The financial services industry is under renewed pressure to help in the fight against climate change after scientists a stark ‘code red’ warning about the “unprecedented” impact on the planet. While the shift to ESG ETFs has been remarkable over the past 18 months, is there anything more the ETF industry can do to tackle what is fast becoming the biggest issue facing society?

According to the International Panel on Climate Change (IPOCC) report released last week, temperatures are set to rise 1.5°C above pre-industrial levels to between 3-4°C by the end of the century causing “irreversible” damage to the Earth’s climate.

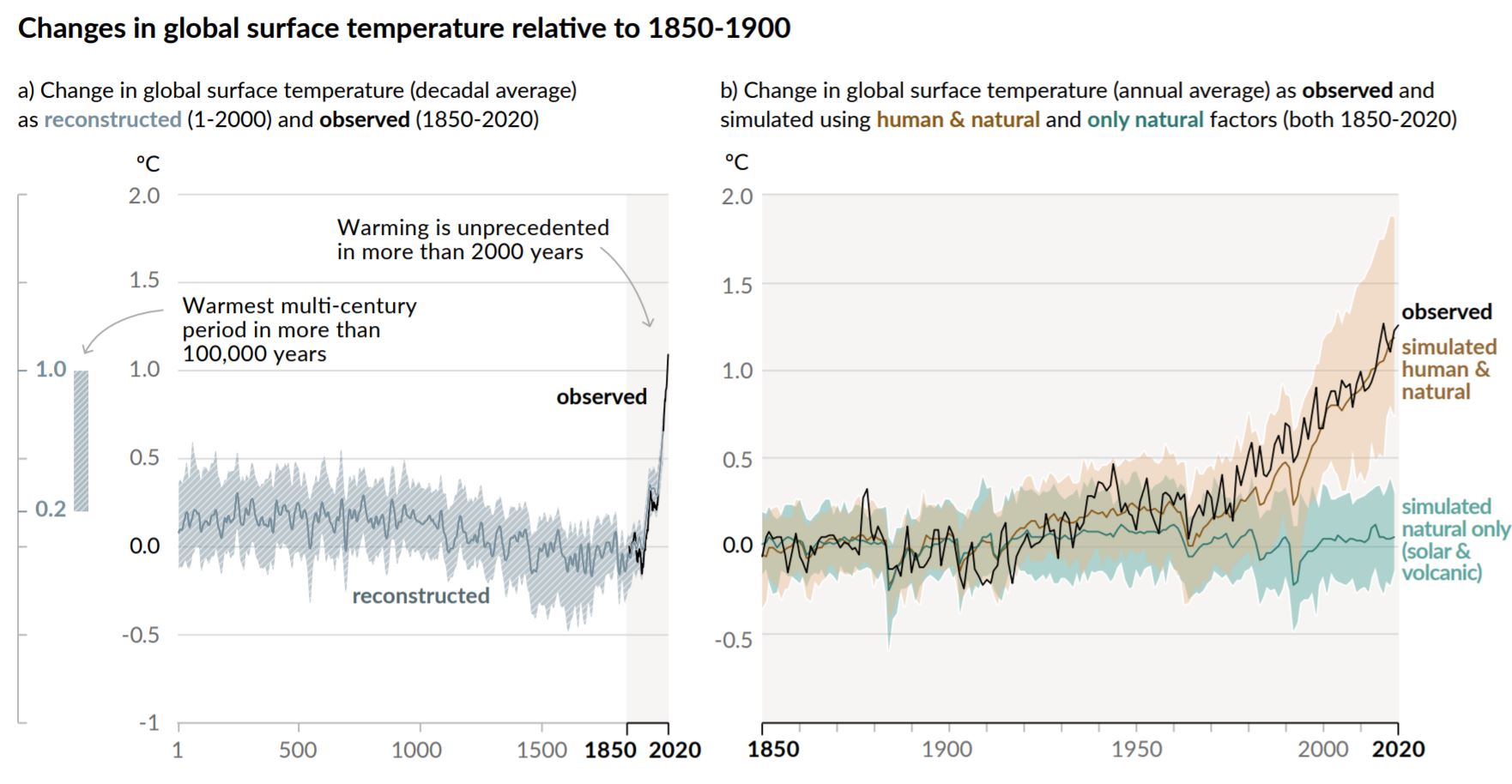

Source: IPOCC

The report comes as 197 countries are set to meet at Cop26, the United Nation’s climate talks, in November where they will discuss the different ways to reduce greenhouse gas (GHG) emissions in order to remain in line with the terms of the Paris Agreement.

But it is not just governments that have a role to play. Asset managers and owners – and within this, ETFs – will be instrumental in the shift to a low carbon future.

As Fiona Reynolds, CEO of the Principles for Responsible Investment (PRI), said: “The report is unequivocal in its findings – it should serve as a massive wake-up call that we are not going to manage the climate crisis without decisive action.

“The financial services sector has a vital role to play in overcoming these challenges. Governments and regulators need to provide near-term accountability for net-zero targets with robust policy frameworks and credible emission reduction plans for 2030.”

An obvious starting point for ETFs could be to introduce carbon intensity rules which exclude the high greenhouse gas (GHG) emitting companies as standard.

This would ensure capital does not flow towards the worst sinners from a GHG emissions perspective while directing assets to companies that score well.

According to data from TrueMark Investments, removing the top five GHG emitting names in the STOXX Europe 600 takes out 160 tonnes of carbon emissions per million dollars of revenue. For context, the iShares Core Euro STOXX 50 UCITS ETF (CSX5) has a GHG average weighted intensity score of 204.6 so this would have a huge impact.

However, as Matt Brennan, head of investment management at AJ Bell, highlighted, the situation is far more nuanced as the biggest polluters are going to be crucial in the transition to a greener economy.

“Simply disinvesting could be seen as wiping your hands of the problem,” he stressed.

Instead, Brennan argued ETF issuer engagement with the underlying companies to ensure they are making better long-term decisions is the area where the industry can have the biggest impact.

“Not only will this benefit the environment, in the long term it should also benefit the share price,” he added. “For an ETF investor conscious about the impact of climate change, it is important that they look at the actions the ETF issuer is taking on the companies for which they are stewards.”

Echoing his views, Andrew Limberis, investment manager at Omba Advisory & Investments, said ETF issuer engagement with underlying still had a long way to go.

“It is difficult to achieve all these objectives (never mind agreeing on which objectives are most important) and therefore an overzealous and reactionary response is also not the answer but as an industry we do need to continue to adapt and respond to today’s challenges.”

While the ETF industry continues to innovate, how issuers engage should be of increasing focus for both investors and regulators as it will be the most important factor in ensuring companies they own are helping, and not hindering, in the shift to a low carbon economy.