Assets held in bond ETPs surpassed $1trn at the end of March reflecting how easier access to the global debt market has been attracting investors. Flows into the space hit record highs in the first three months of the year, according to iShares, but does this mean we should all be buying bond ETFs?

Well, if you think a recession is coming, there is definitely a case for bonds. And those flows into bonds at the beginning of this year suggests that investors are already getting positioned for the storm.

Seeking Alpha said: “The Federal Reserve is advocating a 'patient' approach to interest rates and a survey by the National Association for Business Economics has found that about 50 percent of U.S. business economists believe the country will be in a recession by the end of 2020.”

The first quarter of the year’s record inflows saw investors pour $20.9bn to EMEA-listed fixed income ETFs in Q1, accounting for approximately 60% of total flows into EMEA-listed ETFs across all asset classes.

iShares reported that this more favourable background for fixed income was, in part, created by “dovish central banks, combined with the longer-term structural evolution in fixed income markets to drive greater usage of bond ETFs as tools for building resilient portfolios.

“Analysis of industry ETF flows indicates that while investors have been increasingly allocating to fixed income assets this year, they have been adopting a barbell approach – combining quality exposures with higher risk allocations offering attractive income, such as emerging markets debt,” a note from iShares stated.

Since the financial crisis in 2008 bond assets have increased five-fold, according to a note from the FT. One of the benefits of bond ETFs is that they offer investors level of protection. Typically, government bonds are considered some of the safest and they are often found in multi-asset portfolios due to characteristics such as lower volatility and negative correlations with equity markets.

For example, a UK government bond, also known as a gilt, is considered one of the safest investments on the basis that the UK government will always pay out. It means that during times of political and/or economic uncertainty, gilts typically rally on the basis that UK debt default risk is zero.

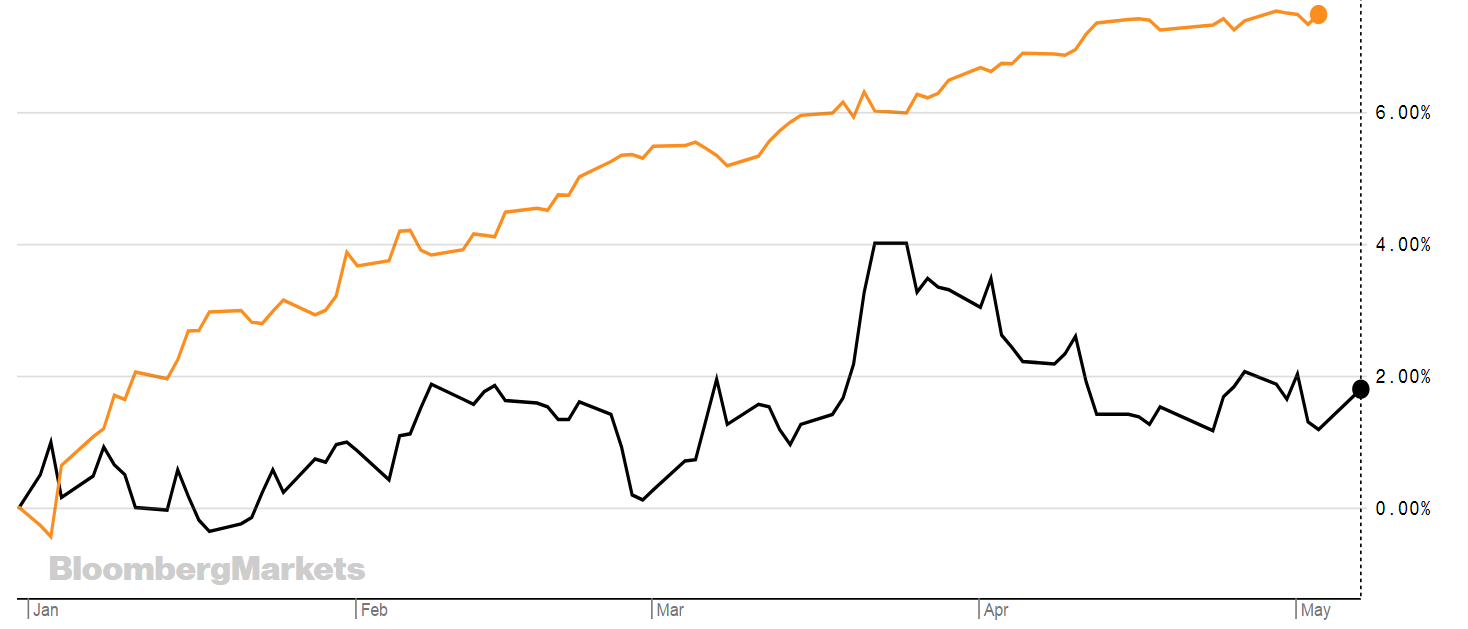

The returns on gilts, however, are low. Riskier types of bond ETFs – such as fallen angel corporate bond ETFs can sometimes generate better returns. The graph below shows iShares IGLT and WIGG – both in GBP – but represent the different year-to-date on returns these ETFs can generate.

Source: Bloomberg

WIGG – iShares Fallen Angels High Yield Corp Bond UCITS ETF

IGLT – iShares Core UK Gilts UCITS ETF

The range of bond ETFs has also increased in recent years and investors can expect to access corporate bonds, government bonds, high yield bonds and emerging market bonds, among others.

Seeking Alpha recently put out a note that highlighted three benefits of bond ETFs; “enabling access, providing diversification and creating liquidity.”

Bond ETFs typically do well in downturns. The chart below shows the iShares UK Core UK Gilts ETF which weathered the financial crisis reasonably well compared to its equity counterpart the iShares Core FTSE 100 ETF (ISF).

Source: iShares

The graph below is the ISF from iShares from Jan 2008 to today.

Source: iShares

Paul Syms, Head of EMEA ETF Fixed Income Product Management at Invesco, previously told ETF Stream: “One of the advantages of developed market Government bonds is they tend to have less credit risk than investment grade corporate or high yield bonds. This means that in a downturn, they are likely to outperform credit markets as investors may have concerns about how the economy will impact corporate borrowers’ ability to repay their debt. Government bonds also tend to be more liquid, with larger issues and higher levels of debt outstanding than would be found in credit markets. For Gilts specifically, the average maturity of debt outstanding is longer than other Government bond markets, which means they would have lower refinancing risk than other markets.”

But ditching equities might be a bit premature.

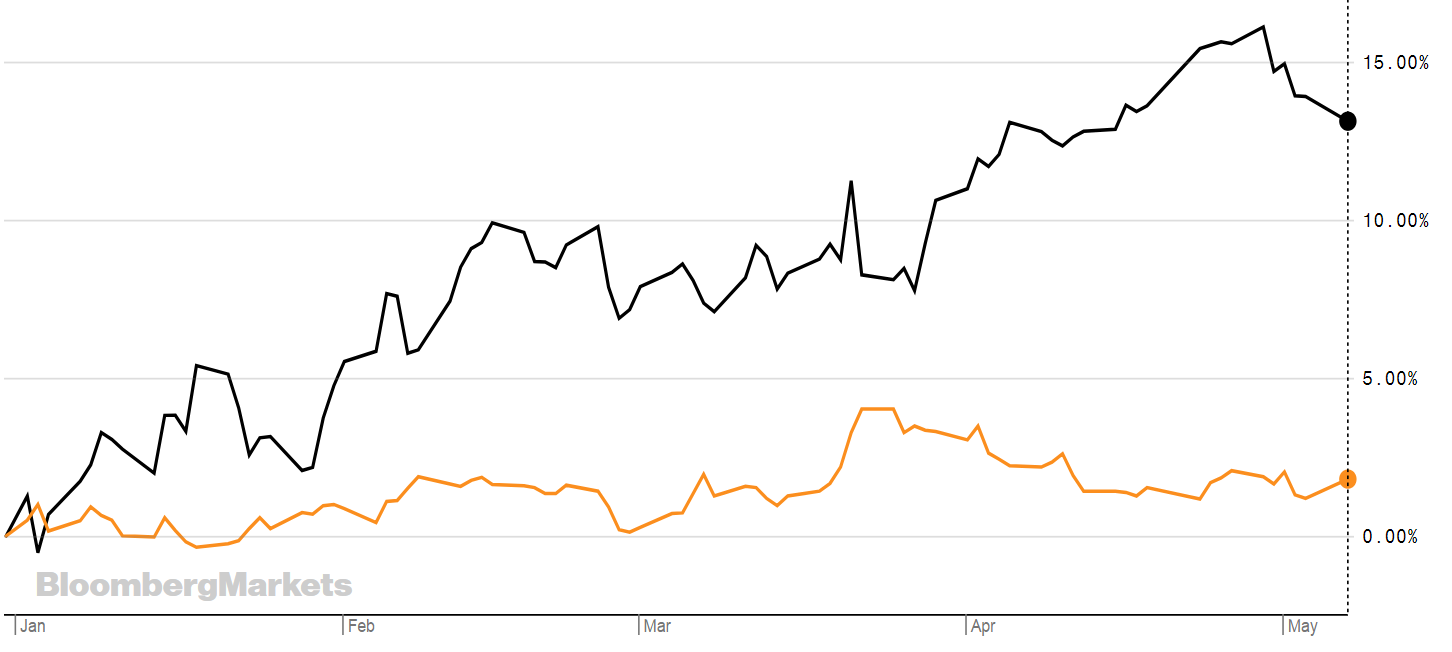

Equities have rallied this year with the S&P 500 returning 15.31% at the time of writing. The chart below shows IUSA and IGLT in GBP since the start of the year.

Source: Bloomberg

While it’s evident that bond ETFs offer some protection in downward trending markets, whether investors need it right now is unclear. What is clear is that access to debt markets through bond ETFs is easier than ever before.

Below is a non-exhaustive list of some of the bond ETFs available to investors on the London Stock Exchange.

RTN

GFGB

WING ($)

FAGB (£)

HYFA ($)

IGLT

GLTY

JG15

VGOV

GILI

GLTL

INXG

EEMB

IEML

EMDD

JPEA

EMLI

XQUA

JPEE

ETFYTDTERINDEXVanEck Vectors Global Fallen Angel High Yield Bond UCITS ETF4.48%0.40%ICE BofAML Global Fallen Angel High Yield IndexiShares Fallen Angels High Yield Corp Bond UCITS ETF7.23%0.5%Bloomberg Barclays Global Corporate ex EM Fallen Angels 3% Issuer Capped Index, which includes bonds originally issued as investment grade and have since been downgraded to sub-investment grade (Fallen Angels).Invesco US High Yield Fallen Angels UCITS ETF8.95%0.50%Citi Time-Weighted US Fallen Angel Select IndexInvesco US High Yield Fallen Angels UCITS ETF9.38%0.45%Citi Time-Weighted US Fallen Angel Select IndexiShares Core UK Gilts UCITS ETF2.44%0.20%The Fund aims to track the performance of the FTSE Actuaries Government Securities UK Gilts All Stock Index.SPDR Bloomberg Barclays UK Gilt UCITS ETF2.52%0.15%The Fund's objective is to track the performance of the UK Government bond Gilt market, as represented by the Bloomberg Barclays Capital UK Gilt Index.JPMorgan BetaBuilders UK Gilt 1-5 YR UCITS ETF0.50%0.10%The Fund's objective is to provide exposure to the performance of Pound Sterling-denominated fixed rate UK government bonds with a maturity of between 1-5 yearsVanguard U.K. Gilt UCITS ETF2.77%0.12%The fund seeks to track the performance of the Bloomberg Barclays Gilts Float Adjusted Total Return Index, a market-weighted index of the U.K. Government fixed-income securities denominated in Pound Sterling.Lyxor Core FTSE Actuaries UK Gilts Inflation-Linked DR UCITS ETF5.10%0.07%The objective of the ETF is to track the evolution of the FTSE Actuaries Bond Indices for British Government Securities Index denominated in British Pounds (GBP)SPDR Bloomberg Barclays 15+ Year Gilt UCITS ETF4.36%0.15%The Fund's objective is to track the performance of the long-dated UK Government bond Gilt market, as represented by the Bloomberg Barclays UK Gilt 15+ Year IndexiShares GBP Index-Linked Gilts UCITS ETF6.17%0.25%The Fund aims to track the performance of the Bloomberg Barclays UK Government Inflation-Linked Bond Index. The index offers exposure to Sterling denominated inflation-linked bondsiShares J.P. Morgan USD EM Bond UCITS ETF9.74%0.45%J.P. Morgan Emerging Markets Bond Index Global Core IndexiShares JP Morgan EM Local Government Bond UCITS ETF1.50%0.50%JP Morgan GBI-EM Global Diversified 10% Cap 1% Floor IndexSPDR Bloomberg Barclays Emerging Markets Local Bond UCITS ETF1.68%0.55%Bloomberg Barclays EM Local Currency Liquid Government IndexiShares J.P. Morgan USD EM Bond UCITS ETF7.01%0.45%J.P. Morgan Emerging Markets Bond Index Global Core IndexPIMCO Emerging Markets Advantage Local Bond Source UCITS3.20%0.60%PIMCO Emerging Markets Advantage Local Currency Bond IndexXtrackers USD EM Bond Quality Weighted ETF5.86%0.40% & 0.50%Markit iBoxx USD Emerging Markets Sovereigns Quality Weighted IndexiShares J.P. Morgan USD EM Bond UCITS ETF9.75%0.45%J.P. Morgan Emerging Markets Bond Index Global Core Index