Ethical and socially responsible investment products have been at the forefront of ETF issuers’ strategies for the last few years.

Extreme weather, melting glaciers and a forest fire in the Amazon for last three weeks are just a few examples of why investors are becoming warry of their environmental impact.

A significantly large volume of Environmental, Social and Governance (ESG) ETFs available take into consideration the carbon emissions of companies within their underlying indices and exclude any stocks which surpass a certain threshold.

They are proving popular with investors already as State Street has seen its ESG index fund has pulled in over $1bn in just seven months of launching.

For investors, this creates the dilemma of thinking ethically and protecting the planet or thinking professionally and maximising returns. But is there actually a dilemma or can investors have the best of both worlds?

Below, we compare the performance of ESG ETFs with their non ESG-screened counterparts.

ETF Insight: Are ETF and index providers taking ESG seriously?

World

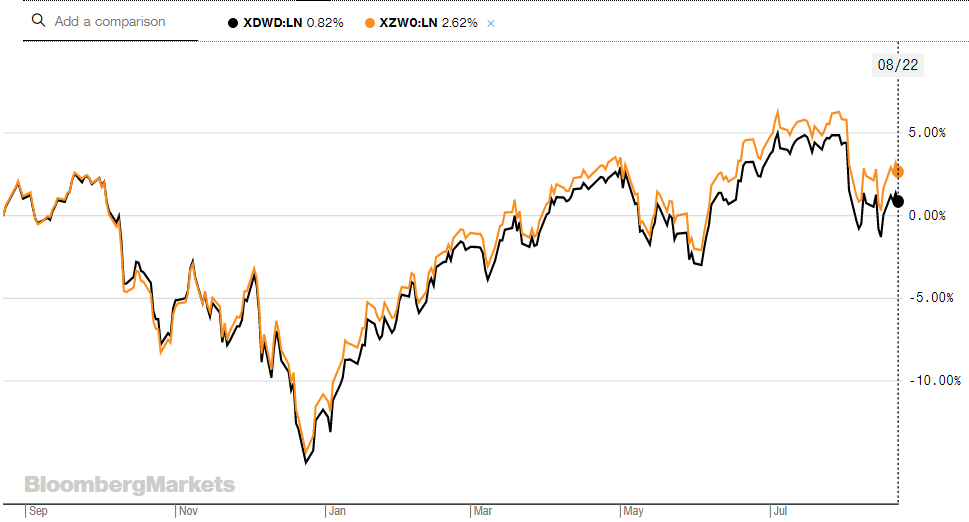

DWS, the asset management arm of Deutsche Bank launched the Xtrackers ESG MSCI World UCITS ETF (XZW0) in May 2018. It was an ESG version of its Xtrackers MSCI World UCITS ETF (XDWD) which launched back in July 2014.

Since the inception of XZW0, it has outperformed its benchmark across a three-month, year-to-date and one-year time frames. ZXW0 and XDWD have a 3 month return of 1.8% and 1%, YTD return of 15.1% and 14.3% and a one-year return of 2.3% and 0.4%, respectively.

ZXW0 tracks the MSCI World ESG Leaders Low Carbon Ex Tobacco Involvement Index. This excludes any carbon with high carbon emissions or receives revenue from tobacco as well as having a low ESG score. From its top holdings, it removes the likes of Apple, Amazon, Facebook, JP Morgan and Nestle which appear in XDWD.

The price for the better returns is only 1 basis point as the XZW0 comes with an expense ratio of 0.2% whereas the XDWD costs 0.19%.

XZW0 (Yellow) and XDWD (Black) one-year return – Source: Bloomberg

USA

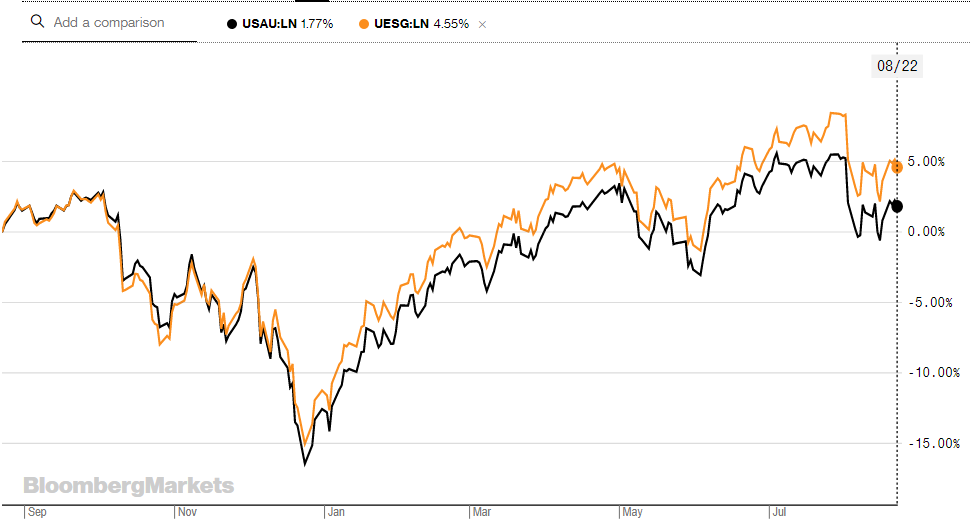

The Lyxor MSCI USA ESG Trend Leaders UCITS ETF (UESG) listed on the London Stock Exchange in May 2018 with a management fee of 0.25%, matching that of its non-screened version the Lyxor MSCI USA UCITS ETF (USAU).

Again, UESG’s returns beat USAU’s but with a smaller margin. UESG and USAU have a three-month return of 2.29% and 2.25%, a YTD return of 17.8% and 17.6% and one-year return of 4.2% and 3.3%, respectively.

The two funds track the MSCI USA Index which covers large and mid-cap stocks of the US market, however, UESG removes any company from “ESG sensitive sectors”, according to Lyxor’s factsheet. MSCI’s factsheet for the underlying index says it excludes companies from the tobacco industry as well as having a low ESG controversy score.

UESG excludes the same companies as XZW0 which appear in USAU’s top holdings.

UESG (Yellow) and USAU (Black) one-year return – Source: Bloomberg

Europe

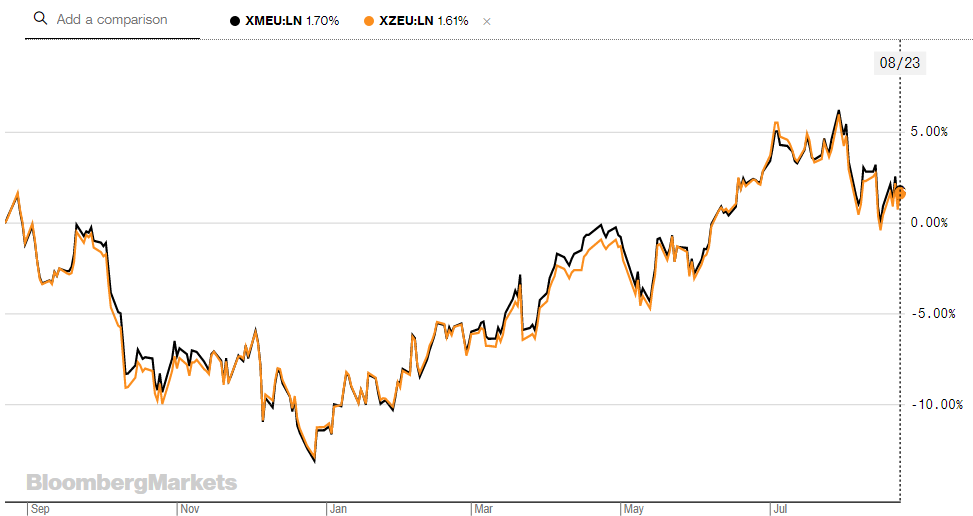

Another ESG product launched by DWS was the Xtrackers ESG MSCI Europe UCITS ETF (XZEU) which listed at the same time as its world exposed sibling. In just 15 months, the fund has pulled in over $1.7bn in assets.

XZEU was an ESG version of the company’s Xtrackers MSCI Europe UCITS ETF (XMEU) which launched all the way back in September 2007.

This comparison differs from the previous two as the ESG ETF is actually 5bps cheaper than the initial product as XZEU comes with an expense ratio of 0.2% and XMEU’s is 0.25%.

Additionally, XMEU has performed better than the ESG version. XZEU and XMEU have a three-month return of 1.5% and 1.8%, a YTD return of 14.5% and 14.9% and a one-year return of 1% and 1.2%, respectively.

XZEU has a similar ESG methodology as XZW0 but for the Europe region. It excludes the likes of Nestle, Novartis and HSBC as well as Europe’s largest oil companies Royal Dutch Shell, BP and Total which all appear in XMEU’s top holdings.

XZEU (Yellow) and XMEU (Black) one-year return – Source: Bloomberg

To learn more about the topic of ESG and what the future holds for the strategy, ETF Stream is holding an event in November.