Amid the ongoing fires across the Amazon rainforest, a report conducted by Friends of the Earth US, Amazon Watch and Dutch financial research firm Profundo has found BlackRock is the world’s largest investor in deforestation.

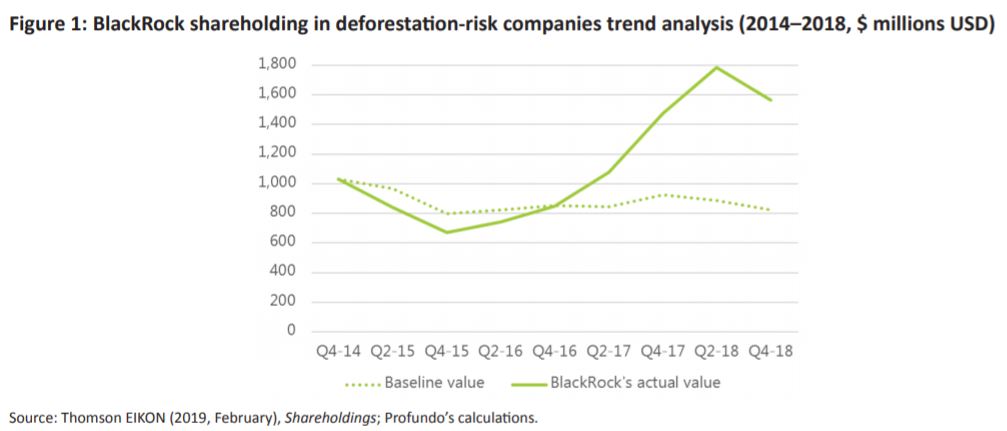

The report, entitled BlackRock’s Big Deforestation Problem, found the world’s largest investment manager’s assets in deforestation-risk commodities increased by more than $500m to $1.5bn between 2014 and 2018.

According to the report, BlackRock is among the top three shareholders in 25 of the world’s largest publicly listed “deforestation-risk” companies, almost entirely (94%) through its index fund and ETF products.

These are companies active in producing and trading soy, beef, palm oil, pulp and paper, rubber and timber.

Furthermore, deforestation-risk companies across the firm’s environmental, social and governance (ESG) funds increased from 0.05% in 2014 to 0.29% in 2018.

Jeff Conant, senior international forest programme manager at Friends of the Earth US, and co-author of the report, commented: “The data is clear: from the Amazon to the great forests of Africa and Southeast Asia, BlackRock is a global leader in financing forest destruction.

“As long as this financial behemoth continues to unconditionally back the world's most destructive agribusiness companies, the forests of the world, and consequently the climate and the rights of forest-dwelling people, will continue to go up in flames. BlackRock is literally reaping profits as the world's jungles burn.”

Moira Birss, finance campaign director of Amazon Watch, added: “BlackRock claims that its hands are tied by index funds. It is wrong.

“BlackRock can follow the lead of other global asset managers and make change for the good of the rainforest, the climate, and of its customers by shifting investments out of companies wrecking the planet, and applying maximum pressure to change company behaviour.”

ETF Insight: Are ETF and index providers taking ESG seriously?

The report stressed the US giant should take the following steps including adopting due diligence policies and practices to manage deforestation and land rights risks, making deforestation-free funds a default option and engaging proactively with stakeholders.

Ward Warmerdam, economic researcher at Profundo, said responsible stewardship is more than just putting out “nice” public statements.

"It is about aligning your investment strategy with broadly accepted environmental and social standards. It is about implementing this strategy by making demands of the companies you are invested in," Warmerdam continued.

"And it is about using your significant leverage to ensure that your demands are met and irreversible environmental and social damage is prevented, in addition to fulfilling your fiduciary duty."

This is not the first time BlackRock has come under fire for ESG-related issues. In March, sustainable non-profit firm Ceres found the firm had voted in favour of climate-related shareholders proposals just 10% of the time in 2018.