The Bank of Japan (BoJ) has spent years offering extensive support to its domestic economy via ETF purchases, however, research shows its decision to wind down this programme has had an immediate and negative impact on stocks included in the Nikkei 225 and JPX-Nikkei 400 indices.

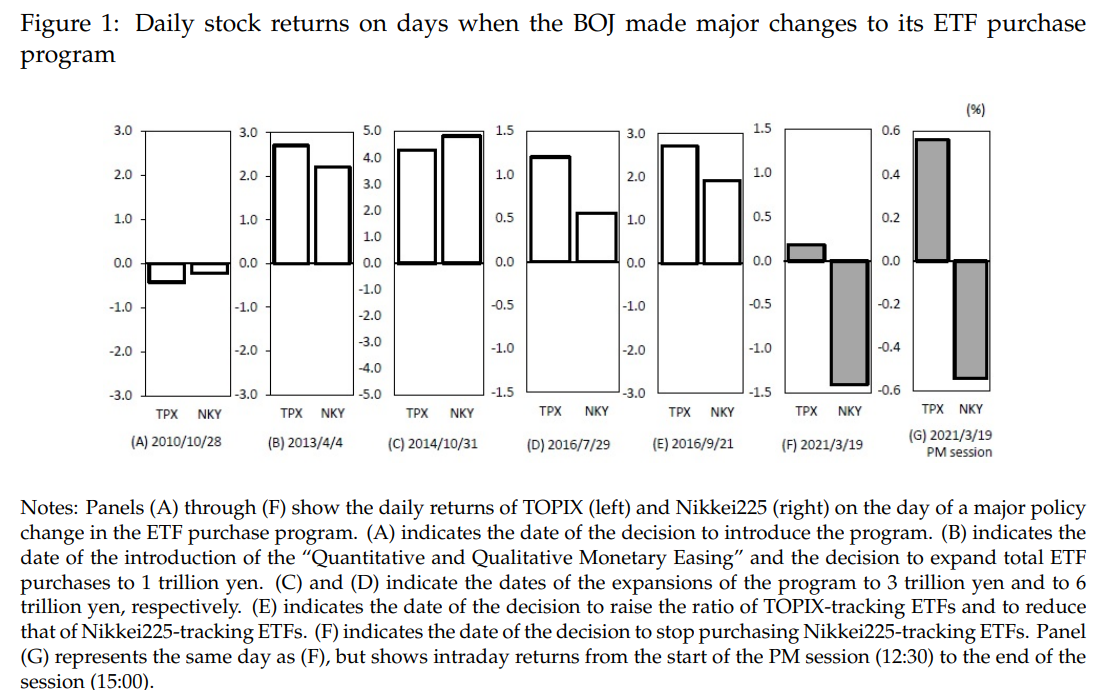

The paper, titled The announcement effects of a change in the Bank of Japan’s ETF purchase programme, from the Bank of International Settlements, Hosei University and Waseda University, said the decision to switch to purchasing Topix ETFs from Nikkei 225 and 400 ETFs on 19 March 2021 had an “instantaneous” downward effect on stocks in the latter indices.

The central bank conducted a grand total of $430bn in equity purchases between 2010 and 2021 but looked to overhaul its balance sheet strategy last year. It announced plans to remove its $55bn annual target for ETF purchases as well as halting all buying of Nikkei 225 and JPX-Nikkei 400 ETFs for the first time in a decade.

The BoJ added it would continue buying ETFs tracking the broader Topix index of 2,190 stocks and would maintain its $110bn annual purchasing limit brought in during March 2020.

Despite these continuities, markets reacted sharply to what most viewed as a surprise move by the policymaker, with the Nikkei 225 falling 6.1% following the news, its most dramatic fall since the start of the coronavirus pandemic.

The research examined six days where the BoJ made major adjustments to its ETF buying strategy, with last year’s announcement the first time the Topix and Nikkei 225 had trended in starkly different directions after a policy announcement since 2010. It was also the steepest negative return for Japan equity indices after a policy change.

Source: Nikkei, Bloomberg

Crucially, the study made a distinction between the impact of actual asset flows and the BoJ merely announcing its intentions. It said the reaction of efficient markets is to price in announcements even before they are implemented in practice.

In the reverse scenario, Tesla’s share price shot up 57% in the four weeks between its inclusion in the S&P 500 was announced and actually implemented, according to a study by Research Affiliates, highlighting that short-term returns are clearly impacted by whether investors expect them to be included in baskets tracked by large sums of capital.

In Tesla’s case, index-tracking products suddenly had to buy $94bn of its stock after its inclusion in the S&P 500. In the case of Nikkei ETFs, changes made in 2016 and 2018 meant the products received a maximum of 25% of BoJ assets used for ETF assets.

Following last year’s decision to cut this allocation – and accounting for the previous target of $55bn in ETF purchases each year – ETFs tracking Nikkei indices will now miss out on potentially $13.8bn in central bank money each year. Such a prospect makes the sudden fall by Nikkei constituents seem unsurprising.

Of course, this may only be a sign of things to come. Japan’s aggressive monetary policy over the past decade means it now owns 80% of all domestic equity ETFs, capturing roughly 7% of its $6trn stock market, according to Bloomberg.

While both Topix ETFs available in Europe have fallen 3-4% over the past year, the two Nikkei 225 ETFs have shed at least 7% apiece. Perhaps a decision by the BoJ to end its Topix ETF purchasing would have a similar effect on the broader index’s constituents.

The question then would be: if the BoJ ends its ETF purchasing altogether, would it be able to offload the assets it already has and if so, what impact would this have on Japanese equity valuations?

Related articles