European equities probably aren't the first choice for most investors right now. They've fallen this week on the back of concerns about global growth and trade talks.

On top of that, you've got concerns about Brexit and rise of populism across the continent, especially in Italy. And the future of the euro may not be 100% secure.

A recent BofAML Global Fund Manager survey reported that exposure to global equities fell to their lowest level since December 2016 in March. What's more, the most crowded trade was shorting European equities, leading the list for the first time in the survey's history. The trade replaces long emerging markets, which dropped to fourth at 16%, while long the US dollar (18%) is in third place.

Despite this, there are some market watchers who think the slowdown is bottoming out and the worst may be behind us. So, is Europe good value or too risky?

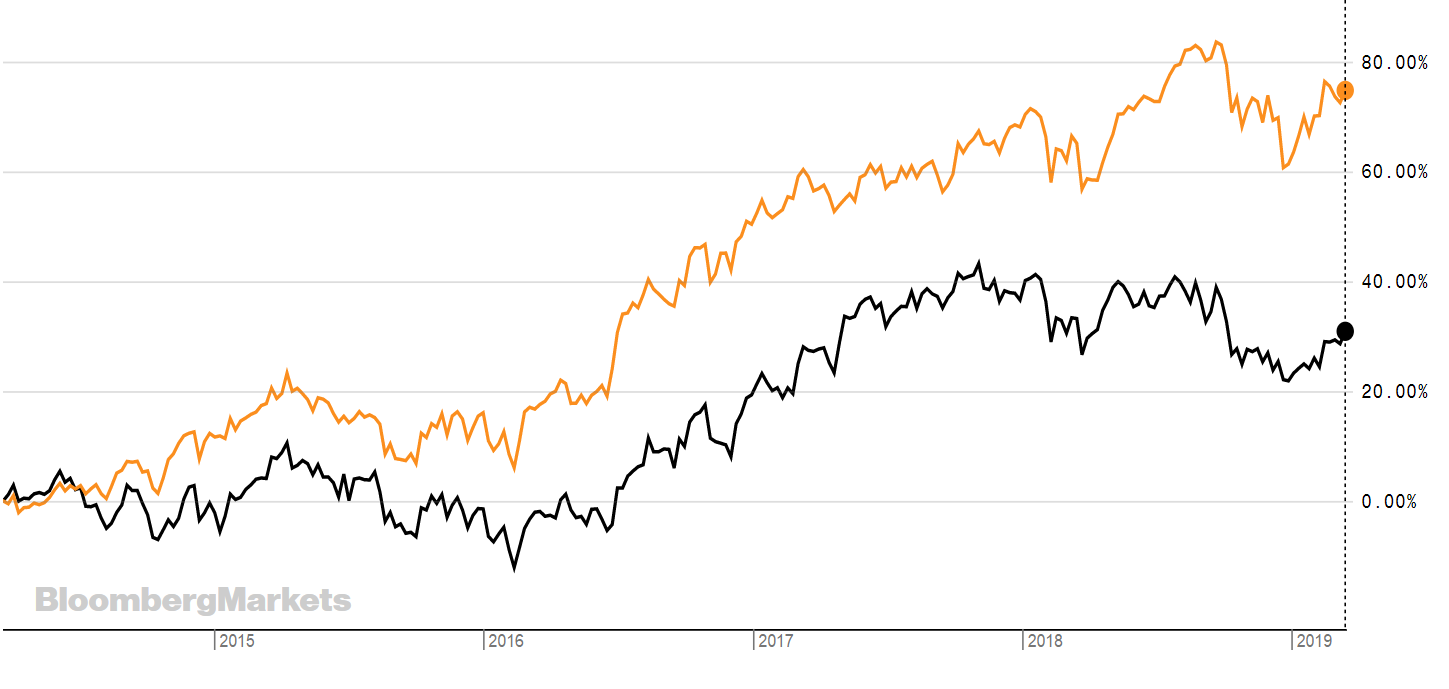

There is no secret that European equities have underperformed global equities over the past five years. The graph below shows iShares Core EUROSTOXX ETF (CS51) in black and its Core MSCI World UCITS ETF (SWDA), both are in sterling.

Source: Bloomberg

However, the worst might possibly be over.

Morningstar wrote last month that "a lot of negativity seems to be priced into the asset class which has suffered from massive outflows. This has resulted in current exposure levels that are only slightly higher than those seen during the Eurozone crisis."

Goldman Sachs economist Jari Stehn, also wrote in a note that: "There are tentative signs that the worst of the weakness is behind us… In contrast to the material downside surprises last year, more recent data have generally come in ahead of expectations."

Morgan Stanley agreed with the sentiment.

Bloomberg reported that many of the idiosyncratic issues seen in 2018 are starting to fade, including problems in the German auto industry, according to Graham Secker, Morgan Stanley's chief European equity strategist. French consumer confidence has also picked up after a dent related to the Yellow Vest protests, though a flare-up at the weekend suggests that situation remains fragile.

"Then there's the improvement in new export orders in China's composite PMI, which tends to lead the euro-area measure, according to Secker. That could be a boon to investors -- after a trough in euro-area PMI, European equities on average see a 9 percent gain in the following six months, he said."

In a recent blog from Lyxor ETF, Lorenzo Bini Smaghi, Chairman and former ECB banker, said: "Some short-term caution is merited but it's important to recognise threat and opportunity alike - and the region offers plenty of both. European assets are pricing in very little in the way of growth but we are actually cautiously optimistic about the outlook and believe sentiment could easily reverse should sentiment shift."

It might be that right now, with the Brexit horror show, trade war hangovers and a cautious outlook Europe might not be the place to invest, but perhaps that why it's worth a second look.

If you want to invest in European equities, then EUROSTOXX ETFs are a good and easy way to get access. The EURO STOXX 50 index comprises Europe's leading blue-chip index for the Eurozone. It includes 50 stocks from 11 Eurozone countries and include sectors such as banking, industrials, insurance, oil & gas, technology, and healthcare, among others.

The range of EUROSTOXX ETFs, some listed below, have done reasonably well over the last year and in the past three months. In sterling terms, you are looking at a roughly 7.5% return in the last three months and in dollar terms around 12.6%.

However, it pays to look under the hood as there are some different returns from seemingly similar ETFs. Lyxor's EURO STOXX 50 DR UCITS ETF (MSEX) has returned 12.69% in the last three months. Meanwhile, the Lyxor Core EURO STOXX 50 DR ETF (MSED) has returned only 7.58%. Both the ETFs are in sterling, so there is no FX discrepancy. The only major difference is that MSEX has a TER of 0.20%, while MSED is cheaper at 0.07%.

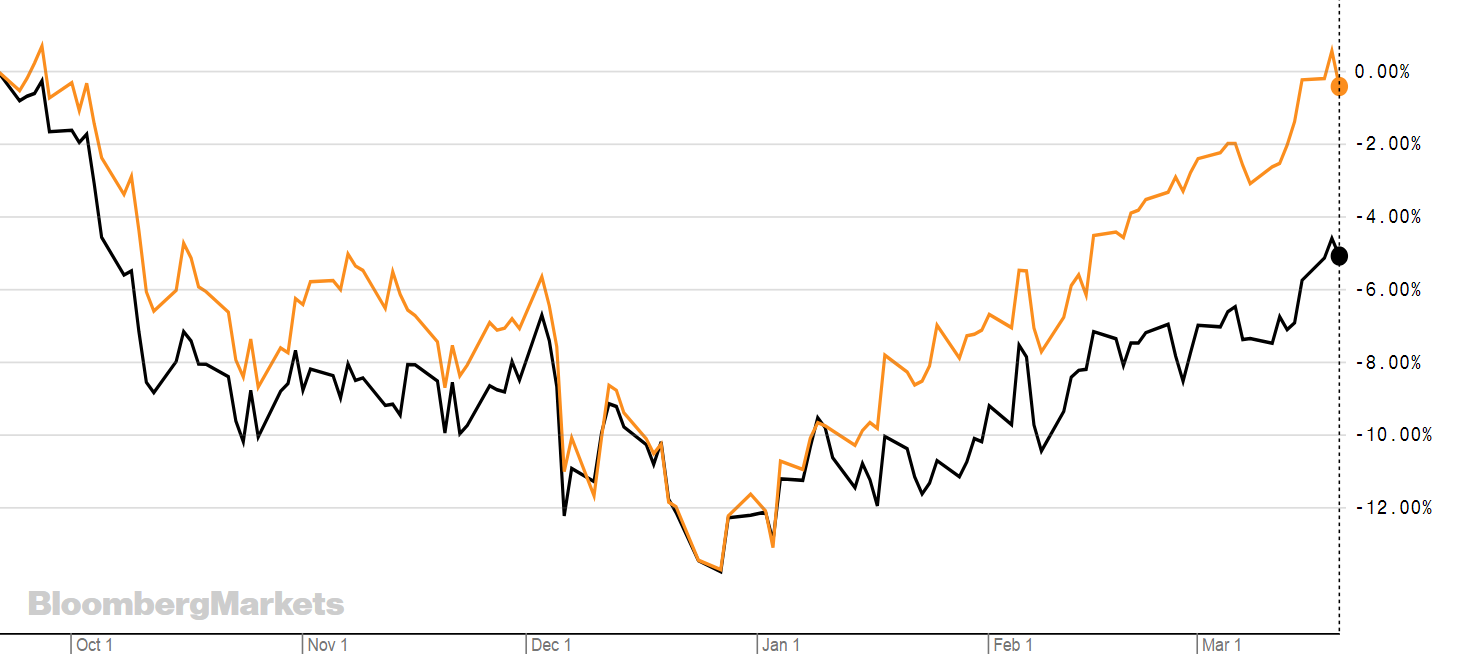

See the chart below.

Source: Bloomberg

Adam Laird, Head of ETF Strategy, Northern Europe, at Lyxor ETF, said: "MSEX is GBP hedged, whereas MSED is unhedged holding of Euro shares. So in a time where political events have impacted on the pound, there's been quite a lot of diversion between the two."

The list below is an example of some of the Euro Stoxx ETFs available on the London Stock Exchange.

RTN

VX5E

MFDD

MSED

MSEX

MSEU

H50E

CS51

EUE

CSX5

UB00

UB01

SX5S

ETF3M TERINDEXVanguard Euro Stoxx 50 UCITS ETF7.54%0.10%Euro Stoxx 50 IndexLyxor Core EURO STOXX 300 DR7.70%0.07%Euro Stoxx Net Return representative of the large cap and mid cap equity performance of the EurozoneLyxor Core EURO STOXX 50 DR7.58%0.07%Euro Stoxx 50 IndexLyxor EURO STOXX 50 DR UCITS ETF12.69%0.20%Euro Stoxx 50 IndexLyxor EURO STOXX 50 DR UCITS ETF13.6%0.20%Euro Stoxx 50 IndexHSBC EURO STOXX 50 UCITS ETF7.52%0.05%Euro Stoxx 50 IndexiShares Core EURO STOXX 50 UCITS ETF7.54%0.10%Euro Stoxx 50 IndexiShares Core EURO STOXX 50 UCITS ETF EUR Dist7.53%0.10%Euro Stoxx 50 IndexiShares Core EURO STOXX 50 UCITS ETF12.96%0.10%Euro Stoxx 50 IndexUBS ETF EURO STOXX 50 UCITS ETF12.91%0.15%Euro Stoxx 50 IndexUBS ETF EURO STOXX 50 UCITS ETF7.48%0.15%Euro Stoxx 50 IndexInvesco EURO STOXX 50 UCITS ETF7.51%0.05%Euro Stoxx 50 Index

For more on investing in Europe, read Five Top ETFs.