In the run-up to Christmas, the City publishes a flood of investment outlook papers and notes - fund management firms, investment banks, ETF providers; they're all at it. I've been reading some of them over the last week or so and I can sum them up in two words: cautious optimism.

That's not a surprising conclusion. Analysts and fund managers are reluctant to spoil the party - and their businesses - by suggesting a crash is round the corner. Equally they have to qualify their optimism given current valuations and the market's strong run in 2017.

Still, I have some picked up some interesting points from the notes, so here's a summary of the best bits. I'll start with a couple of the most positive points.

Grounds for optimism

The global economy looks pretty good and that's one reason why global stock markets are so strong at the moment. Goldman Sachs expects this global expansion to continue in 2018 and 'carry global equity markets to new highs' even if there is more volatility along the way.

Liontrust is also positive and cites positive manufacturing PMI numbers round the world. There's plenty more optimism out there.

Worries

But there are also several issues to worry about and that's why I'd say the consensus view includes some caution. Here are some of the most important worries:

Central banks make a mess of QE wind down

The gradual winding down of Quantitative Easing (QE) has begun. The US Federal Reserve has started to shrink its huge balance sheet which arose from QE. Europe and Japan are still aggressively printing money but Liontrust says that global QE will be close to zero on a net basis by the end of next year.

The risk is that central banks wind down QE too aggressively and trigger a global recession as a result. There's no sign of that now, but things could change. Ending QE is inherently risky, simply because we've never been down this road before. The ultra-lax monetary policy of the last few years is unprecedented.

Communication is also a crucial issue here, banks need to signal their actions so markets aren't jolted by a sudden change. Lombard Odier says banks have been good at signalling in 2017, they need to continue in that vein.

Inflation

When unemployment is low, you often see a significant rise in inflation, but that hasn't really happened so far in this cycle. If inflation did jump in 2018, that could push central banks to raise rates more quickly than markets currently expect.

Goldman Sachs, however, is relatively relaxed on this and doesn't expect a big rise in global inflation.

Schroders, by contrast, thinks we could see a spike in the US. American unemployment is currently at 4.4% and is on course to hit 3.5% in a year, according to the fund manager. Schroders points out that in areas of the US where unemployment has already reached 3.5%, wages are growing at 4%.

Citi also thinks inflation could pick up and says 'the Phillips curve isn't dead.' (The curve shows inflation rising as unemployment falls.) That said, Citi accepts that some of the factors that have held inflation down in 2017 will continue to apply this year. In particular, the ageing population - older workers are less likely to push for big wage rises - and further advances in technology.

China

The issue with China is debt. Chinese debt worries unsettled global markets in 2015 and pessimists fear this could happen again. However, Goldman Sachs believes a Chinese hard landing is 'unlikely' in the next few years. That's because total debt growth has slowed down even if imbalances remain high. Liontrust points out that a lot of the debt consists of loans from one government-controlled entity to another - these debts can probably be unwound without too many negative side effects.

Liontrust also highlights the importance of technology in China's economy. The government has set a target of electric car production comprising 10% of all car production in 2019. China needs technology to deliver economic growth because demographics are no longer in the country's favour.

Geopolitics

Fears over a potential war with North Korea haven't hurt markets in 2017 but Lombard Odier thinks we shouldn't turn a blind eye to this: "we still view this issue as a significant binary risk which should not be ignored."

ETF Securities is worried about the proxy war between Saudi Arabia and Iran, currently being fought most aggressively in Yemen. If this situation deteriorates further, the ETF provider fears we could face another oil price shock.

Valuation and the cycle

Valuation, especially in the US, is another worry. The US market is currently on a cyclically adjusted price/earnings ratio (CAPE) of 32. That's well above average. A correction in the US could pull other markets down, even if their valuations are more reasonable.

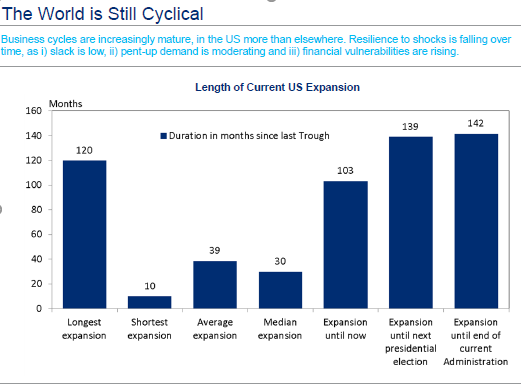

It's also worth noting that the US economy has avoided recession for an unusually long period. The same is true of the current bull market.

Source: Citi and national statistical offices

But as Lombard Odier says, 'it is shocks which kill business cycles not age.'

The shock could come from monetary tightening, inflation, politics or a black swan event, but there has to be some form of shock surely to trigger a substantial correction.

Asset allocation

Let's now move onto asset allocation.

Whem markets look toppy, bonds have traditionally been seen as a good way to diversify portfolios and reduce risks. But Seven Investment Management says that isn't the case this time round simply because valuations are so high. Goldman Sachs expects a sell off in bonds as US interest rate rises pick up speed.

So that pushes investors back towards equities and a search for cheaper pockets within the global stock market.

Seven Investment Management says 'stock markets have already started to see a modest rotation away from growth stocks in December in favour of value…it's hard to believe that the market will continue to be as narrowly led by FAANG stocks in 2018.'

So value is probably one of the better factors to go for. And, of course, there are plenty of smart beta value ETFs available for investors. Two examples are the Lyxor SG Global Value Beta UCITS ETF and the db x-trackers MSCI World Value Factor UCITS ETF.

US

That said, it may be too late to get aboard the value train in the US. Nick Kirrage, co-head of the Global Value team at Schroders, says there are now only a handful of value opportunities in the US, all of which are in retail. Kirrage highlights the tangible book value per share (TBV) for the S&P 500 at 24, which is high by historical standards and compared to other regions.

Looking at the wider US economy, Goldman Sachs says that US interest rates will rise more quickly than the market expects, boosting the dollar. On the plus side, Goldman thinks the US market is less dependent on QE than many realise.

'We think the QE impact is more limited and draw comfort from the fact that the US core asset valuations outside of bonds largely can be explained with models that relate valuations to the macro environment without QE effects.'

Goldman also thinks US bond yields can rise without triggering a major sell-off for the stock market. If the bank is right, that's clearly a major support for the US market.

That said, in my view, you can't get away from the fact that US valuations are high, so I doubt I'll be adding to my US holdings in 2018, unless prices fall a fair bit from here.

Read more in 'Investing in the US'.

Europe

Turning to Europe, the pundits are more positive. Lombard Odier thinks there is a good chance of above trend growth over the coming quarters given Europe's lower capacity utilisation relative to the US. ETF Securities also sees value here and thinks that economic growth is more sustainable in Europe than the US.

Japan

Most of the commentators are positive on Japan too. Goldman Sachs says: 'corporate fundamentals have been recovering over the last 20 years, as evidenced by high cash levels, low debt levels, improving profit margins and a rising return on equity.' What's more, the 'price to book ratio is cheapest relative to the US since the global financial crisis.'

Read 'A Guide to Japan ETFs' to find out more about investing in Japan.

Emerging markets

Emerging markets are also popular. Indeed Goldman Sachs prefers emerging markets generally to developed markets: 'the macroeconomic fundamentals are supportive and valuations are attractive.' Even after a recent recovery, emerging market stocks still trade at a 25% discount to developed market stocks. Goldman thinks consumer-driven economic growth should provide continued support to emerging market equities.

If you want to use ETFs to invest in emerging markets, read 'Investing in emerging market equities.'

Gold

ETF Securities thinks the outlook for gold is 'broadly flat.' On the plus side, some investors may see Gold as a hedge against a possible market correction as well as an insurance policy against any geopolitical crisis. It's also worth noting that although interest rates will rise next year, real interest rates may not rise much. Of course, low interest rates are normally good for gold as gold's biggest flaw is that it doesn't pay an income.

On the downside though, a stronger dollar and a steeper yield curve would normally be seen as bad news for gold.

Oil

Goldman Sachs thinks that oil will probably stay within a $40 to $60 band. OPEC's willingness to cut production if necessary should provide the $40 floor while the growth of shale production in the US should mean there's a price ceiling at $60.

So that's a round up of various notes I've read over the last few days. They may all be wrong, but at least I'm aware of some of the issues to focus on this year.