A minimum of 40 European-listed equity ETFs, including ESG and SRI products from BlackRock, Amundi, BNP Paribas Asset Management, Vanguard and DWS, are exposed to Uyghur imprisonment and forced labour, research from ETF Stream has found.

The findings are based on a report by non-profit Hong Kong Watch (HKW) and Sheffield Hallam University’s Helena Kennedy Centre for International Justice, titled Passively Funding Crimes Against Humanity, which noted at least 13 companies across MSCI indices are “involved in constructing the Uyghur camps, actively use Uyghur forced labour obtained through state-sponsored transfer, or source from suppliers that use Uyghur forced labour obtained through state-sponsored transfer”.

Entities exposed to these companies via MSCI’s China, emerging markets and ACWI ex-US indices include at least 11 US State pension funds, the Japan Government Pension Investment Fund and UK plans such as the London CIV Government Pension Scheme and even the Church of England Pension Scheme managed by Legal & General Investment Management (LGIM).

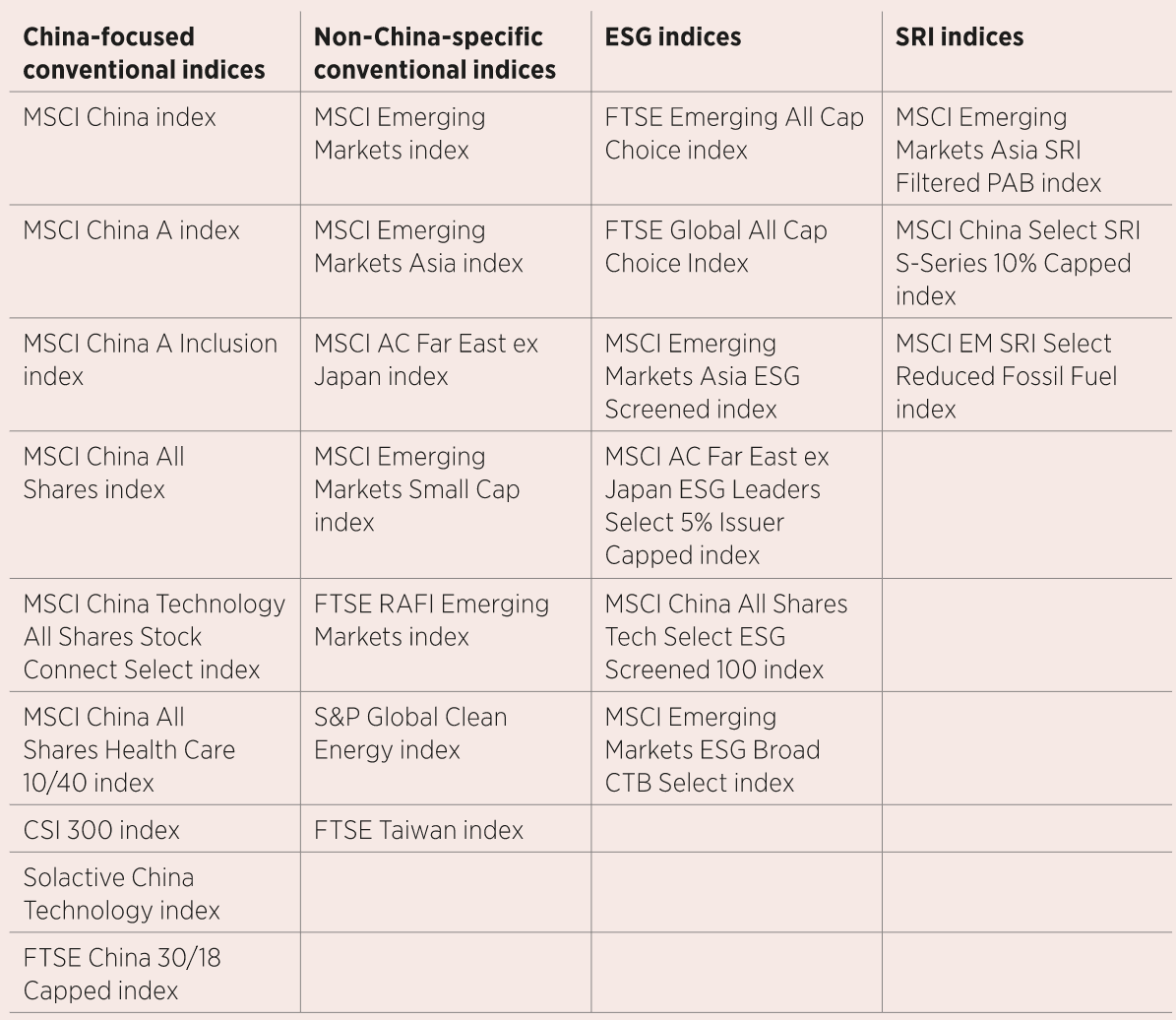

The report provided a “partial list” of 10 ETFs from major asset managers that track the three indices in question, however, research by ETF Stream found at least 25 equity indices from MSCI, FTSE Russell, S&P Dow Jones Indices, Solactive and the China Securities Index Company contained at least one of the stocks flagged by the research.

Source: justETF, ETFLogic

Tracking these indices are at least 42 equity ETFs from an array of issuers including BlackRock, Amundi, DWS, UBS Asset Management, Invesco, Lyxor, State Street Global Advisors, HSBC Asset Management, BNPP AM, LGIM, KraneShares and Franklin Templeton.

The HKW-Sheffield Hallam University report warned by being passively exposed, the indices, the ETFs tracking them and in turn, end investors, are tacitly supporting human abuses, with eye-witness testimonies revealing “torture, sterilisation, sexual assault, constant surveillance, and even slavery” across 380 internment camps and forced factory labour sites since 2014.

However, given the scale of Uyghur Muslim surveillance and internment, Xinjiang’s role in manufacturing and the level of state ownership and oversight of companies, it is perhaps unsurprising to hear a number of Chinese companies have exposure or involvement with reported instances of human rights abuses.

What may come as more of a surprise – and a fact not highlighted by the report – is there are several ostensibly sustainable ETFs in Europe with exposure to flagged companies, while they are marketing themselves as integrating ESG or even more stringent socially responsible investing (SRI) criteria, including screens for human rights abuses and companies not in keeping with social norms.

One company in particular that caught a number of ETFs out is China’s largest wind turbine manufacturer Xinjiang Goldwind Science & Technology Company which held talks and “likely” transferred Uyghur Muslims “hundreds of miles away” to a labour facility, the report said. The company’s CEO has also been an “active participant and supporter of the 'Becoming Family' programme which involves live-in surveillance of Uyghur families.

Several ETFs are exposed to Goldwind including:

$3.8bn iShares MSCI EM SRI UCITS ETF (SUSM)

$367m Amundi Index MSCI EM Asia SRI PAB UCITS ETF (SADA)

$772m AmundiMSCI Emerging ESG Leaders UCITS ETF (SADM)

$309m Amundi MSCI AC Far East Ex Japan ESG Leaders Select UCITS ETF(ACUU)

$248m Amundi Index MSCI Emerging Broad CTB UCITS ETF (SBIM)

$171m BNP Paribas Easy MSCI China Select SRI S-Series 10% Capped UCITS ETF (CHINE)

$513m Xtrackers MSCI EM Asia ESG Screened Swap UCITS ETF (XMAD)

Although not ESG-labelled, it is also worth noting the $6.1bn iShares Global Clean Energy UCITS ETF (INRG) and $5m Fidelity Clean Energy UCITS ETF (FNRW) also have exposure to the stock.

Elsewhere, the $190m Vanguard ESG Global All Cap UCITS ETF (V3AM) and recently launched $8m Vanguard ESG Emerging Markets All Cap UCITS ETF (V3MM) have exposure to Taiwanese contract electronics manufacturing specialists Foxconn Technologies.

The report said “hundreds of Uyghur workers” had been transferred to the company’s factories, where they were expected to work at least 100 hours of overtime each month and take part in “re-education”.

BlackRock, Amundi and Vanguard were approached but did not provide a comment.

MSCI told ETF Stream in a statement its indices are based on publicly available, rules-based methodologies that apply filters such as the MSCI ESG Rating, MSCI ESG Controversies scores and controversial business activities screens for its ESG Leaders and SRI indices.

“MSCI’s clients have their own investment objectives, and so are free to choose the index that best suits their investment objectives and constraints and their approach to ESG integration,” the firm continued.

MSCI did not respond when asked whether it would remove flagged companies from its ESG and SRI products.

In a statement, a DWS spokesperson told ETF Stream the firm has ESG policies in its investment process and voting practices regarding violations of international norms.

The issuer added: “ETFs passively mirror indices composed by third-party index providers. For DWS, not only the engagement with companies plays an important role to achieve improvements regarding ESG factors but with index providers as well.

“We are pursuing two goals here: Firstly, we want to achieve that sustainability criteria are increasingly integrated into existing indices, and secondly, that more new sustainable indices are developed for new products.”

It bears remembering even the report’s findings and subsequent research on ETFs may only represent the tip of the iceberg when it comes to Chinese and emerging market companies’ involvement in the Uyghur crisis.

“Many other indexed companies could be participating in the PRC's forced labour schemes,” the report warned. “All Chinese companies, whether located in Xinjiang or elsewhere in China, should be investigated thoroughly to identify any links they may have to these programs.”

Another good example the research did not flag is Hikvision, a subsidiary of a Chinese military conglomerate and a key supplier of surveillance equipment used against Uyghurs in Xinjiang province.

Thankfully, Swiss regulator National Contact Point (NCP) flagged the company within the basket of the UBS ETF MSCI China Universal UCITS ETF (CNSG) more than a year ago. It was removed and subsequently ejected from all MSCI indices from 5 January 2021, which begs the question of what will happen to the companies earmarked in the recent report, should regulators take notice.

Investors are also pressuring ETF issuers to stop stamping ESG labels on funds with exposure to parties involved in the Uyghur crisis. Over a year after SCM Direct co-founder and CIO Alan Miller called on the Financial Conduct Authority (FCA) to investigate LGIM over its L&G ESG China CNY Bond UCITS ETF (DRGN), the issuer volunteered to strip the ETF of its ESG label and marketing ahead of ‘level two’ of SFDR.

The HKW-Sheffield Hallam University report concluded by calling on index providers, asset managers and investors to not focus entirely on environmental causes at the expense of key social issues such as human rights abuses. Given its findings, regulators such as the FCA and European Commission should reflect on greenwashing outside of just climate metrics – and investors should assess whether socially responsible investing is possible for certain exposures.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles