The ETF industry is defined by only two consensuses. One: to index is better. Two: to rebalance is better.

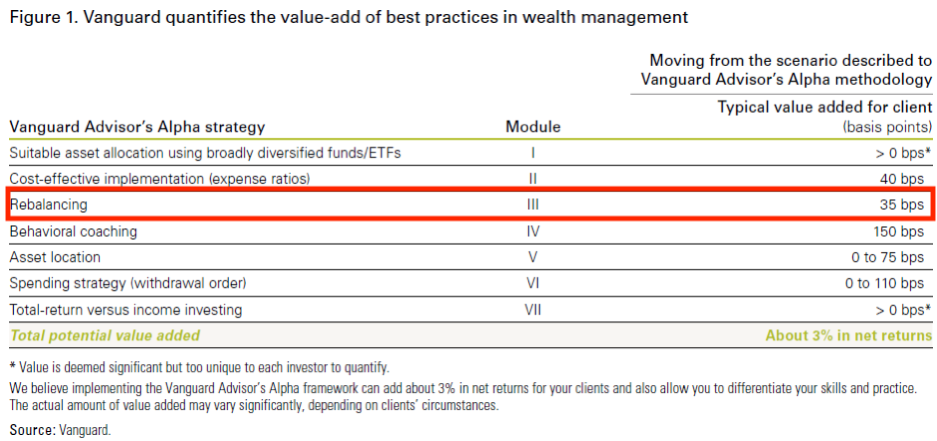

And to that end, portfolio rebalancing is recommended by virtually every ETF provider, advisor and planner. According to Vanguard, rebalancing can provide 35 basis points of alpha a year. BlackRock rebalances its model portfolios every quarter. While most planners and advisors actively militate for rebalancing.

But does rebalancing add value for investors? Perhaps not, an important new research paper has found.

The benefits of rebalancing are marginal, at best. And there seems to be no difference in average return between buy-and-hold portfolios and rebalanced portfolios, it found.

The study, conducted by Michael Edesess, an associate professor at the Hong Kong University of Science and Technology, compared the returns of two groups of 50/50 equity-bond portfolios: where one group was rebalanced while the other was not. It compared both groups' historical returns over 20 and 30-year periods.

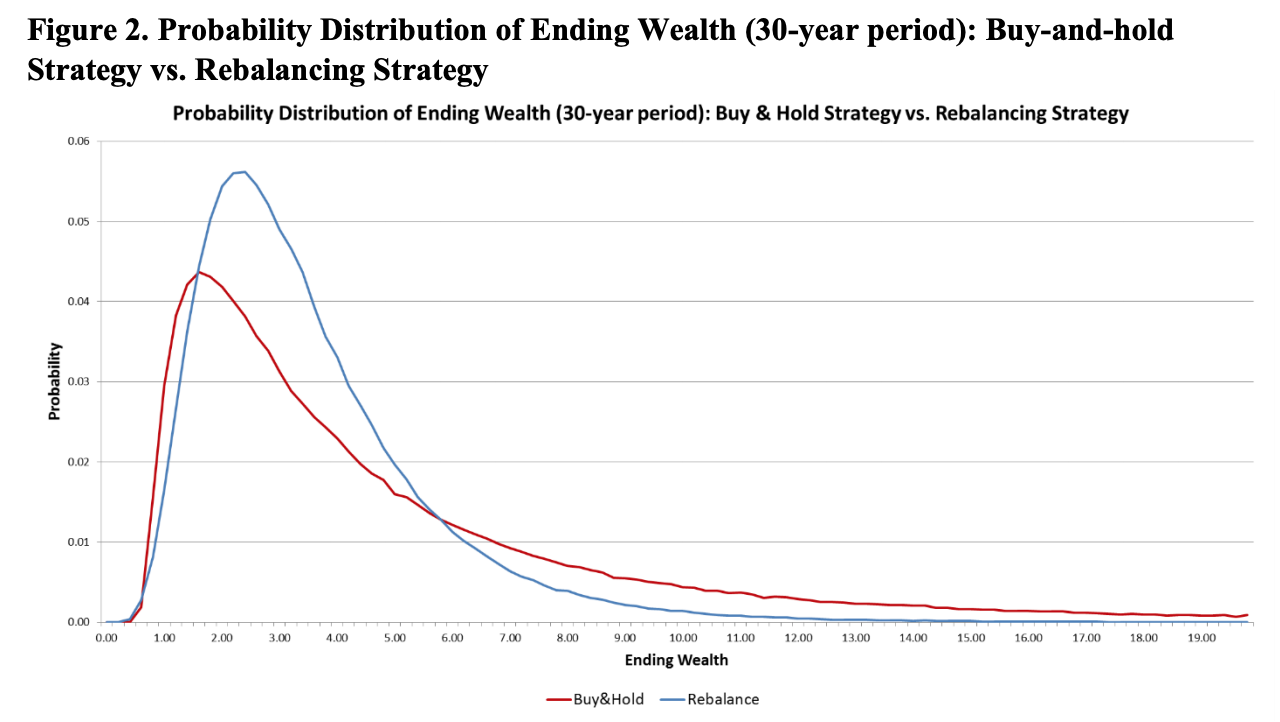

It found that rebalanced portfolios were more likely to produce a return of 2 - 5% a year. But much less likely to produce a return greater than 6% a year. While buy-and-hold portfolios tended to be more unpredictable, they were much more likely to produce returns greater than 6% a year.

"[Rebalancing] is not necessarily superior to a buy-and-hold strategy; the choice involves trade-offs of different perspectives on risk and return, similar to virtually every other choice of investment strategies," the study concluded.

"Buy-and-hold has attractive features, not least that it requires the minimal amount of trading… and a chance to "win the lottery" by lucking into extremely good returns. Rebalancing, on the other hand, may be superior for the investor for whom extreme upside scenarios have relatively low utility."

On the risk management-side, the study found that the Sharpe ratios of all the rebalanced portfolios were superior in keeping with other literature.

However, Prof Edesess noted that Sharpe ratios only told part of the story when it comes to risk. This was because most of the higher standard deviation generated by buy-and-hold portfolios was on the positive side.

"While the buy-and-hold strategy has a greater standard deviation of ending wealth than the rebalancing strategy, that greater standard deviation is almost entirely due to an increase in upside opportunity rather than an increase in downside risk," it said.

The study adds to a small, but growing body of literature that casts doubt on the benefits of rebalancing.