Dr Roger Cohen is a lecturer at the University of Sydney. As one of the pioneers behind Deutsche Bank's Xtrackers ETF platform in London, Cohen now acts as a private investor and advisor to BetaShares, the Sydney ETF provider. In his interview with ETF Stream, Cohen argues that young people should be open to borrowing money to invest in stocks rather than just property, especially as interest rates stay low.

ETF Stream: With the coronavirus rocking markets, a lot of investors are wondering what to do. Some are sitting on cash, anticipating another dip. Others are trying to buy work-from-home or healthcare companies. What do you think investors should do?

Roger Cohen: For me, the best thing to do is to put on your hindsight glasses and look at the dark times in the past and ask: “what should I have done then?” So, if you look back at the 2008 financial crisis, or the 2000 dotcom crash – what should investors have done in those dark days?

Typically, the answer may be: you should have kept buying, averaging in. While we don’t know when markets will recover, nor do we know if there’ll be another dip; we do know that – eventually – things will get better. And if you look historically, in many instances the best thing to have done in big sell-offs was to just keep swimming.

A lot of investors know that they should do this. But a mistake they often make is trying to perfectly pick the bottom. You need to understand that it’s extremely unlikely you’ll pick the exact bottom, so average in - keep participating.

In my view, that’s a lot better way to proceed than trying to pick specific winners and losers in this highly unpredictable market.

An area of research of yours – and something I’m a big believer in – is borrowing money to build portfolios rather than just buying a house. You’ve suggested it can be especially effective for young people. What’s the reason you recommend young people borrow money to buy assets?

The blunt reason is that the long-term growth rate of your portfolio should be higher than your cost of funds. You have time.

In other words, the share price increases and dividends you receive should, together, generally be greater than the interest you have to pay on the loan over the long-term. This is especially the case now given the current low interest rate environment.

But I would add a few caveats to this observation.

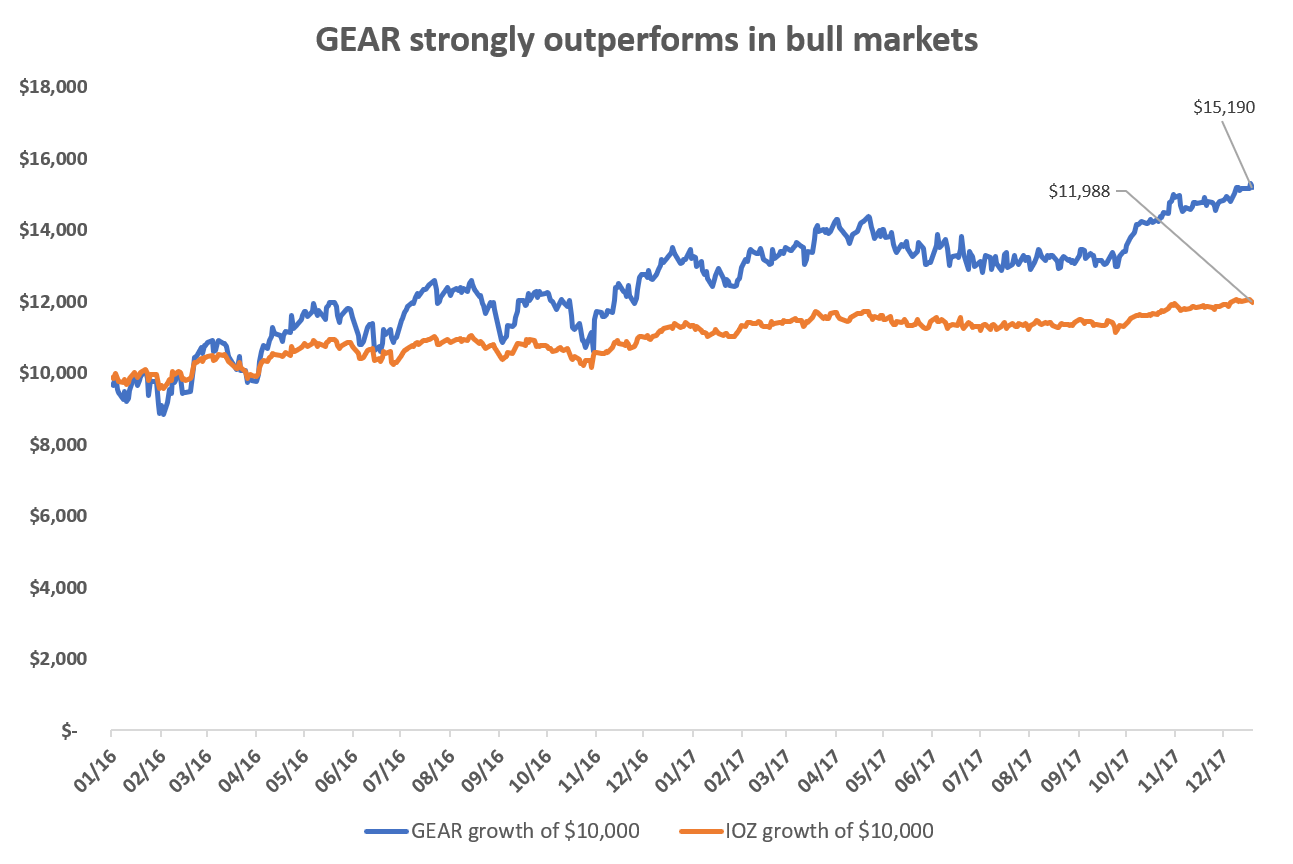

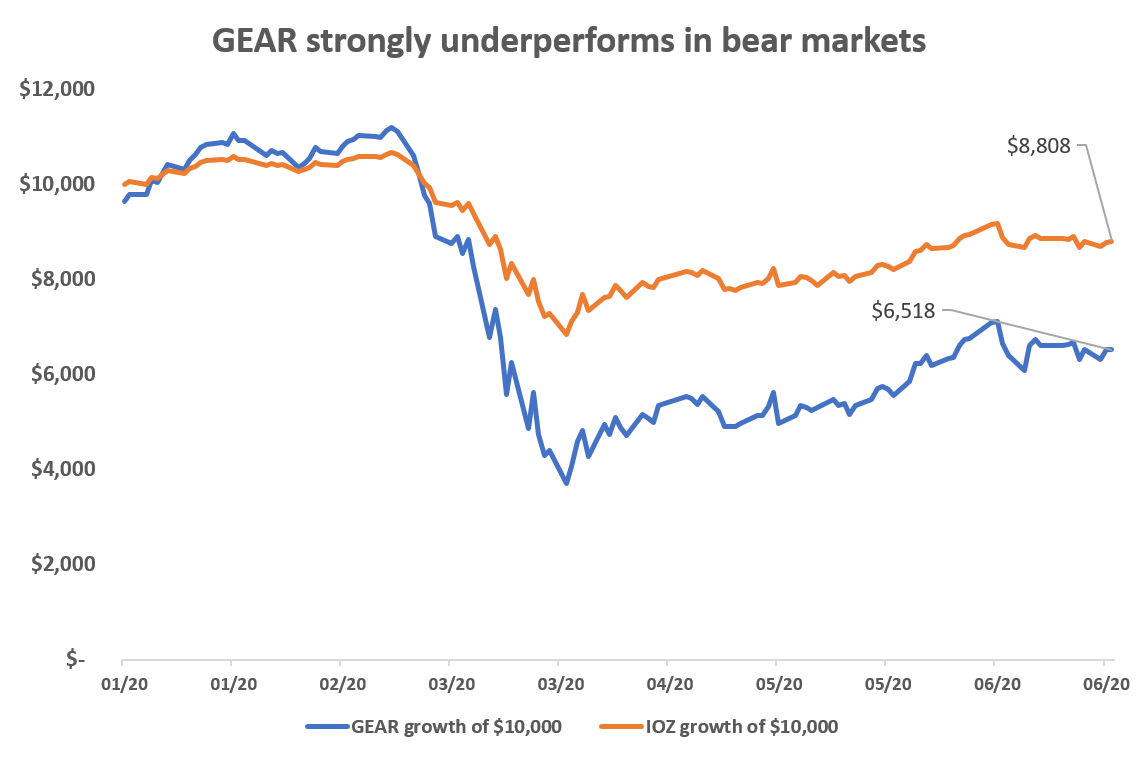

[Editor's note: BetaShares runs a geared hedge fund that buys Australian shares, known by its ASX ticker "Gear". Its NAV - shown in the charts above and below - gives a similar result to what investors would achieve if they bought an ASX 200 ETF with borrowed money.]

First, it is important to gear sensibly. That is: if you’ve got $100 to buy shares, it’s not necessarily wise to buy another $200 or more shares with borrowed money. Rather, the wiser thing to do may be to buy your $100 worth of shares, borrow $50 and buy bonds. As an alternative to borrowing the $50 yourself, you can buy $50 of an exchange-traded geared equity fund and $50 of a bond fund. The outcome is that your $100 gives you $150 (approximately) in a roughly 70/30 diversified portfolio.

Second, when gearing, I do not believe that it is a single-shot rifle. The key is regular investment. For example: if you geared up just before the coronavirus hit, you would have suffered greatly. But if you continue buying through the same averaging I described above, then you are more likely to get the benefit of the recovery when it comes. So, in my view, when gearing you need to take something like a rules-based month-by-month approach.

Third, if you do gear, you must accept that gearing magnifies both gains and losses – and in volatile markets such as now, there will be times where you suffer big losses. As such, it is important to choose a sensible level of gearing.

What does implementation look like for those interested in this approach? I take it you’re not advocating buying deep out of the money options from Robinhood.

If your gearing is tactical because you think something is going to double tomorrow then sure, you might consider going at it with call options or maximum leverage. Think of that as risk capital and you will be right or wrong.

However, if gearing is part of your long-term accumulation strategy, then you may need to look at gearing reasonably conservatively. And yes, a low-cost margin loan or an exchange-traded geared fund could be the way to go. Remember to invest regularly. You shouldn’t do it just once. That can be a good way to mitigate the effects of volatility.

A lot of Australians can find the idea of borrowing money to buy shares and REITs off-putting. They can think it is like taking your credit card to go play the pokies. Yet they don't mind going into a life of debt servitude to buy a property. Is this inconsistent?

Yes. I was going to lead onto this exact thing.

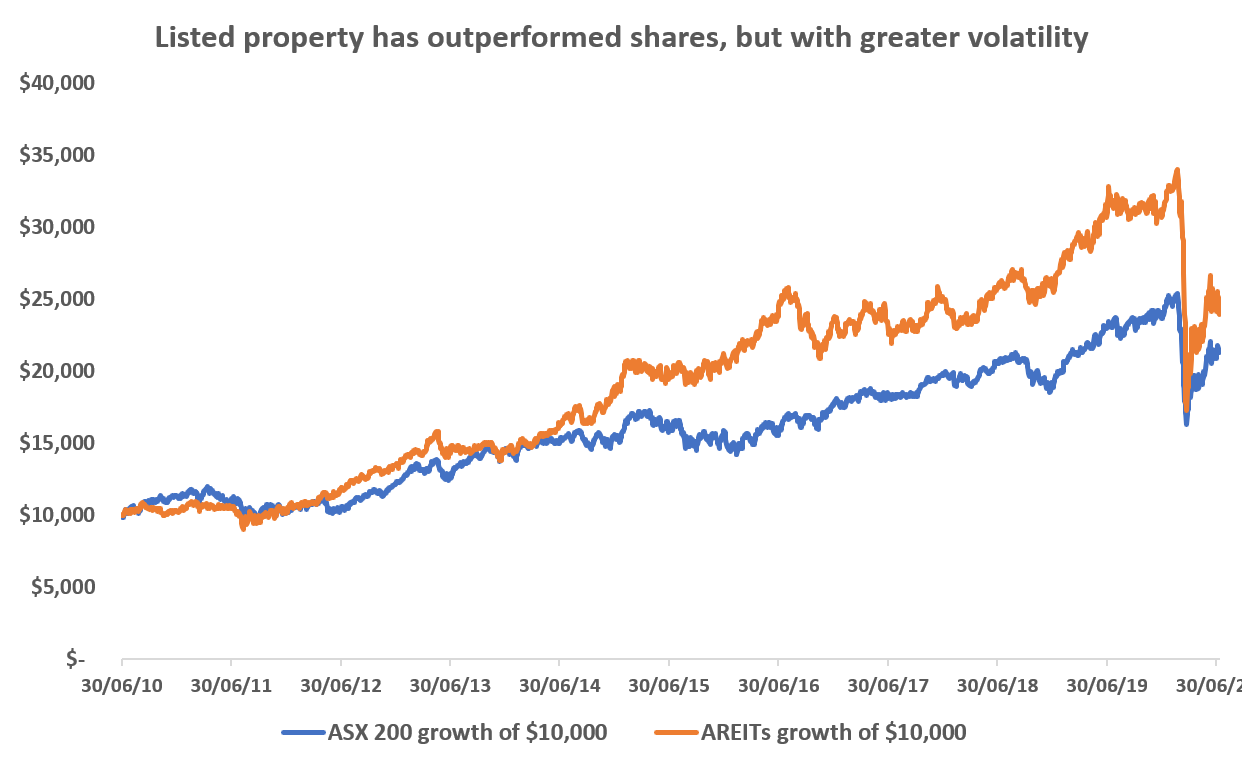

I think the view that investment properties are superior to shares stems from the fact that share prices are volatile while property is not. Shares trade every day, so we see the short-term price fluctuations which we don’t see for property. Imagine that property prices were continuously visible and home-owners had to suffer watching their home values move up and down every hour - I imagine their attitudes would be quite different.

Source: ETF Stream, S&P Global

Our psyche with property is that it always goes up. We don’t see any day-to-day price volatility in property, so because of that, people tend to be more comfortable gearing into it. Seeing the volatility in share prices makes us less comfortable gearing into them.

Let’s wrap this up by talking about the new BetaShares Global Government Bond 20+ Year ETF. It buys G7 debt with maturities of 20+ years. This means it can be very interest rate sensitive. Were you guys expressing a view on the direction of future interest rates when you chose to list this?

That’s part of it, but more importantly, it’s a portfolio completion tool. When we talk about constructing robust portfolios investors generally want exposure to equities and growth assets, and also want diversification. Arguably, one of the most efficient ways of diversifying is with exposure to duration. An ETF with exposure to government bonds with as long a duration profile as possible gives you a tool to do this in an extremely capital efficient manner (meaning you need less capital for the same exposure).

You guys went for currency hedging on it. What’s the rationale and do the costs of hedging cut away at the yield?

Each investor may have their own preferences and investment approach, I generally want my equity exposures to be unhedged and bond exposures to be hedged. Not everyone agrees with this – especially when it comes to equities. Some investors prefer to embed their currency view together with their equity view.

However, if you’re unhedged in fixed income, it adds a currency exposure which completely changes the risk profile away from anything fixed income like (i.e. capital stable). This also potentially negates some of the diversification benefits which fixed income provides.

As for the cost of hedging, in context, it is not expensive. There will be some amount of slippage but compared to currency volatility and the benefits of hedging, in my view the cost is low.

Sign up to ETF Stream’s weekly email here