The MSCI China A index has a number of “distinct advantages” over other mainland China benchmarks, according to a research note by ETF issuer KraneShares.

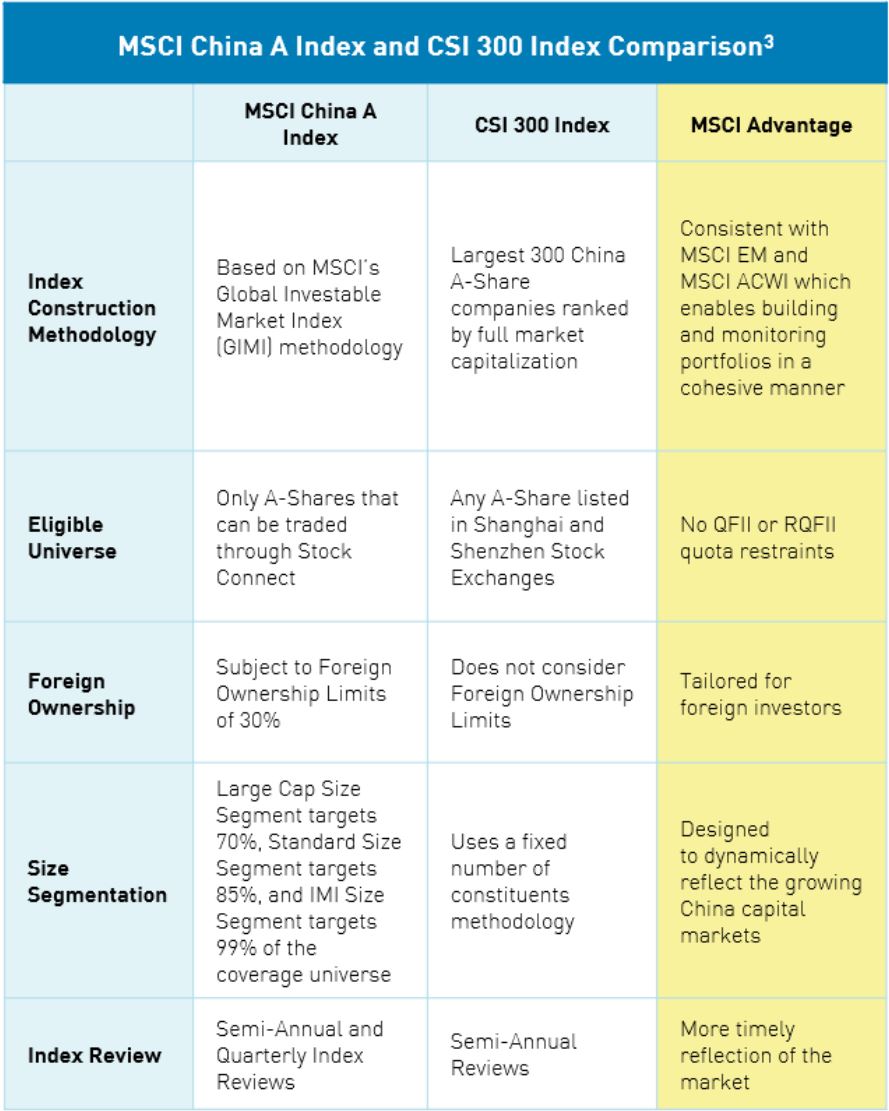

The note, entitled Tracking the MSCI Inclusion: the MSCI China A Index versus the CSI 300 Index, argued the MSCI China A index is more tailored for foreign ownership than the CSI 300, which does not take this factor into account.

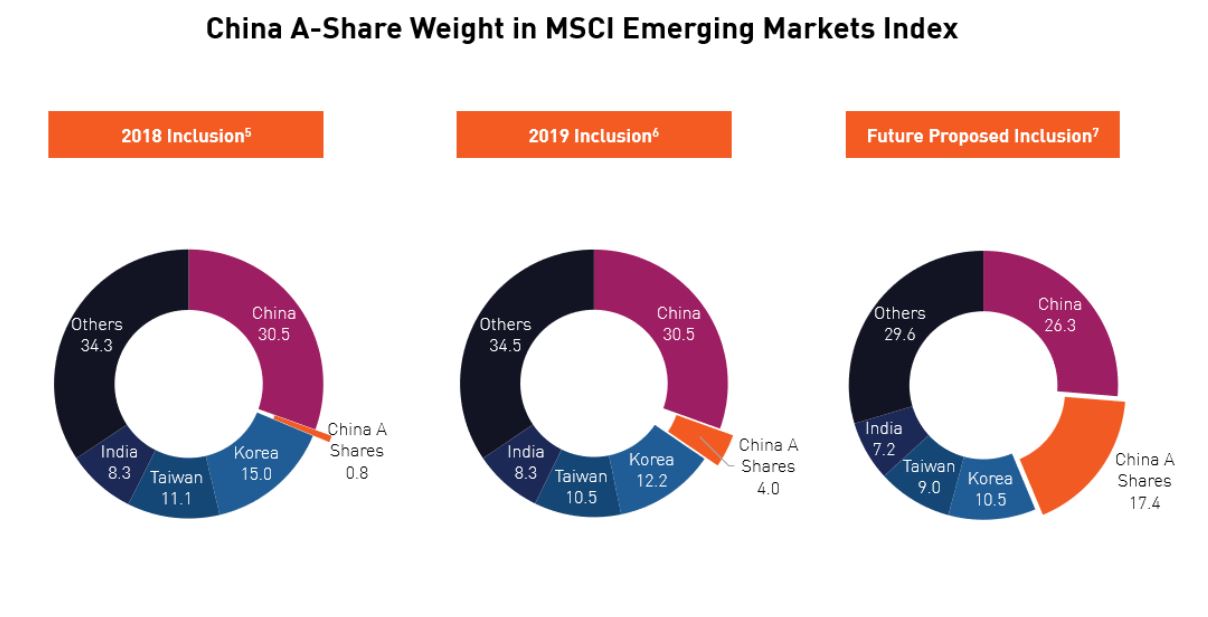

The KraneShares report comes just weeks before the MSCI Emerging Markets index is set to include another set of China A-Shares.

Following the rebalance on 26 November, China A-Shares will make-up 4% of MSCI’s flagship index which has $1.8trn assets tracking it.

“The MSCI inclusion could trigger significant institutional flows from both passive and active managers into the A-Share securities in the MSCI China A index.”

Source: KraneShares

Along with being more tailored for foreign investors, the report said the MSCI China A index has a more preferable index construction methodology and size segmentation than the CSI 300.

KraneShares said this is because the index is based on MSCI’s Global Investable Market Index (GIMI) methodology and therefore enables investors to build and monitor portfolios in a “cohesive manner”.

Originally built for domestic Chinese investors, the CSI 300 consists of the 300 largest China A-Shares stocks ranked by market cap while the MSCI China A index currently tracks 443 securities.

Further China A-Shares inclusion prompts concentration risk fears

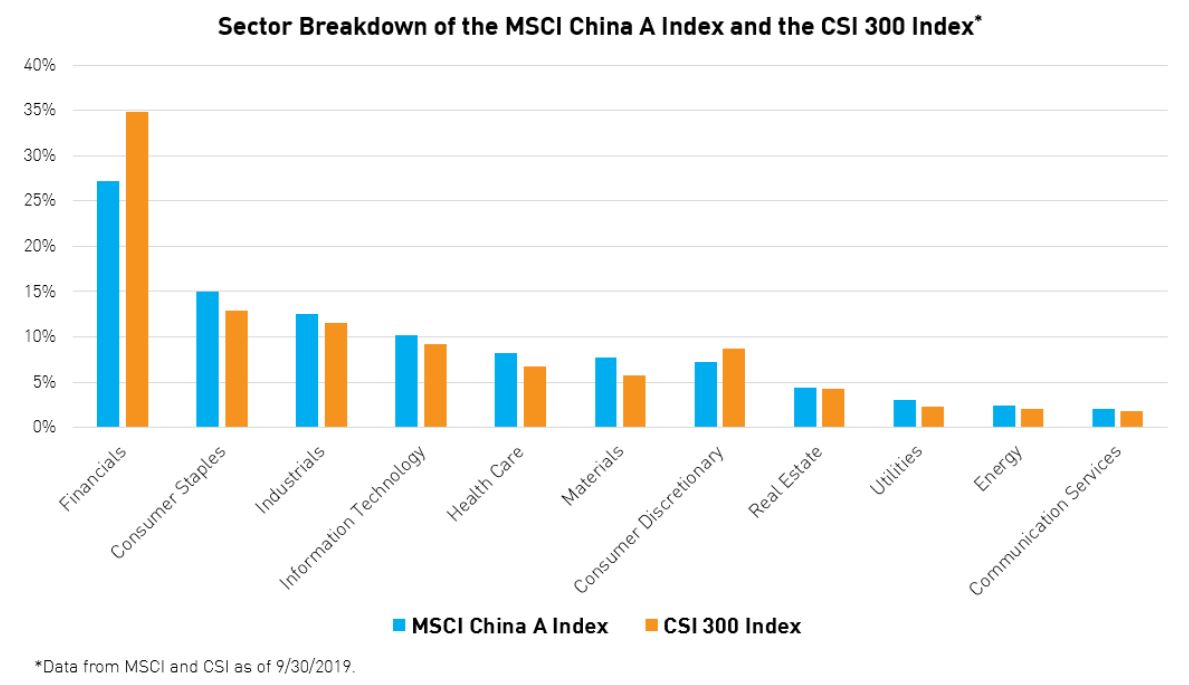

In terms of the sector breakdown of the two indices, the MSCI China A has a relative decreased weight to financials and an increased weight to growth sectors such as tech and healthcare.

Source: KraneShares

"We believe the MSCI China A Index is a more holistic representation of the mainland China market than the CSI 300," the report said.

"Indices that do not hold mid-caps, like the CSI 300, may not be optimized to benefit from the influx of foreign investments into this specific subset of China A-Shares.

"However, the MSCI China A index, which is becoming more diverse through the incremental inclusion process, is in a better position to evolve and grow alongside China’s economy."

MSCI has come under pressure this year over the reasons for allowing China A-Shares to be included in its wider indices. One industry expert told ETF Stream in May "it is clear that political pressure has been exerted in this case by the Chinese authorities".

Source: KraneShares