BRIC ETFs are hanging on for dear life with just one of six products surviving the last decade amid underperformance, high fees and a quarter of the acronym falling away as Russian securities became inaccessible this year.

The term ‘BRIC’ was coined by Goldman Sachs’ former head of global economics research Baron Jim O’Neill in 2001 as an attempt to bunch together the ‘Big Four’ of emerging markets – Brazil, Russia, India and China – which were deemed to be at a similar stage of economic development at the time.

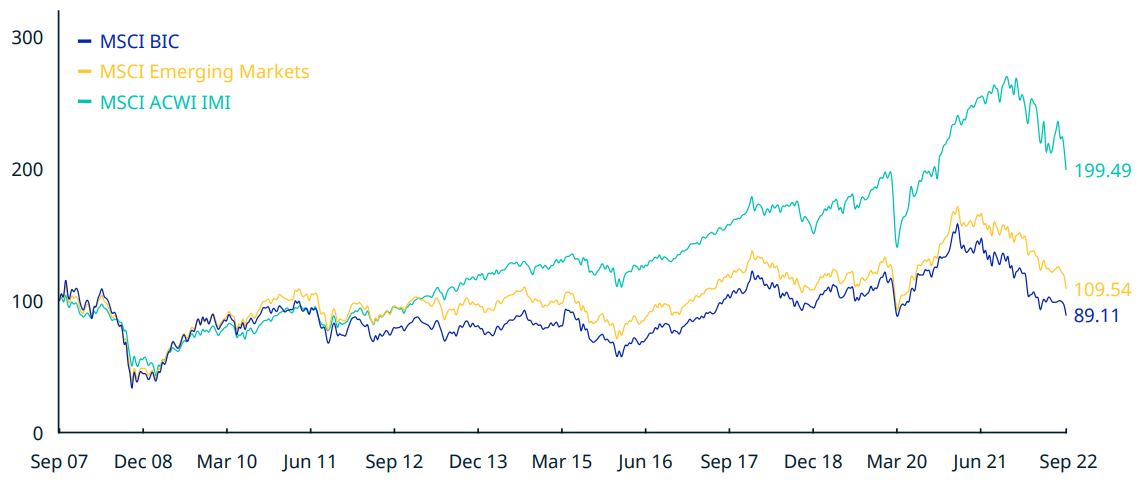

Six years later, ETFs launched to capture the largest stocks in the four countries and despite MSCI’s China and India indices outperforming broad emerging markets over the past 15 years, the underperformance of Russian and Brazilian equities – and high fees – have been death knells for wrapped BRIC exposures in Europe.

The Xtrackers MSCI BRIC Index UCITS ETF (XBRI) was the first to shut out the lights in 2015, soon followed by the Lyxor MSCI EM Beyond BRIC UCITS ETF (BBEM) and the HSBC S&P BRIC 40 UCITS ETF (BRQ) a year later, the SPDR MSCI EM Beyond BRIC UCITS ETF (EMBB) in 2017 and the Market Access DAXglobal BRIC UCITS ETF (M9SH) in 2018.

Source: MSCI

The only stubborn ETF issuer to hold on is BlackRock with its $126m iShares BRIC 50 UCITS ETF (BRIC), which has roughly halved in size after booking returns of -29.4% and $87m outflows over the five years to 6 October.

Understandably, even this ETF has not been a hit with investors with its total expense ratio (TER) of 0.74%, considerably higher than the 0.13% charged by the iShares MSCI EM UCITS ETF (IEMA).

The ETF also faced a challenge earlier this year as one of four of its geographical exposures – Russia – faced financial sanctions, making it difficult to access Russian equities or Global Depository Receipts (GDR) targeting them.

Given the ETF’s underlying benchmark, the FTSE Russell BRIC 50 index, used depository receipts for its Russia exposure, the introduction of Russian federal law 114-FX – forcing Russian companies to end their depository receipt programmes – effectively giving the strategy no choice but to abandon Russian securities.

The impact of disposing of Russian GDRs and market volatility have seen the ETF fall 42.1% in a year, which now means it is down 4.2% since its inception in 2007.

It now has a 84.1% allocation to China after Russia’s deletion and while still awarding 13.6% to Brazil, it offers just 2.1% to India, even though the country’s Sensex and Nifty benchmarks have more than doubled their value since March 2020.

As a now predominantly China-focused ETF, it also bears noting there are Sino equity ETFs in Europe with fees from 0.19%, almost a quarter for the fee charged by BRIC ETF.

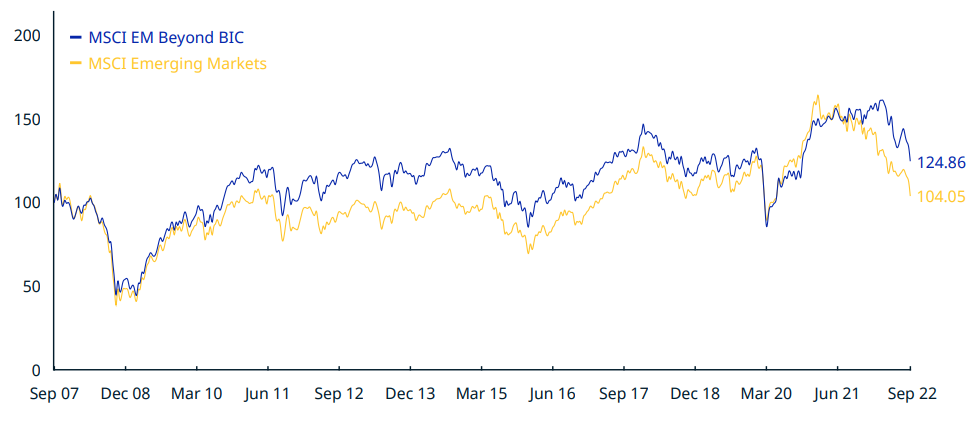

Over time, our thoughts about which emerging markets might outperform has evolved considerably and to reflect this, MSCI also offers an MSCI EM Beyond BIC index – with a name change since excluding Russian stocks.

The benchmark captures other emerging markets such as Saudi Arabia, Taiwan, South Korea, South Africa and Mexico and has not only outperformed MSCI’s BIC index but also its emerging markets index over the last 15 years.

Source: MSCI

As noted previously, Lyxor’s BBEM and State Street Global Advisors’ EMBB both captured this exposure but closed at least five years ago.

Even if these better-performing strategies cannot hold out, it is worth asking whether there is a place for any high-cost, low-performance BRIC ETFs in Europe.

Related articles