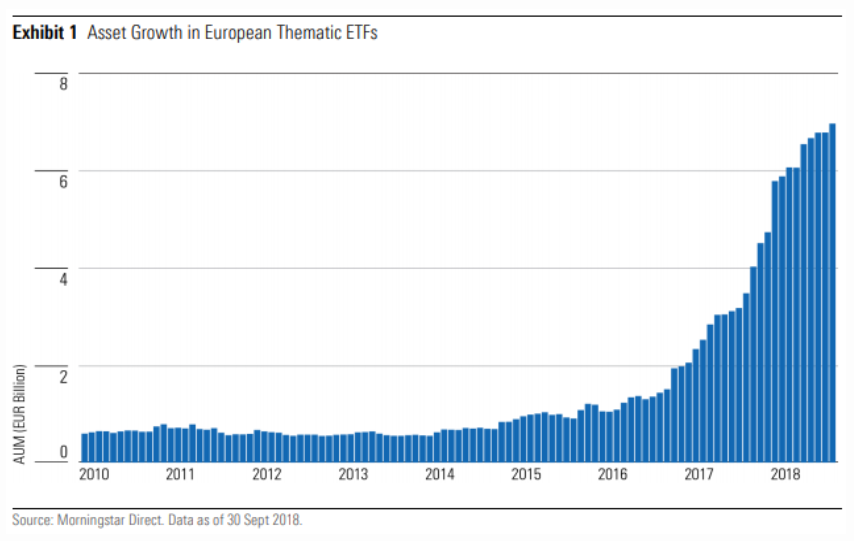

Thematic ETFs are very much in vogue at the moment with investor demand on the rise. Assets in European thematic ETFs now exceed £5.6bn and providers are adding to their offerings in droves.

Recently, LGIM added three new disruptive technology and innovation ETFs to its range. But which sectors are the ones to chase?

It is helpful to try and define thematic ETFs. Essentially they tend to track new markets that are unusual and/or have the potential for rapid growth. The aim is to profit from long term trends, such as technology advancement or environmental changes.

As a result, the ETFs can include health technology, AI, robotics, cyber security, environmental, ESG, and others.

According to a note from LGIM: “The ETFs are designed to invest in markets that are experiencing the potential for rapid growth due to significant changes driven by technological advancements, providing investors with access to pioneering companies that are creating solutions to longstanding challenges.”

However, the untested nature of these ETFs means picking one is not always straight forward if you don’t have an obvious conviction.

As Kenneth Lamont, ETF research analyst at Morningstar, writes: "Unlike other investment approaches such as strategic-beta strategies, the best of which are tested across sprawling historical datasets, thematic investing is entirely focused on trends that have yet to fully play out.

"This lack of track record means that a thematic investment proposition rests heavily on the research supporting the theme, making it particularly difficult to evaluate the robustness of the strategy.

"In many cases, the lack of appropriate benchmark or robust peer group also means that even ex-post performance is difficult to assess."

The chart below shows asset growth in European thematic ETFs from Morningstar.

The ETFs are based on a strategic index that has been created specifically to track the underlying market. As a result of this, the ETFs often have higher fees than plain vanilla ETFs.

The best performing ETF year-to-date is WisdomTree’s Artificial Intelligence UCITS ETF (INTL), which has returned over 33% YTD. It tracks the Nasdaq CTA Artificial Intelligence NTR Index. It’s also one of the cheaper thematic ETFs on offer with a TER of 0.40%.

Artificial Intelligence (AI) technologies could increase global GDP by $15.7 trillion by 2030, according to LGIM.

The firm launched its L&G Artificial Intelligence UCITS ETF this month. The ETF will seek returns from the global market for AI solutions and applications, in which revenues are projected to grow from $16.2 billion in 2018 to $31.2 billion in 2025. In terms of index exposure, the fund will include companies building AI engine and platform solutions, as well as those applying AI capabilities for the purpose of digital transformation.

In fact, most of the thematic ETFs have done well this year with nearly all returns from those launched last year and before in double digits.

In particular, water, robotics, and cyber security ETFs seem to have done particularly well.

Two of the older ETFs on offer are robotics ETFs: the L&G ROBO Global Robotics and Automation UCITS ETF (ROBO) and iShares iShares Automation & Robotics UCITS ETF (RBOT). The former was launched in 2014 and has $935m in AUM. iShares’ RBOT was launched in 2016 and has $2bn assets under management.

Morningstar notes that the five largest ETFs account for 73% of total thematic ETF assets. The top two, iShares Automation & Robotics ETF (RBOT) and L&G ROBO Global Robotics and Automation ETF (ROBO), account for almost half.

The International Federation of Robotics (IFR), reports that the preliminary statistics of the World Robotics Report shows that a new record high of 384,000 units were shipped globally in 2018 – an increase of one percent compared to the previous year.

What is driving the boom in thematic ETF launches?

And demand is coming from investors.

Howie Li, Head of ETFs at LGIM, added in a statement: “All sectors and businesses are being transformed by disruptive technology and we’re seeing increasing demand from investors looking to access these themes in a cost-efficient way. These new funds offer investors the opportunity to hold companies directly benefiting from these themes, with bespoke indices constructed around active selection and research and implemented in a systematic and rules-based way.”

If you want access to a thematic ETF there are over 30 available on the London Stock Exchange, we have listed a number of them below. Performance is noted at the time of writing.

AIAI

AIAG

DOC

DOCG

GLUG

GLGG

WATL

DH2O

IH2O

TSGB

TSWE

ROBG

ROBO

ROBE

ROAI

RBTX

RBOT

INTL

WTAI

SKYY

ITEK

EMQQ

WELP

WELL

DRDR

HEAL

ISPY

USPY

AGES

AGED

DGIT

DGTL

UB45

UB39

UC46

UC44

Expense Ratio:0.38%

ETFYTD RTNTERINDEXL&G Artificial Intelligence UCITS ETFn/a0.49%ROBO Global® Artificial Technology IndexL&G Artificial Intelligence UCITS ETFn/a0.49%ROBO Global® Artificial Technology IndexL&G Healthcare Breakthrough UCITS ETFn/a0.49%ROBO Global®Healthcare Technology and Innovation IndexL&G Healthcare Breakthrough UCITS ETFn/a0.49%ROBO Global®Healthcare Technology and Innovation IndexL&G Clean Water UCITS ETFn/a0.49%Solactive Clean Water IndexL&G Clean Water UCITS ETFn/a0.49%Solactive Clean Water IndexLyxor World Water UCITS ETF24.91%0.60%World Water Index CWiShares Global Water UCITS ETF22.03%0.65%S&P Global Water 50 IndexiShares Global Water UCITS ETF23.94%0.65%S&P Global Water 50 IndexTHINK Sustainable World UCITS ETFn/a0.30%Solactive Sustainable World Equity IndexTHINK Sustainable World UCITS ETFn/a0.30%Solactive Sustainable World Equity IndexL&G ROBO Global Robotics and Automation UCITS ETF24.77%0.8%ROBO Global Robotics and Automation UCITS IndexL&G ROBO Global Robotics and Automation UCITS ETF22.79%0.80%ROBO Global Robotics and Automation UCITS IndexL&G ROBO Global Robotics and Automation UCITS ETF24.27%0.80%ROBO Global Robotics and Automation UCITS IndexLyxor Robotics & AI UCITS ETF27.26%0.40%Rise of the Robots NTR IndexiShares Automation & Robotics UCITS ETF25.94%0.40%iSTOXX® FactSet Automation & Robotics IndexiShares Automation & Robotics UCITS ETF24.02%0.40%iSTOXX® FactSet Automation & Robotics IndexWisdomTree Artificial Intelligence UCITS ETF33.25%0.40%Nasdaq CTA Artificial Intelligence NTR IndexWisdomTree Artificial Intelligence UCITS ETF30.18%0.40%Nasdaq CTA Artificial Intelligence NTR IndexHAN-GINS Cloud Technology UCITS ETF24.78%0.75%Solactive Cloud Technology Index |HAN-GINS Innovative Technologies UCITS ETF20.03%0.75%Solactive Innovative Technologies IndexEMQQ Emerging Markets Internet & Ecommerce UCITS ETF18.74%0.86%EMQQ Emerging Markets Internet & Ecommerce IndexHAN-GINS Indxx Healthcare Innovation UCITS ETFn/a0.75%Indxx Advanced Life Sciences & Smart Healthcare Thematic IndexHAN-GINS Indxx Healthcare Innovation UCITS ETFn/a0.75%Indxx Advanced Life Sciences & Smart Healthcare Thematic IndexiShares IV PLC-iShares Healthcare Innovation UCITS ETF10.66%0.40%iSTOXX® FactSet Breakthrough Healthcare IndexiShares IV PLC-iShares Healthcare Innovation UCITS ETF8.83%0.40%iSTOXX® FactSet Breakthrough Healthcare IndexL&G Cyber Security UCITS ETF28.83%0.75%ISE Cyber Security IndexL&G Cyber Security UCITS ETF26.55%0.75%ISE Cyber Security IndexiShares Ageing Population UCITS ETF13.58%0.40%iSTOXX® FactSet Ageing Population IndexiShares Ageing Population UCITS ETF12.08%0.40%iSTOXX® FactSet Ageing Population IndexiShares Digitalisation UCITS ETF26.62%0.40%iSTOXX® FactSet Digitalisation IndexiShares Digitalisation UCITS ETF25.10%0.40%iSTOXX® FactSet Digitalisation IndexUBS ETF-MSCI Pacific Socially Responsible UCITS ETF16.90%0.40%MSCI Pacific Socially Responsible 5% Issuer Capped Index (Net Return)UBS ETF - MSCI EMU Socially Responsible UCITS ETF20.57%0.28%MSCI EMU SRI 5% Issuer Capped Index Total Return NetUBS ETF - MSCI USA Socially Responsible UCITS ETF21.51%0.33%MSCI USA Socially Responsible 5% Issuer Capped Index (Net Return)UBS ETF-MSCI World Socially Responsible UCITS ETF21.09%Current Mgmt Fee:0.25%MSCI World Socially Responsible 5% Issuer Capped Index (Net Return)