If there was a silver lining in 2020 it was that investors started to take global warming seriously.

In what seemed unthinkable 10 years ago, the value of oil companies sunk to decade lows while green energy companies hit all-time highs.

All this flowed through to ETFs with some of the best performing strategies last year in renewable energy.

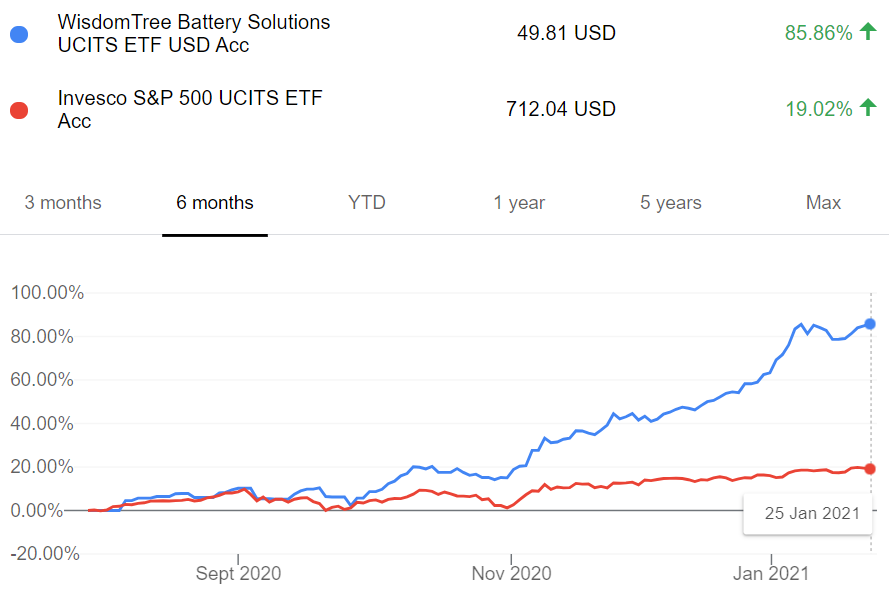

Among them was the $292m WisdomTree Battery Solutions UCITS ETF (VOLT), which is my pick for the best ETF launch in 2020. Below I give my five reasons why.

Reason 1 – Compelling thesis and performance

For any kind of fund to succeed it needs two things: investment thesis, and outperformance.

The need for outperformance is self-evident. Half the reason the ETF industry has triumphed globally is because legacy mutual funds rarely beat low cost index funds.

But outperformance alone is never enough to make a successful ETF. For an ETF to really succeed there has to be some narrative or some investment thesis behind it so investors can believe that outperformance will be sustained and was not just dumb luck.

On both these scores, VOLT has delivered. It has beaten the index since inception but it also has a compelling investment thesis behind it.

What is the thesis? Battery storage is crucial to the future of renewable energy. This is because electricity generated from wind and solar needs to be stored somewhere. Renewable energy is not like oil or coal which intrinsically store energy and can be simply warehoused.

Wind and solar power are also unpredictable. This means that they can produce lumpy quantities of energy depending on whether it is sunny or windy. For this reason, batteries are utterly crucial for maintaining supply in a world powered by green energy.

Reason 2 – ESG without virtue signalling

ESG investing is on a rip. But it has alienated as many people as it has won over -- and for good reason.

No-one likes being told what to say, what to think, and what to do by cultural elites. And when the holier-than-thou rhetoric comes from bourgeois financiers – among the highest paid professionals on the planet – many people can find it repellent.

But VOLT offers a different take on ESG -- a better one, I would argue, as it comes without the moralising or signalling. That is, rather than just "screening out" oil and coal companies – which is what most ESG ETFs do – VOLT helps drive (and profit from) the essential shift away from fossil fuels.

Reason 3 – Beyond Tesla

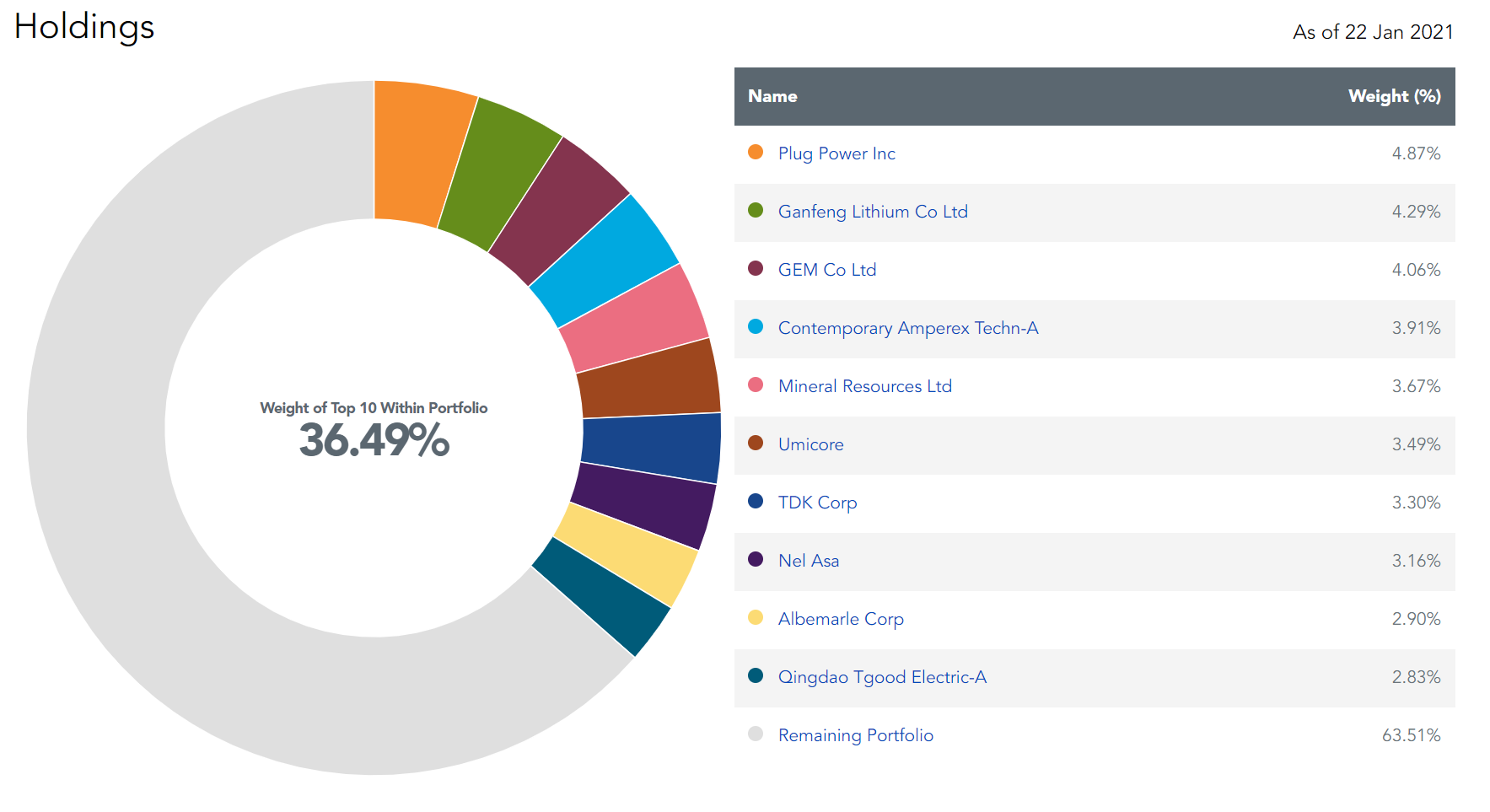

The second strength is that VOLT is not a single stock bet on Tesla, which is the first name that comes to mind when people think of batteries. (Tesla makes up just 0.80% of the portfolio).

Rather, the ETF is made up of a whole bunch of companies investors will probably never have heard of. Some are plain old lithium miners. But others are completely out of the blue. Examples include Nel ASA from Osla, which produces hydrogen for fuel cells. Tgood from Shenzhen, develops charging stations for electric cars. In fact, looking through the portfolio, I only recognised about half the names.

The tilt away from Tesla is reinforced by the weighting, which uses both quality and momentum factors.

Reason 4 – Access to overseas companies

One of the great advantages of bond ETFs is that they give retail investors and advisers access to a wide range of bonds, many of which are only available to banks and brokers.

But the same thing can be said of many ETFs that invest in global shares. Retail investors and advisers typically have some access to global shares through their brokerage platform. However access to global shares is usually quite limited and trading costs are far higher.

An advantage of a global shares ETF like VOLT for retail investors especially is that it gives them access to foreign companies - especially Chinese companies - that they cannot buy on retail trading platforms.

Reason 5 – Lower fee

The longer the ETF fee war lasts, the harder it becomes for ETF issuers to charge any kind of fee at all. And thanks to BNY Mellon last year, there are now ETFs that are literally free.

For ETF issuers, part of the appeal with thematic ETFs is that they give them the chance to charge fees.

But with VOLT, WisdomTree has refrained from charging particularly high fees. VOLT’s fee is just 0.40%. Most thematic ETFs charge fees at least 10 basis points higher than this.

I think this is a clever move, for a number of reasons.

The first is that it keeps copycats out. European ETF issuers are notorious for copying each other. When a European ETF issuer comes up with a clever ETF idea and gathers assets, it is never long before a rival launches a very similar fund at a lower price point. (Witness bitcoin ETPs at present). By starting the fees from a low base, WisdomTree has rolled out its hedgehog quills and made VOLT a less attractive potential target.

The second is that low fees create good will with investors and increases their patience with underperformance -- periods of which are inevitable for an ETF like this.