Smart beta is almost constantly in the news at the moment.

Depending on who you talk to, the rise of factor based investing is either a huge opportunity for ETF issuers - or a marketing disaster based on hype.

Whatever your view, the hard numbers suggest that investors are nevertheless buying into smart beta. According to London based research firm ETFGI, assets invested in Smart Beta equity ETFs/ETPs listed globally reached a "new record of US$592 billion at the end of the first half of 2017" - not bad for an idea for an idea which only started as recently as 1976, with Prof Steve Ross of Sloan Business School critiquing research by Bill Sharpe.

Other notable statistics relating to smart beta include a report which suggested that smart beta ETFs have a greater than 80% satisfaction rate with investors. Another recent report concluded that in the US 67% of ETF investors are using smart beta ETFs to gain exposure to smart beta strategies, compared to 49% in 2014.

So much for the headline market statistics - what does the academic research suggest?

To date academics have identified more than 300 factors although based on the current status of academic research, there is a consensus on just four consistent factors: volatility, value, momentum and size.

But are factor ETFs the same as Smart Beta ETFs?

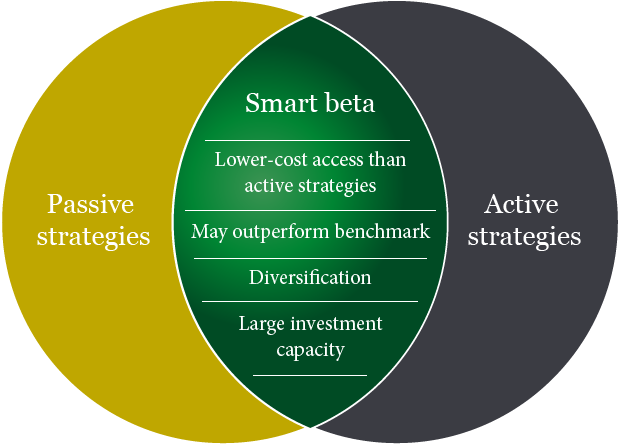

For most, factor investing is a broader category which subsumes smart beta but is much more comprehensive. Many argue for instance that smart beta use factors in a strategic way - smart beta ETFs are meant to overcome the shortcoming of market weighted indexes which boast under-rewarded risk factors and lack potential lack of diversification.

Other unresolved background disputes include:

Is the benchmark for these funds equal weighted or market cap weighted indexes?

Is the value added in smart beta ETFs from the factors like value, which can be arbitraged away over time, or is it in their rebalancing?

Is there such a thing as alpha?

Is there an observation effect, where people see a smart beta ETF work well so they flood into it, killing its success through overvaluing it?

Arguably the most cited research article on smart beta comes from academic economist Burton Malkiel - the analysis is called

'Is Smart Beta Really Smart?

' and is published in

The Journal of Portfolio Management

40.5 (2014).

Malkiel's core observations? That smart beta portfolios do not consistently outperform and when they do produce appealing results, they flunk the risk test. Malkiel observes that "smart beta portfolios have been the object of considerable marketing hype. They are more a testament to smart marketing rather than smart investing….All smart beta strategies represent active management rather than indexing."

Malkiel suggests when smart beta outperforms it's because it takes on more risk i.e there's a huge amount of evidence of reversion to the mean. Thus, smart beta funds don't produce alpha - in effect it's an academic bubble. Malkiel argues that the "actual records of smart beta portfolios run with real money do not in general replicate the results suggested by academic studies. For example, an examination of mutual funds' returns of funds with value and growth mandates starting in the mid-1930s shows that both types of funds had similar 70-year average annual returns."

Another crucial - and critical - paper comes from Ben Johnson, Hortense Bioy, and Dimitar Boyadzhiev - the paper is called 'Assessing The True Cost of Strategic Beta ETFs', and is in The Journal of Index Investing Summer 2016, Vol. 7.

This analysis suggests that smart beta ETFs are more expensive. Why? Three reasons are suggested: higher replication and indexing costs, more thought goes into smart ETFs which means there are higher staff costs, and last but by no means least, issuers are looking for profitable territory given fee cuts in plain vanilla ETFs. The 'impending' good news? Fees are declining.

Johnson, Bioy and Boyadzhiev's key message is that issuers don't appear to be willing to lower their fees on smart beta ETFs. This contrasts with plain vanilla ETFs where there has been an intense fee war. In essence, the suggestion is that investors care less about fees of smart beta ETFs than on plain vanilla ones - the authors wonder whether in reality investors benchmark smart beta ETF fees relative to active management fees. "The average total expense ratio (TER) of strategic-beta ETFs using the S&P 500 as a parent index is three times higher than that of ordinary S&P 500 ETFs".

Smart beta also comes under some attack in a paper called 'How Smart Are Smart Beta Exchange-Traded Funds? Analysis of Relative Performance and Factor Exposure' by Denys Glushkov published in the Journal of Investment Consulting, Vol. 17, no. 1, 50-74, 2016.

The author finds "no conclusive evidence to support the hypothesis that smart beta ETFs outperform their benchmarks on a risk-adjusted basis." The author also rejects the claim of smart beta advocates that rebalancing boosts smart beta ETFs, finding no evidence. Crucially this paper reminds investors that smart beta also has unintended factor tilts, as well as intended ones. These unintended ones might offset the intended factor tilts!

Changing the asset management business model

A more positive account of smart beta comes in a paper called '

The asset manager's dilemma: How smart beta is disrupting the investment management industry,'

by Ronald Kahn and Michael Lemmon in

Financial Analysts Journal

72.1 (2016). This paper argues that smart beta is a disruptive innovation, using Clayton Christensen's definition of the term.

The authors - two Blackrock staff - argue that smart beta, in effect, roots out active managers charging alpha-level fees while delivering only beta exposure. It also argues that active managers will survive, but only those who provide pure alpha. "Many traditional active managers deliver a significant fraction of their active returns via static exposures to smart beta factors while charging active fees", Kahn and Lemmon suggest. "Active management will evolve into two separate product types: smart beta products with lower fees and pure alpha products with higher fees."

Another positive take on smart beta comes from Cao, Jie and Hsu, Jason C. and Xiao, Zhanbing and Zhan, Xintong, in a report entitled 'How Do Smart Beta ETFs Affect the Asset Management Industry?'

This paper argues that smart beta ETFs make investors more critical of mutual funds and active managers. The authors' report that "(Smart Beta) ETFs changes investors' way of evaluating mutual fund performance. With intensified competition from Smart Beta ETFs, mutual fund managers now must provide an outperformance after adjusting for the influence of easily replicable risk factors."

The authors also argue that "the trading of smart beta ETFs has led to a structural change in the mutual fund industry by altering the way investors assess active mutual fund managers' skills. Investors no longer reward managers for being exposed to common risk factors when ETFs, which could replicate the return to such risk factors, are actively traded."

One last notable paper comes from Rob Arnott, Mark Clements, and Vitali Kalesnik, available on the ETF.com website. In a note entitled 'Why Factor Tilts Are Not Smart 'Smart Beta'', the Research Affiliates analysts argue that factor-loading portfolios and smart beta strategies (i.e. smart beta ETFs) are very different.

The authors observe that "factor-replicated portfolios are poor substitutes for their smart beta counterparts: performance is poor, turnover is high, and capacity is terrible. Why? The simple answer is that construction details matter in achieving both lower trading costs and higher performance."

Gurus and Bloggers: a critical bottom line?

Heisenberg Report: The widely followed blog observes that backing momentum strategies to win in the long term is tautological because momentum ETFs, are those, that by definition, that keep winning long term. More at: https://heisenbergreport.com/2017/06/30/whos-super-excited-about-momentum-smart-beta-etfs-for-q3/

Jack Bogle (Morningstar interview): Bogles message is simple and clear - smart beta empirically doesn't work and produces a worse Sharpe ratio than the S&P. According to Bogle there are only two funds with a long enough track record: Rob Arnott's RAFI 1000 and a Jeremy Siegel's fund at Wisdom Tree. According to Bogle they've had 10 years to prove themselves and they have not done so. Bogle says that the RAFI1000 has outperformed the S&P a little bit but has done so by assuming more risk - and has a lower Sharpe ratio. Wisdom Tree has done the opposite: it has a lower return but also a lower risk. And again, it has a lower Sharpe ratio. In each case the S&P does better. Bill Sharpe (FT interview): The US based academic's view is also critical. Smart beta is flawed from the concept up - according to Sharpe smart beta makes him "definitionally sick". In his view, smart beta funds are either factor bets (which guess which small or cheap stocks will grow) or an active attempt to beat the market (which would class them as "alpha" not "beta"). If smart beta is smart, says Sharpe, why is dumb beta doing so well?