be worth more than $1trn annually by 2040, while the Bank of America forecasted it could be worth as much as $2.7trn by 2045, Chanin noted.

Elia Montanari, head of management and control at the European Space Agency, added many banks in New York think the world’s first trillionaire will be made in space.

On the growth outlook, Montanari said: “It would be at least $2-3trn in terms of size of the space economy with a horizon of around 2030.”

Space industry take-off

Regarding where this growth might come from, Montanari noted three subsectors with identifiable growth opportunities: space tourism, space resources and universal connectivity.

On the first, space tourism, Montanari said many will have heard of tycoons such as Richard Branson and his high-profile Virgin Galactic venture. To a lesser extent, individuals can also look at the likes of Jeff Bezos and Elon Musk and their attempts to support access to space via Blue Origin and SpaceX, respectively.

On space resources, Montanari said the future could involve looking to space for human necessities such as water and when commercially viable, asteroid mining will be in play.

“An asteroid grabbing mission would cost around $3bn or even twice as much as that,” Montanari noted. “They have very dense cores so you would be able to find a lot of gold under very shallow surfaces.”

Finally, Chanin said the key driver of the space industry will be communications capabilities, driven for demand for technologies such as the internet of things, 5G, cloud computing, data exchange and space link – and quite simply better connectivity.

Space within a thematic framework

In terms of targeting these avenues for future growth, Tom Bailey, ETFs editor at Interactive Investor and the webinar’s moderator, said in the past, prospective space investors have been confined to either single stock picking or using funds with very limited coverage of space-related equities.

Looking to address this gap in the market, Procure AM partnered with white-label ETF issuer, HANetf, to launch Europe’s first space-specific thematic ETF, the Procure Space UCITS ETF (YODA).

Product Panel: Procure's space ETF hits Europe

Speaking on the merits of this product class, Bailey said: “Thematic ETFs allow investors to tap into the long-established thematic approach to investing but in a lot more of a flexible and targeted way than they previously could by using sector ETFs – but also in a more diversified way than if they went down the route of individual stock-picking.”

Hector McNeil, co-founder and CEO of HANetf, agreed and said thematic products offer exposure to liquid securities within niche areas while providing the advantages innate to the ETF wrapper, including transparency and instant intraday trading.

“What is clear about the thematic investing universe is it is quite specialist and you get experts behind products, very similar to active investing, actually,” McNeil added.

One concern raised on niche investment themes is the purity-liquidity-diversification trade-off which is often seen as an expected feature of relatively immature investment universes.

On this, McNeill pointed to his firm’s other thematic strategies and said innovative themes change constantly and new companies will be added to thematic indices – such as Procure’s – over time.

Chanin said Procure’s index seeks to balance pure-play companies deriving at least 50% of revenues from space-related activities, with diversified large caps such as Boeing and Lockheed Martin, which can only make up a combined 20% of the index while generating either a minimum of 20% of total revenues or $500m of revenue annually from space business.

To watch the full webinar, click here.