As the price of bitcoin moved below its 200-day moving average – known as a ‘death-cross’ pattern – pessimists cast their minds back to tulip mania, railroads and the ‘dot-com’ tech of years gone by and watched on as crypto entered the annals of burst bubbles.

According to a recent survey conducted by the UK’s Financial Conduct Authority (FCA), ownership and average crypto holdings by UK consumers have both risen by around 50% between March 2019 and March 2021.

More concerning, though, is that while more people are getting involved in crypto, those investing in 2021 are less likely to understand how the products work and almost half of users were unclear on the benefits of stablecoins, the FCA’s research found.

Likewise, the asset class’s high volatility means 29% of crypto investors check their balances every day, up from 13% in 2020, while the proportion who viewed crypto investing as ‘a gamble’ fell to 38%, down from 47% a year earlier.

Responding to the findings, Rick Eling, investment director at Quilter Financial Planning, said: “The fact that participation in cryptocurrencies is up but understanding is down paints a troubling picture. Rather than people seeing crypto as a gamble, the research suggests they see it as an investment.

“As responsible investors we fear for the safety of the majority, for the inexperienced, and for those whose investment expertise goes no further than an Instagram post that makes you feel like easy money exists.”

Eling’s reaction mirrors that of many long-term and value-minded investors, who not only favour assets offering consistent returns over the course of decades but are also wary of the fads costing speculators dearly through the centuries.

A taste for shiny things

Unfortunately, several behavioural parallels can be drawn between the most recent crypto boom and many of history’s teachable moments, which are the result of speculative appetite winning out over prudence.

First, is the power of the fear of missing out (FOMO) illustrated during the South Sea Company (SSC) bubble of 1720. Formed in 1711 to convert £10m of UK government debt into its own shares, the SSC agreed to take on the entirety of the British national debt in 1720.

Speculators then gambled on the success of the conversion plan and the company issued several overpriced share placings, which then encouraged other joint-stock companies to form in an effort to sell get-rich schemes to unassuming investors.

Despite getting the UK government to pass the Bubble Act to stop these other companies forming in June 1720, the SSC suffered as overseas backers led an investor run in August, British domestic credit became overstretched, and its scheme collapsed, causing SSC shares to fall 75% in four weeks while the government confiscated £2m from the company’s directors.

Suffering because of this was renowned mathematician and scientist, Sir Isaac Newton, who made a 100% profit on his £7,000 initial investment in SSC, only to jump back in later in 1720 and lose £20,000 – or £3m in today’s money – according to commentary by Jason Zweig in the fourth edition of Benjamin Graham’s 'The Intelligent Investor'.

Speaking on the collective speculation on SSC stock, Newton said in 1720: “[I] could calculate the motions of heavenly bodies, but not the madness of the people.”

This collective FOMO can certainly be seen in bitcoin’s market cap growth. Even after valuations topped out in April, the crypto’s popularity hit an all-time-high of $2.5trn on May 12, up from $235bn a year earlier.

Another lesson that can be drawn is greed leading to investors gambling more than they can afford to lose.

This was seen during the ‘tulip mania’ speculation of 1630s Holland, where the popularity of the flower became so widespread that families of all classes began to speculate on tulip bulbs in hopes of getting their hands on one of the variegations most coveted by collectors.

This came to a peak between 1636, when people began mortgaging their homes, exchanging large sums of livestock and crops, and selling family heirlooms in order to finance bulb purchases during the following year’s bloom.

Then, in early 1637, as the bulbs came close to flowering, the market for tulips collapsed. Those who had committed possessions they could not afford to lose received mostly worthless bulbs and even following government intervention in 1638, tulip contracts could be annulled for just 3.5% of the agreed price.

While in microcosm, a similar dynamic has played out in a portion of bitcoin investment, with market cap growth data illustrating around half of backing has arrived since its price passed $35,000, while 14% of UK participants borrowed money to finance their purchase, according to Laith Khalaf, financial analyst at AJ Bell.

“The extreme volatility and uncertain long-term outlook for crypto means holdings can be wiped out, leaving borrowers with nothing but their debt as a memento,” Khalaf warned.

Finally, hopes of future glory have seen industries’ valuations inflated into unsustainable bubbles with no support offered by near-term earnings.

The next ‘dot com’ crash? Blockchain ETFs enter bubble territory

Comparing investors’ recent surge into crypto to the ‘railway mania’ of pre-gilded-age USA, Eling said: “Speculators were drawn into risky assets on the basis that ‘railways will change the world’.

“They did indeed, but not before a self-promoting cycle based purely on speculation (and often fraud) left many families bankrupt. The fact a new technology has great potential does not in itself insulate people from the risks of an associated asset price bubble.”

The combination of feverish optimism, cheap borrowing and the absence of support in fundamentals has seen these kinds of scenarios play out through time, from the Japanese zaitech bubble of the 1980s, to the 1990s and noughties ‘dot-com’ tech bubble and now – although bearing less macroeconomic significance – cryptocurrency.

Another teachable moment

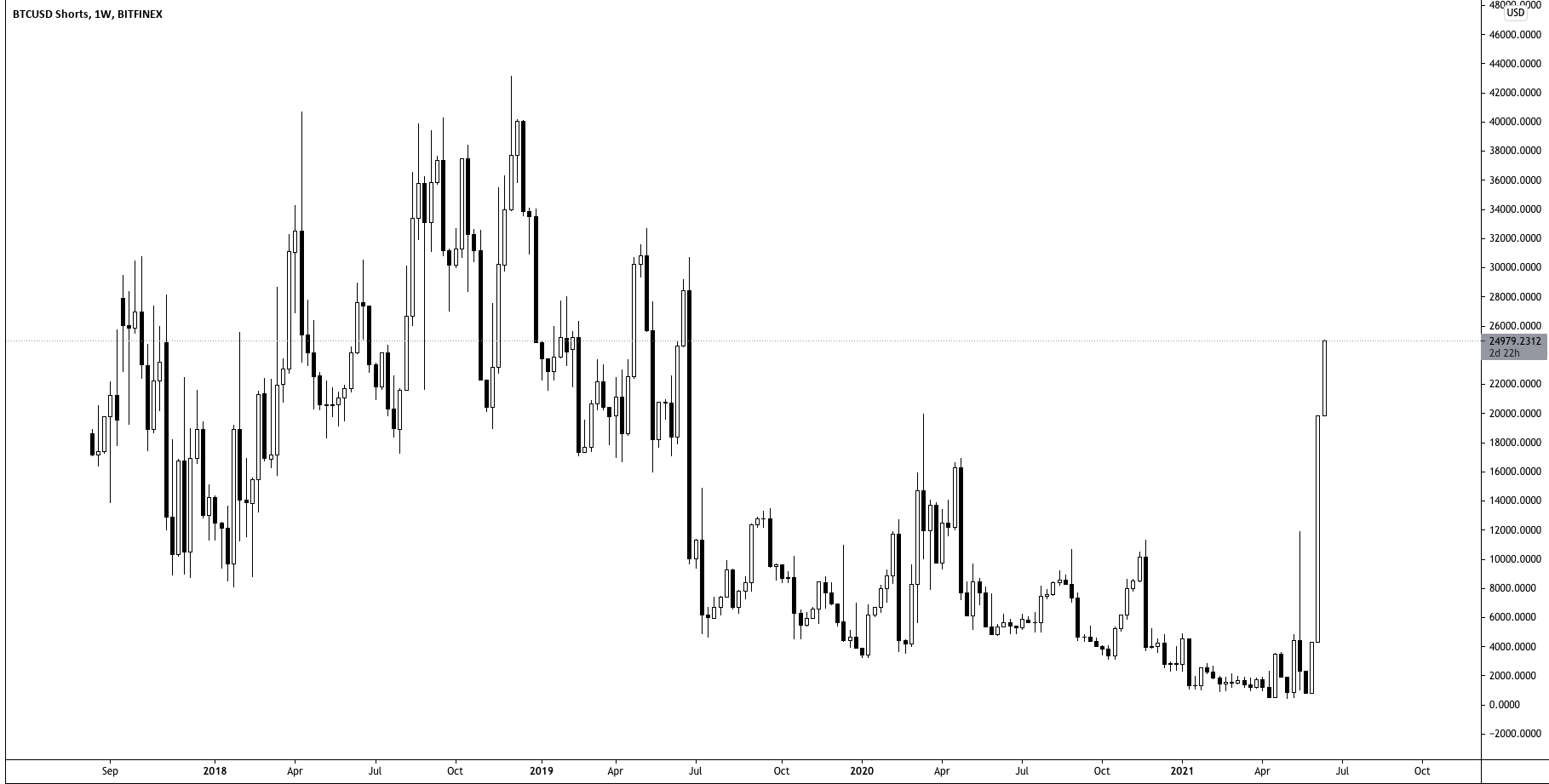

Having enjoyed their most prolific sixth month period since their inception, a good portion of the wind is leaving cryptos’ sails.

Last week, bitcoin shorts hit their highest level since July 2019 and having been at an all-time-high of $64,830 two months ago, the asset’s valuation has since fallen to less than half of that sum – beneath $30,000 on Tuesday.

This is not to say cryptocurrencies are doomed. Initially launched with a vision of creating decentralised, digital transactions with universally accepted tender and a secure ledger, greater acceptance of cryptos and ensuing practical applications will hopefully lead to less price volatility as the winners cement their position. As occurred in the establishment of railways and dot-com tech victors, so too will this happen – hopefully – in digital assets.

This, in turn, could sway some sceptics to drop the dreaded ‘gambling’ and ‘speculation’ diatribes used to undermine the asset class’s legitimacy.

For now, though, Eling cautions onlookers about conflating investing with gambling.

“There needs to be much greater understanding of what constitutes investing, trading and gambling, and how language of one category gets co-opted into others,” Eling warned. “We often hear investors talk of ‘taking a punt’ or ‘hedging their bets’ but they are playing down how complex their work actually is.

“People should instead look to get rich slowly and craft an investment strategy which takes into account how much you can realistically set aside each month to invest, your capacity for loss and appetite to risk given your investment objectives.

“Diversified, multi-asset portfolios will guard you against violent swings in asset prices and ensure your long-term objectives are achievable. Something crypto assets are currently ill-equipped to provide,” Eling concluded.

Given the speedy roll-out of other products – such as thematic ETFs – offering exposure to momentum plays and future growth industries, investors should note having the wrong temperament can see dream-chasing end in tears.

Investment wisdom would suggest that at most, speculative investments without a basis in fundamentals should remain a peripheral part of any investment strategy.

Further reading