Here's a headline that struck this correspondent as being somewhat confusing. It came in a recent issue of Investment Week and read 'Morningstar advises investors to "quit chasing" consistent fund performance.'

What struck me was the message here. The premise is that, as the S&P 'persistence scorecard' shows, the number of active funds that manages to outperform consistent is perishingly low.

It is a stick with which the passive industry has been able to beat the active sector - and as we know, that stick has been wielded by all and sundry to much effect.

At the risk of mixing military and sporting metaphors, instead of even attempting to hold any ground on the key issue of persistency, Morningstar instead moves the goalposts.

So is persistency overrated?

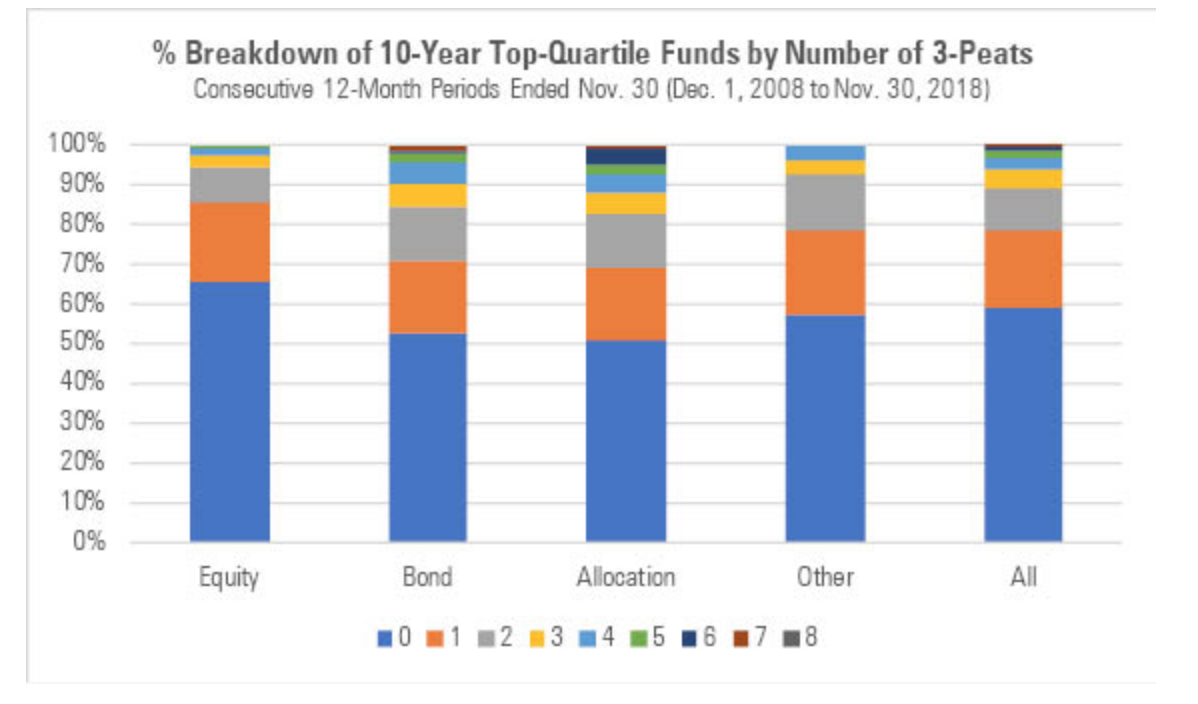

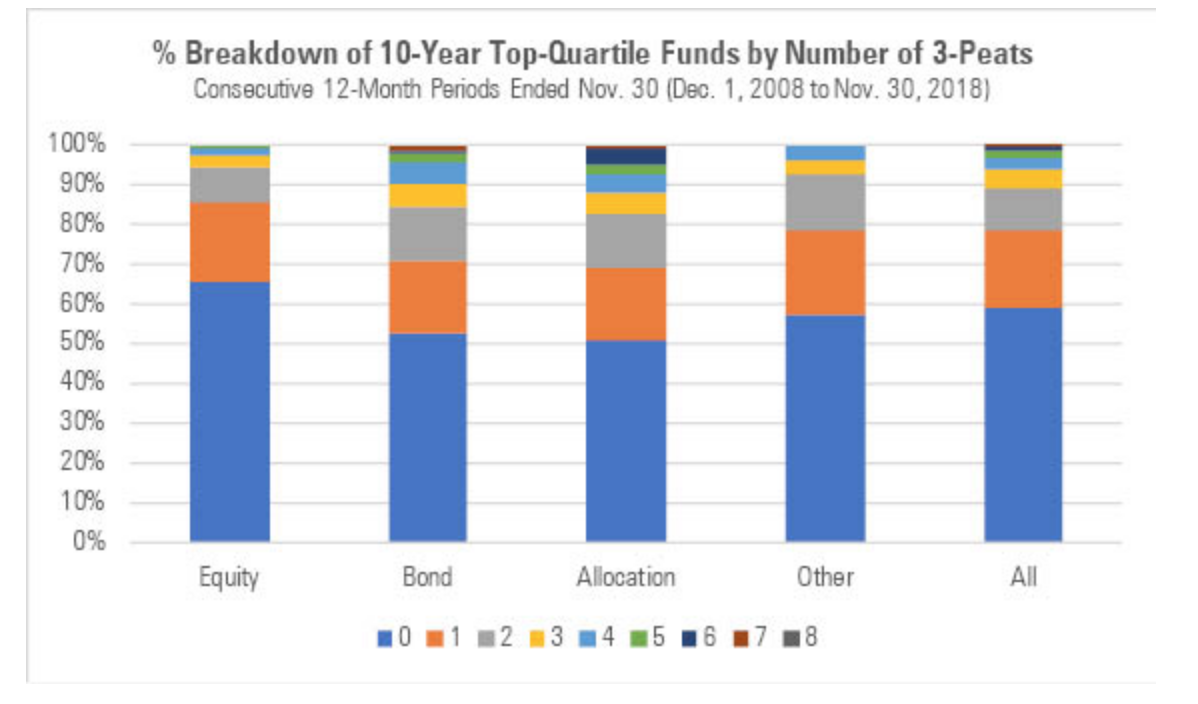

This is the first point made by the author of the report, Jeffrey Ptak, the global director of manager research at Morningstar. Looking at the list of top performers over the 10 years to November last year, he searches for funds which among those in the top quartile over the period (a total of 1,188) which managed to be top quartile for three years in a row over that 10-year period.

Most - 702 to be exact - failed this test. Moreover, Ptak informs us, the picture is worse for passive funds. "Index funds were even less likely to three-peat than active funds over the 10-year period we examined - just 16 of the 58 top-quartile index funds did so even once, whereas 470 of the 1,130 active funds three-peated once or more."

Now, I don't think I'm wrong in thinking that index funds would never wish to benchmark themselves against this arbitrary "three-peat" test. Arguably, whether an index fund is top, middle or bottom quarter should by rights be down to the index, not the fund.

Ptak goes on to point out that of the 60% of funds that did three-peat over the period ended up as a top performer over the 10-year period, while 8% of those funds died over the 10-year period.

So, three-peaters tend to do well over 10 years. That's the good news. The bad news is that once a three-peater has been identified, it is unlikely to provide further outperformance. As Ptak says, only 14% of all funds three-peated "even once." Then comes this killer line: "What this means is that you'd have had a better chance of choosing a top-quartile 10-year performer at random, as 21% of all funds that began the 10-year period survived to the end and landed in their category's top-quartile."

At random? It might be asked at this point, what is this research really telling us. Now, Ptak goes on to say that index funds are less likely to manage the three-peat trick. As he says, only 11% of index funds three-peated once versus 15% of active.

"What's more," he adds, "only about 48% of three-peating index funds went on survive the full 10-year period and land in their category's top quartile by the end, versus 61% of active funds."

Survival factors aside - and accepting the arbitrary nature of the three-peat line - the four hundred basis point difference between active and passive would appear to offer active investors slim pickings indeed given their chances of hitting upon said winnings funds are random.

Ptak concludes with some stinging words for the index industry in particular. "Studies like the S&P Persistence Scorecard put consistent performance on a pedestal," he says.

"It doesn't belong there. Even the most durably successful funds have bouts of underperformance and thus flunk tests like these. What's more, inconsistency isn't an active-fund problem, per se. If anything, index funds are just as prone to inconsistency, if not more so. There are a number of reasons to index - wide diversification and low fees among them - but consistency isn't one of them."

Now forgive me, but is Ptak setting up a straw man here? I don't recall that consistency is much put forward with regard to index funds. By rights, consistency is actually out of the hands of passive funds - it is simply something they can't control. Whereas active funds - with their focus on performance for good or ill - is obsessed with consistency. It is it's one great selling point over passive - that the manager can attempt to outperform over time.

If they fail at that - and the evidence is building up here - then what are they even for? Answers on a postcard please.