The degree to which smart beta has transformed the investment landscape while also driving product innovation is all too evident. And it's also helped asset allocation techniques to improve.

At least, that's one reading of MSCI's announcement that it has launched a new asset class factor model which, it boasts, will help investors analyse key portfolio exposures across asset classes through an "integrated and consistent framework."

Increasing regulatory pressure and the rise of passive investments have combined to hugely disrupt the investment landscape.

This disruption has seen more and more investors focus on the outcomes of their investing. The drive towards ever lower fees in the passive space is one example of this.

But in smart beta-land, it isn't the cost of the product that is being disrupted. Instead, arguably, the disruption is occurring via ever more complex modelling.

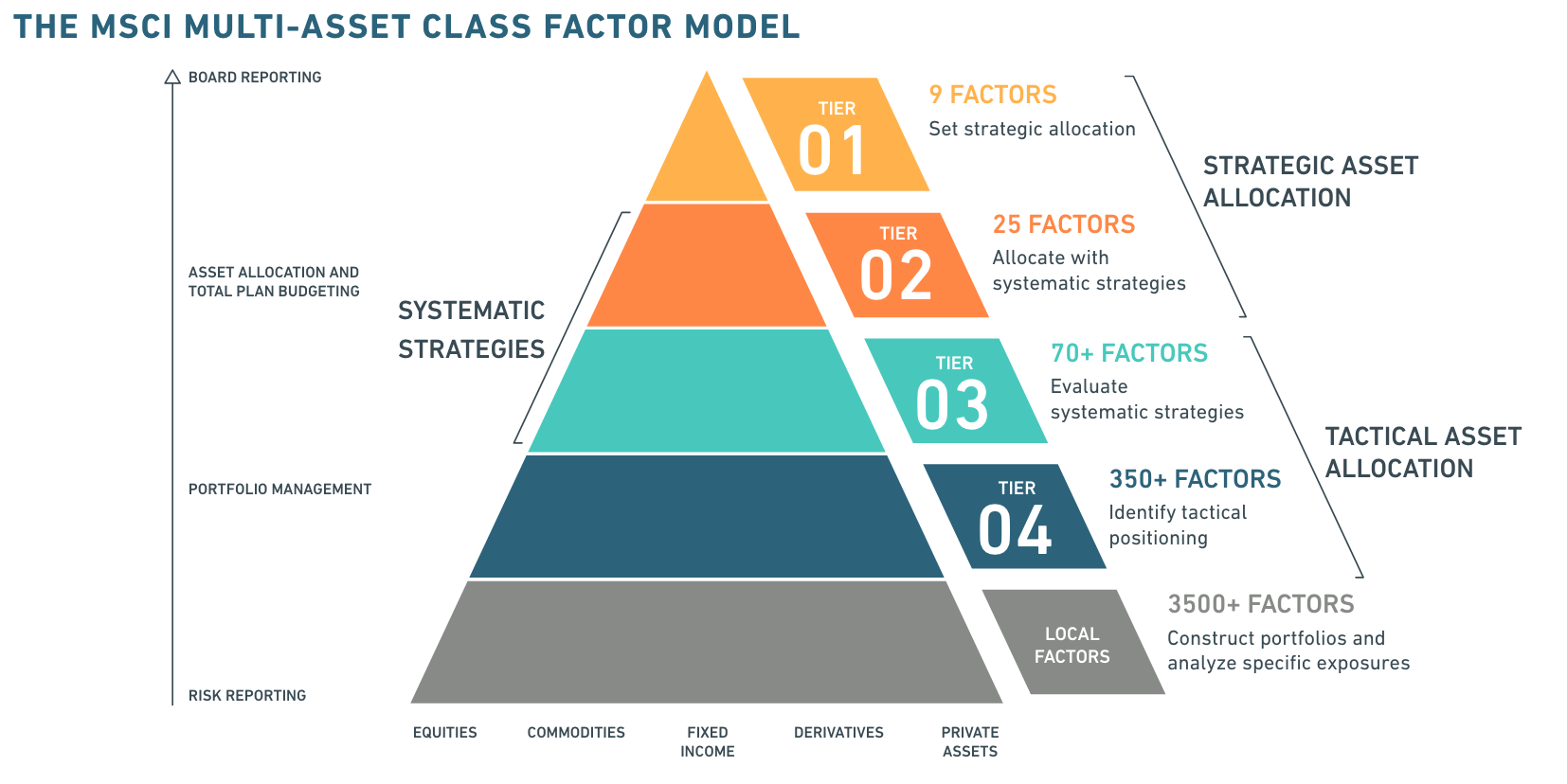

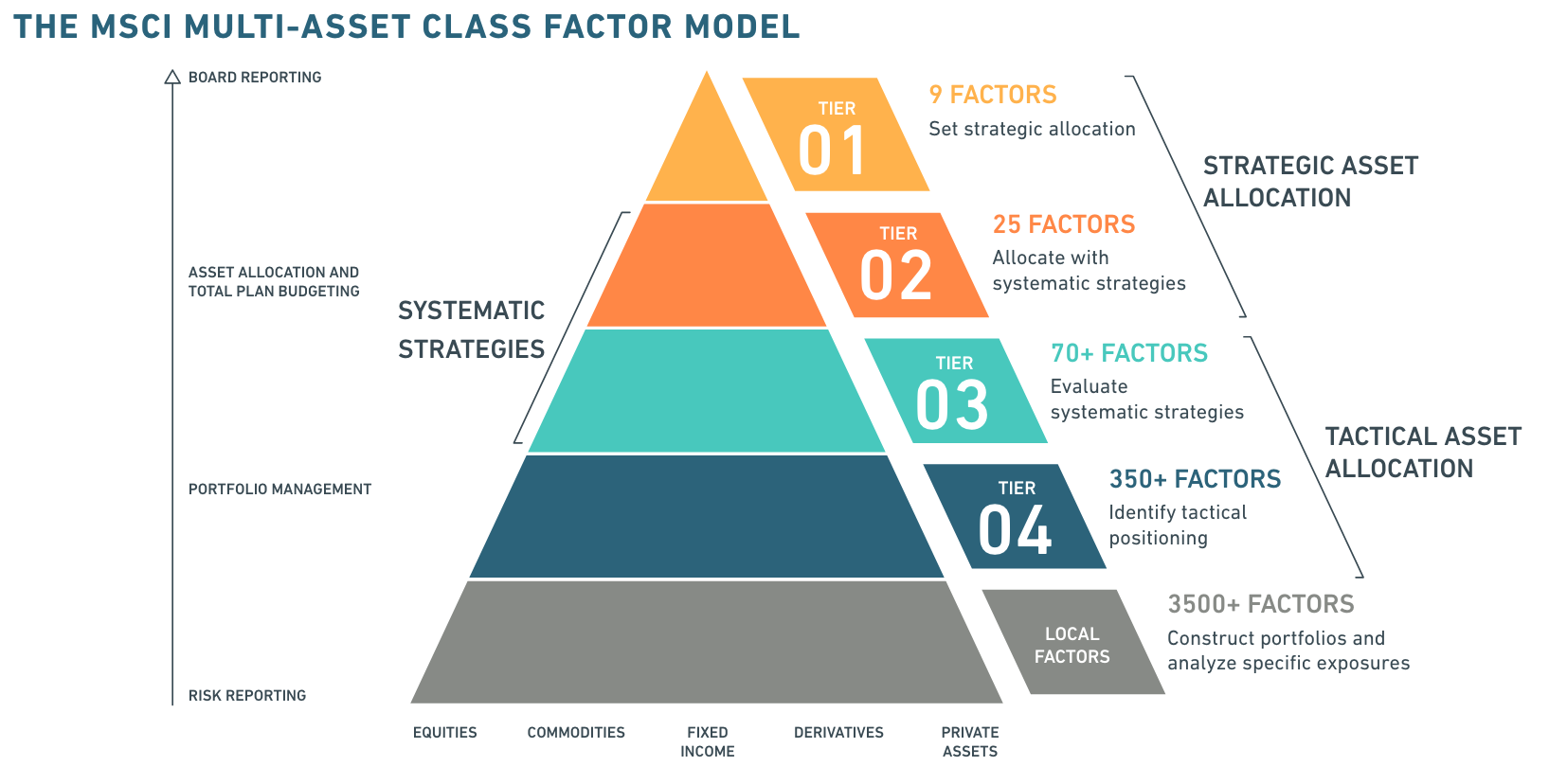

This is no bad thing. Asset allocation is a complex subject - hence MSCI using such jargon as "multi-tiered modelling."

The terminology is backed up by complex diagrams. See below.

Source

Source: MSCI

According to MSCI, this tiered structure provides "multiple levels of granularity" while also providing consistency. The integration of the tiers, meanwhile, "helps bridge the gap from construction to communication" between the various levels within an asset management organisation.

Jargon yes, but the message they are trying to convey clearly isn't a simple one. Asset allocation generally is not a subject where simple explanations work, at least not in the experience of most investors.

What MSCI does make clear is that factor-based investing shows how traditional asset allocation is transitioning. It makes sense. Factor investing, arguably, is all about asset allocation.

As MSCI says, it can help investors "identify and implement systematic strategy factors beyond equities across asset classes". It can simplify thousands of exposures across asset classes to a set of "key risk and return drivers" and therefore make multi-asset class portfolio exposures "easier to communicate."

Of course, this kind of blurb isn't really for the eyes of the end investor - or rarely so at least. This is for people in the industry such as wealth managers, and what is certainly the case is that as the rise of passive and smart beta products has changed the nature of the financial advice, so it leaves more advisors to consider how best to offer relatively simple asset allocation strategies for their clients rather than heading down the road of fund selection.

But what I would like to see is somebody - whether it is MSCI or some other organisation perhaps closer to the end user -take the wealth of information contained within such innovations as the MAC and translate that into easily understood concepts.

In talking about his company's product, Peter Zangari, global head of research and product development at MSCI says that the growth of factor investing has "transformed the way investors view their portfolios, underscoring the importance of factor awareness in active portfolio management."

If he is talking about institutional investors, that is very likely true. But if he is talking about the investor on the top of the Clapham omnibus, then this comment is likely way off the mark.

Zangari says MSCI is "committed to helping our clients navigate the complex nature of the global markets and enhance their investment approach."

Now we just need to see the same commitment from those talking to the wider investor community. Asset allocation is a hugely important subject - and factor investing will be a vital element of that. But that needs to be clearly conveyed to the investing public in language they can understand - and diagrams that are potentially more explicable.