I've been nervous about investing in the US for a while now. The valuations just seemed too high. As a result, I reduced my exposure. But I didn't sell out completely. There's still a case for investing in America and the recent market falls strengthen that case.

Valuation

Let's start by looking at valuation. My favourite valuation metric is the CAPE ratio or cyclically adjusted price/earnings ratio. It compares share prices with average profits over the last ten years. You can use the CAPE to look at individual stocks as well as wider markets. It's not a perfect metric - no one number can tell you the whole story - but if only one number were available, it's the one I'd go for.

We can use the CAPE ratio to compare the US with other markets as well as historic performance. Take a look at this table:

CAPE ratios 1989 - 2018 (end of October each year)

YearUSUKEuropeJapanChina198919.416.718.374.5199427.218.418.539.6199943.727.536.567.8200040.727.440.175.3200128.421.226.660.4200222.716.219.770.1200325.116.720.290.7200424.717.220.474.510.3200524.318.622.372.613.4200626.020.024.262.722.7200727.020.424.352.655.3200815.911.913.122.417.1200918.114.014.925.128.2201020.215.216.021.826.7201119.413.613.819.818.7201219.913.614.217.516.8201323.615.216.625.215.8201425.614.416.825.514.7201525.714.318.127.813.2201625.716.618.724.512.7201730.418.422.429.317.3201829.417.820.725.213.9

Source: Barclays

These ratios were calculated at the end of October. US share prices are at roughly the same level they were at the end of October, so these figures are broadly correct for now. I've bolded the most important years.

You can see from the table that the US is more expensive than Europe, the UK, Japan or China. It's also at a relatively high level historically - higher even than in 2007 when the market was booming prior to the financial crisis. That said, it's nowhere near as high as the crazy peaks back in 1999/2000.

If you're bullish about the US, you could argue that the current premium over other global markets is justified by two factors. Firstly, the US economy is stronger than most of its rivals right now. Secondly, the US has a long track record of innovation that leads to the development of major global companies.

And even if you think the current valuation is too high, there's no guarantee the market will ever agree with you. You could sit out the current market, waiting for cheaper share prices to come, and your opportunity to buy might never come. Timing is hard.

The US market is hard to ignore. It's easily the biggest in the world - in fact it comprises more than half of the global stock market by value. These are all good reasons for having some money in the US.

On the other hand, there's clearly plenty for bears to chew on. A CAPE ratio of 29 is higher than the historic average, and when you look at share price movements over the last couple of months, investors are clearly nervous. And that's against a backdrop of tightening monetary policy. The US Fed has already started raising interest rates and is reversing quantitative easing (QE). QE triggered large rises in asset prices across the board earlier this decade - it seems rational that a reverse will at least crimp future asset price growth.

So it's a tough call. As I've said, I've reduced exposure, but I'm not bailing out of the US completely. And as well as reducing my overall exposure, I've been tilting my US exposure to less glamorous parts of the market.

Value

Value is one obvious place to look for cheaper shares. Granted, value shares have had a rotten run for the last decade but we're at a point in the market cycle where you'd expect that to change before long. And value shares look cheap compared to their growth brethren. If you compare the price/earnings ratio for the Russell 1000 growth index and the price/earnings ratio for the Russell 1000 value index, the growth premium is currently 1.43. That's higher than for most of the last 12 years. There are some early signs of investors beginning to switch over to value, but it's very early in the process.

If you're interested in US value, take a look at the SPDR MSCI USA Value UCITS ETF UVAL.

Size/small cap

There's plenty of evidence that smaller companies do better over the very long term. And right now, they look set to do better than larger stocks in the S&P 500 over the short term too. That's because smaller US companies have more exposure to the US domestic economy than larger stocks. (Your average S&P stock generates around 70% of revenue in the US, whereas for smaller stocks, it's more like 80%.) This is important because while many economies around the world look weak, the US continues to grow strongly.

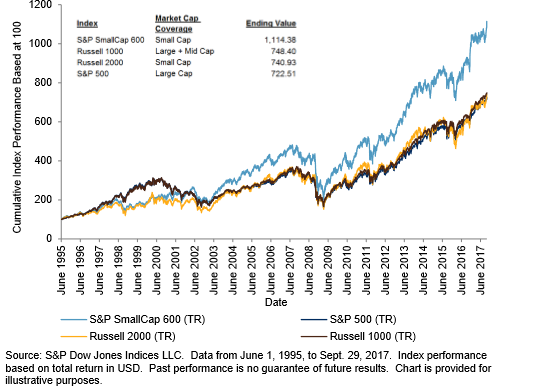

For a US smallcap ETF, I'd go for the iShares S&P smallcap 600 UCITS ETF IDP6. It tracks the S&P 600 smallcap index which isn't the most famous US smallcap index - that honour goes to the Russell 2000. However, I prefer the S&P 600 because its performance is better. Look at this chart:

Cumulative Performance of the S&P SmallCap 600 Versus the Russell 2000

Source: S&P

Jodie Gunzberg, Head of US Equities at S&P, says that the S&P does better because it applies an ‘earnings screen' before stocks are eligible for an index. A stock needs to deliver positive earnings over the previous quarter and on average over the previous four quarters.

Gunzberg also points that US smallcaps are less correlated with international markets than the large caps. The S&P 500 has 0.81 correlation with the UK market whereas the smallcap S&P 600 has 0.67 correlation. If you want to diversify your portfolio away from the UK, it makes sense to go for markets that aren't well correlated with the UK. Otherwise your attempts at diversification are likely to disappoint.

Equal weight

An equal weight ETF is one where equal weightings are applied to all the stocks in an index. So a new equal weight S&P 500 ETF would comprise 500 stocks all with an 0.2% weighting. Equal weight ETFs tend to become slanted towards value and away from the largest stocks. Value and size are both embedded in equal weight.

Gunzberg says ‘over the long term - ten to fifteen years - it's extremely hard to beat equal weight.' And it also tends to do well in bear markets. It ‘snapped back much better after the financial crisis than large caps.'

One equal weight option is the XTRACKERS S&P 500 Equal Weight UCITS ETF XDEW

Volatility

Don't get me wrong - I'm not suggesting that now is the perfect time to invest in the US. I expect the markets will carry on being choppy and we may see significant falls. But, if you're a long-term investor, I think it's a mistake to avoid the US completely. There's definitely a case for investing in the US.