Returns above 50% across commodities and whispers of recession might imply the good times are soon to end for exchange-traded commodity (ETC) investors but a few eminent pundits have argued why the commodity train might keep on rolling.

While economic recoveries are usually the boom periods for commodity valuations and asset inflows, the current backdrop of monetary tightening and geopolitical unrest has turbocharged the asset class so far in 2022.

In fact, commodity exchange-traded products (ETPs) in Europe booked €6.9bn inflows in Q1, according to data from Morningstar, a dramatic improvement on the €700m inflows seen in the previous quarter.

Furthermore, commodity ETPs in Europe were the only asset class to show capital gains in the first three months of 2022, with assets under management (AUM) surging from €103bn to €123bn.

By 14 April, commodities had staged one of their most impressive periods of value appreciation in a decade with all ten of the largest diversified commodity ETPs returning more than 50% over the trailing 12 months, according to data from ETFLogic.

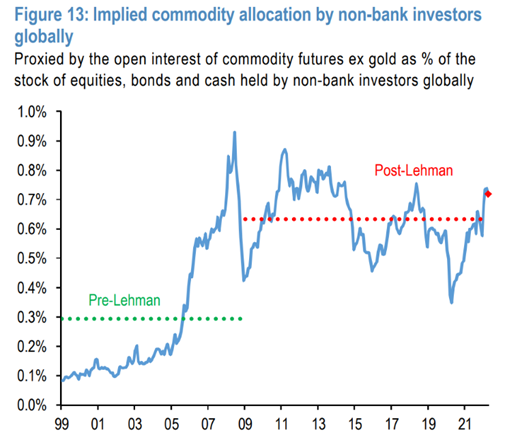

Remarkably, the product range’s outstanding returns – and popularity – may yet have further to run, with analysts from JP Morgan forecasting “further increases in investors’ allocation to commodities”.

The bank first looked at speculative positions as reported by the Commodities Futures Trading Commission (CFTC) and found the percentage of open interest in commodity futures contracts made up by speculation was actually lower than levels seen in early April 2021 and “close to historical averages”.

JP Morgan then aggregated the momentum of different commodities futures contracts, which indicated momentum traders such as commodity trading advisers (CTAs) have de-risked since reaching “very overbought territory” at the start of March. While long positions held by momentum traders remain “elevated”, speculative positioning remains “far from extremes”.

Zooming out, the JP Morgan analysts suggested non-bank investors are currently overweight commodities versus historical averages but comfortably short of highs seen in 2008 and 2011.

Source: JP Morgan

“In the current juncture where the need for inflation hedges is more elevated, it is conceivable to see longer-term commodity allocations eventually rising above 1% of total financial assets globally, surpassing the previous highs seen during 2008 or 2011,” the JP Morgan note said.

At such levels, this would imply an additional 30-40% upside for commodities from current levels, JP Morgan concluded.

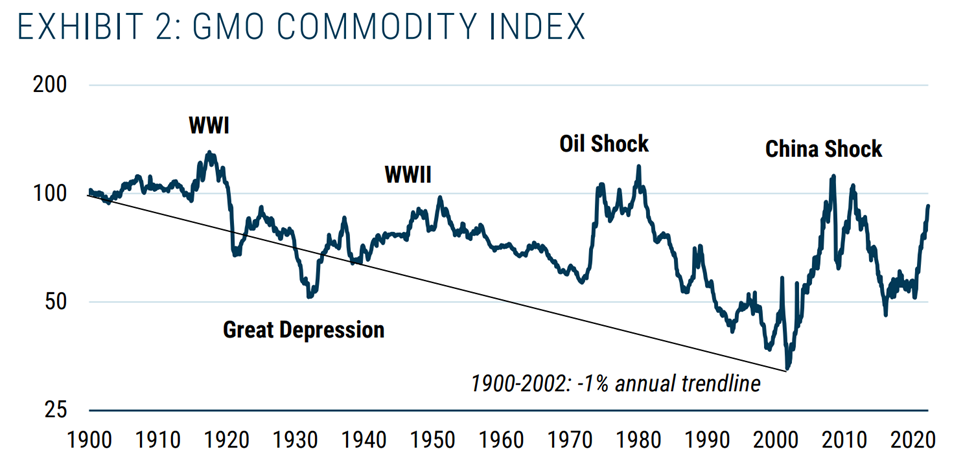

Looking at commodities from a macro rather than capital markets perspective, Jeremy Grantham, founder of one of the world’s first index funds and co-founder of asset manager GMO, said we are currently in an extended period of rising commodity valuations – after 100 years of depreciation.

Source: GMO and Global Financial Data

This price appreciation has been driven by the “impressive” rise of China, whose share of important commodities hot from 5% in 1980 to 50% in 2013. It has also been led by falling ore grades, with active copper mines having declined from an average of 2.5% 100 years ago to 0.5% today, Grantham said.

Looking ahead, commodities face a trifecta of pressures in the shape of Russia’s invasion of Ukraine adding strain to agricultural goods, energy and metals; growing consumption of energy and metals by the next generation of emerging economies; and “unprecedented” demand for industrial metals from the green energy transition.

“It is for precisely those metals which are most constrained that the coming demand expansion will be the most unprecedented,” Grantham continued. “The electric vehicle (EV) industry, for example, is likely to consume 15 times the current annual global lithium supply by 2050!

“And the energy situation is just as bad and even more underappreciated. Nearly all of the investment to generate 30 or 40 years of power from a wind or solar farm is upfront – whether measured in money, resources or energy.”

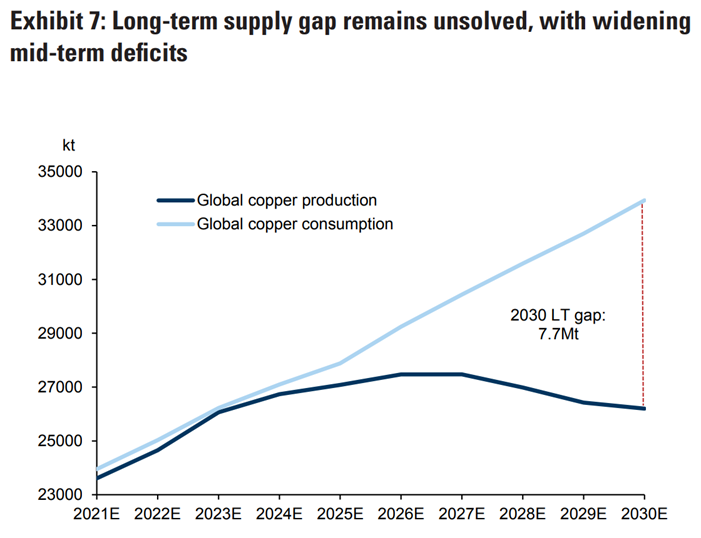

Underlining the issue of supply shortages in energy transition metals, Goldman Sachs said in a recent note that copper could be “sleepwalking toward a stockout”, with the investment bank doubling the size of its previous supply deficit expectations.

Source: Goldman Sachs

Without softening deficit expectations through the coming years, it warned “higher prices are an inevitability” to balance supply and demand inputs.

Interestingly, in the interim between current the current energy mix and green power, GMO’s Grantham argued traditional fossil fuel commodities will have a vital role to play in spiking electricity demand from electric vehicles and other electric-powered hardware.

Related articles