When it comes to emerging market ETFs, there are two broad-based indices from MSCI and FTSE Russell used by issuers highlighted by Vanguard FTSE Emerging Markets UCITS ETF (VFEM) and the iShares Core MSCI EM IMI UCITS ETF (EIMI).

EIMI is the largest emerging market ETF in Europe with $19.3bn assets under management (AUM) while VFEM has $2.7bn.

Both VFEM and EIMI are passive, tracking market-cap-weighted indices. The most significant difference between the two ETFs is that VFEM excludes South Korea while EIMI does not.

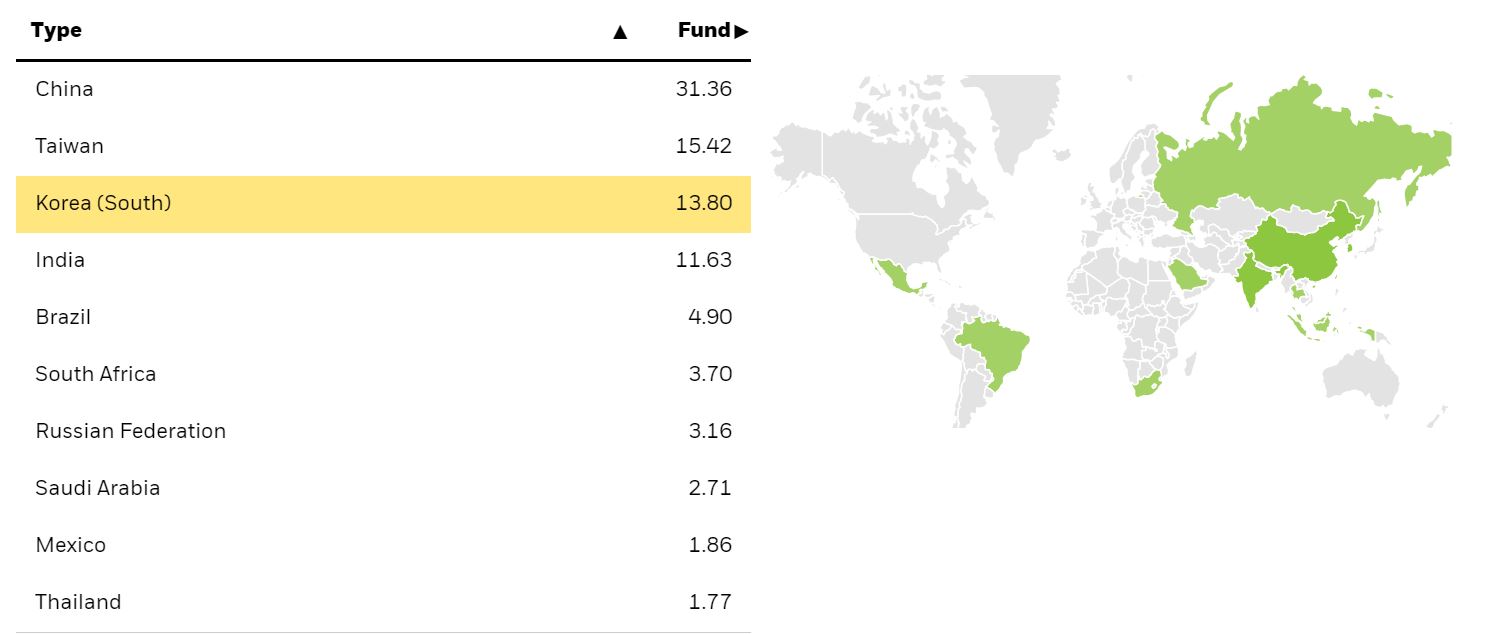

Chart 1: EIMI's country weightings

Source: BlackRock

In fact, South Korea makes up 13.8% of the portfolio, the third-largest country exposure within IEMG. FTSE Russell considers South Korea to be a developed market. It is included in the Vanguard FTSE Developed World UCITS ETF (VEVE).

Strong performance in Korean equities has given EIMI a slight performance advantage, outperforming VFEM by about 3.3% so far this year, as at 4 August.

One thing these ETFs have in common is a significant allocation to China, making up approximately 31% for EIMI and a massive 41.5% for VFEM.

Chart 2: One-year returns for EIMI and VFEM (4 August 2020-4 August 2021)

Source: ETFLogic

Allocations are not as they seem

However, there are some quirks when analysing Chinese equities that investors should keep in mind. Publicly traded companies in the People’s Republic of China can fall under several categories.

One type of equity is Chinese A-Shares. These shares represent publicly listed Chinese companies that list on Chinese stock exchanges and are quoted in renminbi, China’s currency.

Previously, A-Shares were primarily owned by Chinese investors. However, changes in both FTSE Russell and MSCI index construction methodologies mean that both VFEM and EIMI now hold allocations to Chinese A-Shares.

H-Shares are traded on Hong Kong’s exchanges and trade using the Hong Kong dollar but are regulated by Chinese law. Though they are listed on Hong Kong exchanges, these are Chinese companies. This means that each of these ETFs actually holds a larger exposure to China than it might initially seem. Chinese companies make up anywhere from 30-40% of the portfolio.

This outsized exposure to one country could be a risk for these popular emerging market ETFs. Chinese equities have had a rough year with the government cracking down on the private education industry.

This move has investors wondering whether Xi Jinping’s Communist Party might make further moves to restrict the economy. The iShares MSCI China UCITS ETF (ICHN) is down 11.4% year-to-date.

In spite of China’s drag on performance, EIMI and VFEM are still positive for the year, gaining over 3.5% and 0.2%, respectively. But the extent of China’s negative impact on performance is shown when you consider the strength of Taiwanese equities. Taiwan is the second-largest country allocation in each portfolio. The iShares MSCI Taiwan UCITS ETF (IDTW) has gained 22.6% so far this year.

Other ways to play the space

There are several ETFs that seek a solution to China’s oversized impact on emerging market ETFs. One option is the Lyxor MSCI Emerging Markets Ex China UCITS ETF (EMXC).

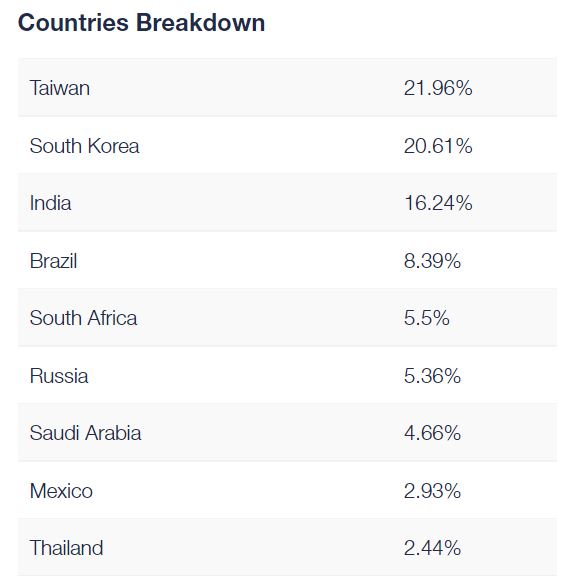

As the name suggests, this ETF tracks a market-cap-weighted index of emerging market equities, excluding China. By excluding China from the portfolio, all other country allocations are increased. Similar to EIMI, this ETF includes an allocation to South Korea, making up more than 20% of the portfolio.

Chart 3: EMXC's country weightings

Source: Lyxor

Another ETF in the US that excludes China is the Freedom 100 Emerging Market ETF (FRDM).

This ETF tracks an index that selects and weights exposure to emerging market equities based on personal and economic freedom metrics. As the current market environment underscores, China does not currently meet the index’s criteria for civil, political and economic freedom.

The index construction methodology creates a portfolio that looks different from any of the other EM funds covered in this article.

By excluding Chinese equities, both ETFs have done better than traditional market-cap-weighted emerging market ETFs so far this year.

Investors who want to maintain an allocation to China but prefer to have more control over the country’s weight in their portfolio might consider pairing one of these ETFs with an ETF like ICHN.

By investing in the country-specific ETF separately, the allocation to emerging markets could be constructed so that Chinese equities make up a smaller portion of the overall allocation, reducing the impact on future returns.

This story was originally published on ETF.com