As the bulk of conventional index trackers continue their climbdown from the highs of 2021 and alternatives enjoy a spell of outperformance, we are once again reminded of the managed futures-shaped hole in the European ETF roster.

Managed futures, also known as commodity trading advisors (CTA) or trend-following strategies, are a popular diversification tool involving a portfolio of actively managed futures contracts going long or short on equities, bonds, commodities and currencies.

In the US, managed futures ETFs have enjoyed a strong start to the year amid market volatility, with the iMGP DBi Managed Futures Strategy ETF (DBMF) returning 27.5% during the year-to-date to 10 June, according to data from ETFLogic.

Peter Sleep, senior portfolio manager at 7IM, said equivalent instruments such as the AQR Managed Futures Fund (AQMIX) have benefited from strong trends in fixed income, commodities and currency, which have seen it gain 32.5% since the turn of the year.

WisdomTree also operates its own CTA product, the WisdomTree Managed Futures Strategy Fund (WTMF), which has added a more modest 1.3%. However, it is worth putting this in context by saying the largest ETF tracking the MSCI all-country world index has fallen 21.3% since the start of 2022, so WTMF has enjoyed notable outperformance.

“I always thought a CTA ETF would be a perfect product for Wisdomtree,” Sleep said.

WisdomTree did not respond when asked about its decision not to launch a wrapped version of its managed futures strategy.

Its lack of enthusiasm is perhaps understandable, though, given JP Morgan Asset Management launched the JP Morgan Managed Futures UCITS ETF (JPMF) as one of its two maiden ETFs in Europe in 2017, only to close the product in November 2020 after three years of weak performance.

“Trend following has not really worked for the last 12 years after building a great track record over many years,” Sleep continued. “What has hurt the CTA funds in the last 10 years has been choppy markets and sharp reversals of a trend that were often caused by government policy like the fall in Feb 2020 was halted by the US rescue package.”

However, CTA funds should not be viewed as merely outperforming during periods of volatility but more broadly as tools for non-correlation.

While the inverse equities narrative held some weight between 2008 and 2016, where CTAs gained during all five notable stock market dips, trend followers then lost out during the three subsequent crashes, according to data from FactorResearch.

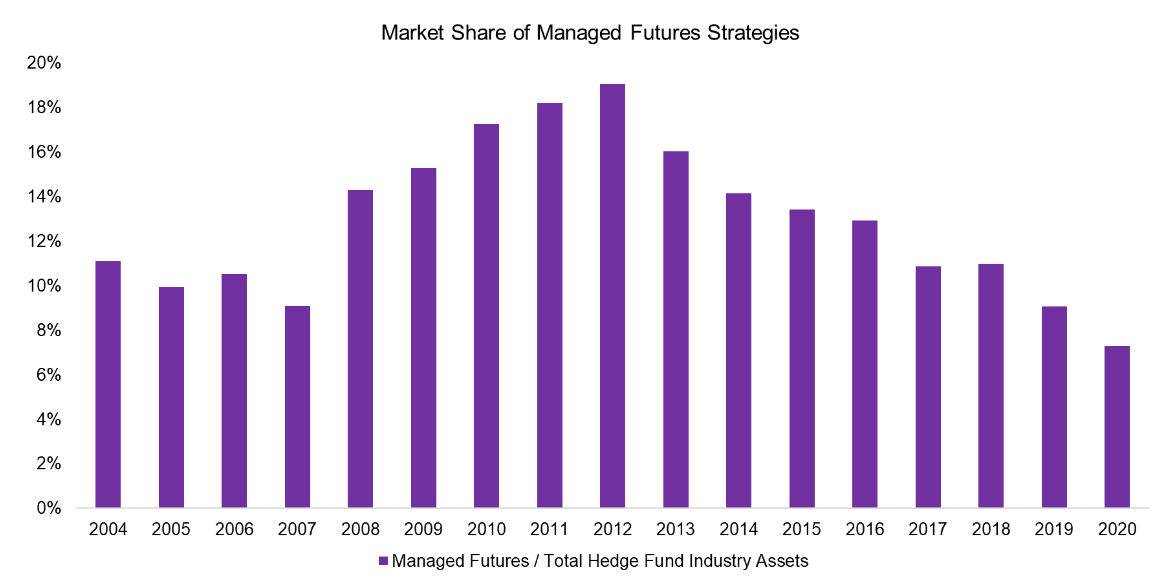

Although managed futures are proving their worth again in 2022, their inability to justify periods of lacklustre returns with gains during periods of volatility has seen them lose market share in recent years.

Sources: BarclaysHedge, FactorResearch

Interestingly, their market share doubled between the recessionary period of 2007 and 2012, so perhaps the materialisation of the much-prophesied recession by the end of next year could see CTAs return to favour – and renew the case for such products to exist in European ETFs.

Weixu Yan, head of ETF research at Close Brothers Asset Management, previously told ETF Stream: “It is unclear why a strategy like CTA, based on liquid futures, could not be featured in an ETF.

“Investors have a perception of ETFs being solely passive, and alternatives are typically allocated to an active manager,” Yan added. “I believe it is this perception that hinders some of the asset gathering for the ETFs.”

Related articles