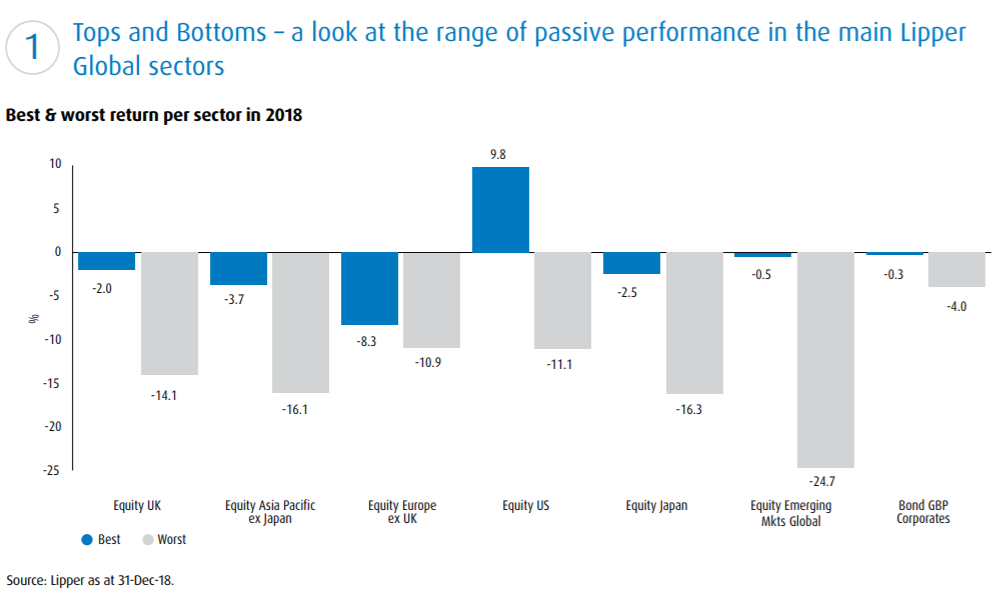

There was a vast range between the best and worst performing passive funds in 2018, according to BMO Global Asset Management, highlighting the importance of selecting the right product when investing in ETFs.

BMO Multi-Manager's annualPassive Watch report found a big difference in performance was seen across all sectors. Last year, the best and worst fund in the Lipper Global Equity - US sector ranged between 9.8% and -11.1% while, in the Lipper Global Equity - UK sector, the spread was between -2% and -14.1%.

The report said this highlights the importance of choosing the right index and subsequently a good passive manager to run the fund, as tracking error can have a major impact.

The biggest factors affecting a fund's tracking error is the tracking methodology, the skill of the manager to follow the index within the constraints of their methodology, taxation and the ongoing charges.

There are various approaches that can be taken by a passive manager to match the return of the index, the report said.

A costly but accurate one is "full replication". This is where the ETF holds all the stocks within the index in the same proportion. Although this leads to low tracking error, it also has high costs due to the amount of dealing required to maintain the correct weights.

For example, the FTSE All-Share has 636 securities while some bond indices, such as the Bloomberg Barclays Global Aggregate index, has considerably more.

"Stratified sampling" involves buying the largest shares of an index in the same proportion and then holding a sample of shares from different industry sectors.

"The main positive here is that the dealing costs will be much lower as a result," BMO GAM explained. "The potential issues include a risk of a higher tracking error due to potential market cap and sector biases or even stock specific issues impacting returns verses the index."

Another method that can lead to high tracking error is "optimisation". This is where a portfolio manager selects a sample of stocks that is a mix highly correlated to the index, which is more cost effective than full replication.

Investors should also be aware of whether the product stock lends, the report noted. This can lead to an increase in performance on the fund however, there is an element of counterparty risk.

When to choose active

BMO's multi-manager team said there are a number of asset classes which they would avoid in a passive vehicle.

One asset class is property. While it is possible track property equities, the report said it is tricky to access bricks and mortar investments.

"This diversification benefit is more prevalent in bricks and mortar investments whereas property equities tend to be highly correlated (at least in the short term) to equity markets," it added.

Another asset class was the corporate bond sector due to the team's concerns around corporate bond liquidity since the Global Financial Crisis. Market making in the credit market has shrunk as investment banks have faced increasing regulation.

"We do have concerns around corporate bond liquidity in this regard and feel that an active manager would be better placed to weather any potential volatility."