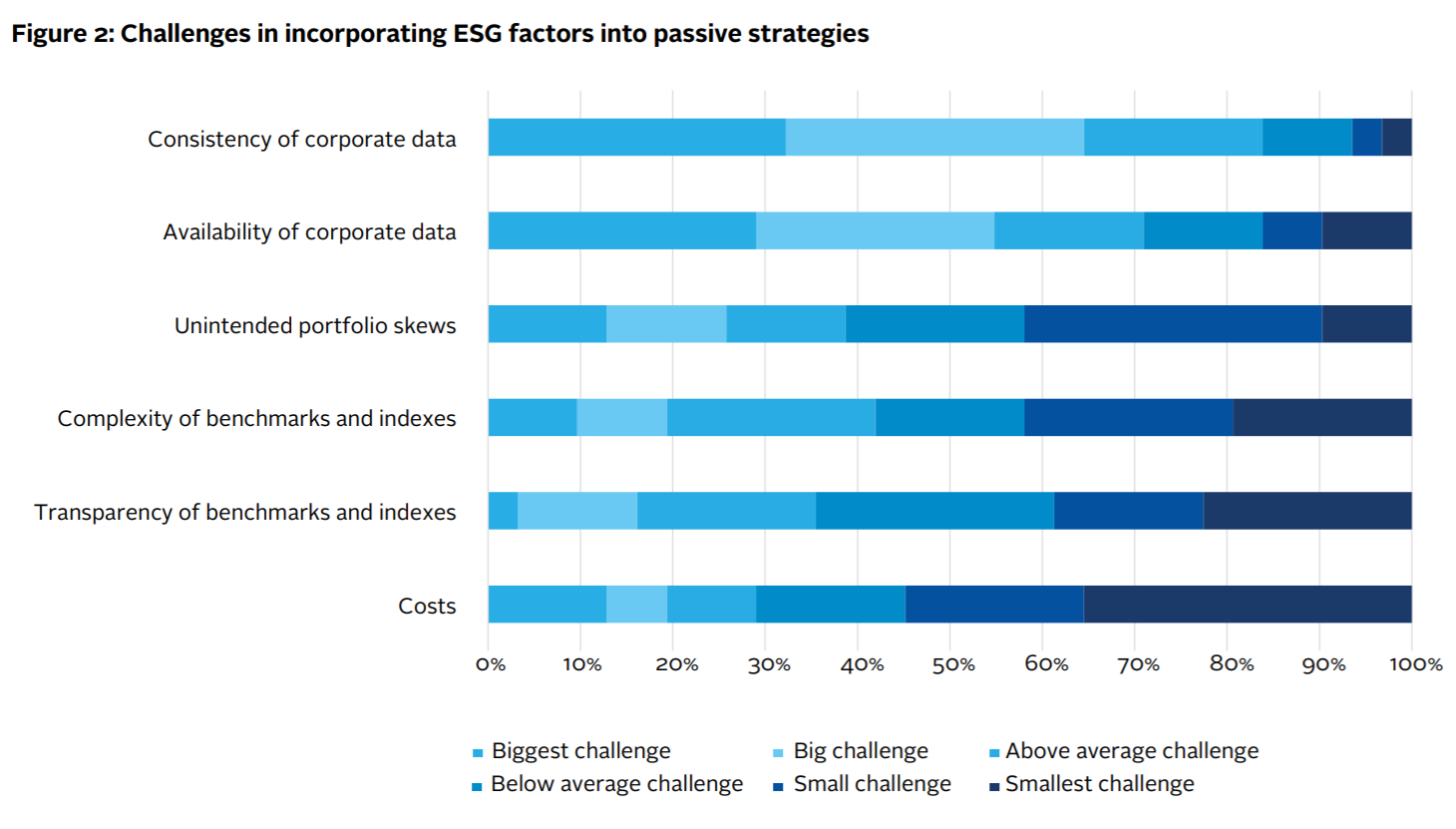

The consistency and availability of data is the biggest challenge in incorporating ESG factors in passive strategies, according to a survey conducted by the Principles for Responsible Investment (PRI).

The survey, which consisted of 130 industry professionals from investment managers to asset owners and index providers, found some 80% of respondents bemoaned the lack of consistent ESG data at a corporate level.

A lack of consistent ESG data is a big issue for the industry as it can lead to malpractices such as greenwashing.

Meanwhile, 70% of respondents highlighted a lack of readily available data as a challenge. Other issues included unintended portfolio skews, complexity and transparency of benchmarks and indices and costs.

Source: PRI

The published findings come eight months after the PRI launched a consultation last August into the impact passive investing is having on ESG factors and the potential risks involved.

Over the past six months, the PRI has been collecting views from the investment industry on two areas; ESG incorporation in passive strategies and active ownership.

The PRI report said the key issue for many respondents around a lack of consistent data, which is subjective analyst judgement, was it provided the basis for constructing ESG indices.

It added: “ESG data issues are a recurrent issue across much of the asset class-specific work the PRI has undertaken – and the passive investment roundtable discussions were no exception.

“Common issues included: gaps in small company and emerging market data; the lack of standardisation; the reliance on voluntary reporting; and the backward-looking nature of ESG data.”

ETF Insight: Are ETF and index providers taking ESG seriously?

Respondents also highlighted a number of solutions to the challenges of integrating ESG factors into passive strategies.

For asset owners, these included encouraging data providers to report and disclose on ESG index methodologies, utilising these reporting insights in their processes and reconsidering tracking error limits to benchmark selection to enable the corporation of ESG factors in index construction.

Toby Belsom, director, investment practices at the PRI, commented: “For the continued growth of ESG passive markets, products need to be transparent and comparable.

“Passive managers need to ensure they are not seen as lazy owners and are instead engaging corporates or regulators on systemic issues that cut across markets.”

Sign up to ETF Stream’s weekly email here