"In your text, treat Africa as if it were one country. It is hot and dusty with rolling grasslands and huge herds of animals and tall, thin people who are starving. Or it is hot and steamy with very short people who eat primates... Africa is big: fifty-four countries, 900 million people who are too busy starving and dying and warring and emigrating to read your book."

Binyavanga Wainaina, How To Write About Africa

***

ETFs are everywhere these days, but in some places more than others.

The North American ETF market is worth over $3.1 trillion. Europe's over $700 billion. Asia Pacific's almost $400bn.

But what about Africa?

One of the ironies of today's investment climate is that amid strong demand for emerging-market ETFs, including those with African exposure, investors tend not to think too much about Africa itself. And while ETFs and passive investing are a truly global movement, Africa remains a blind spot for many investors.

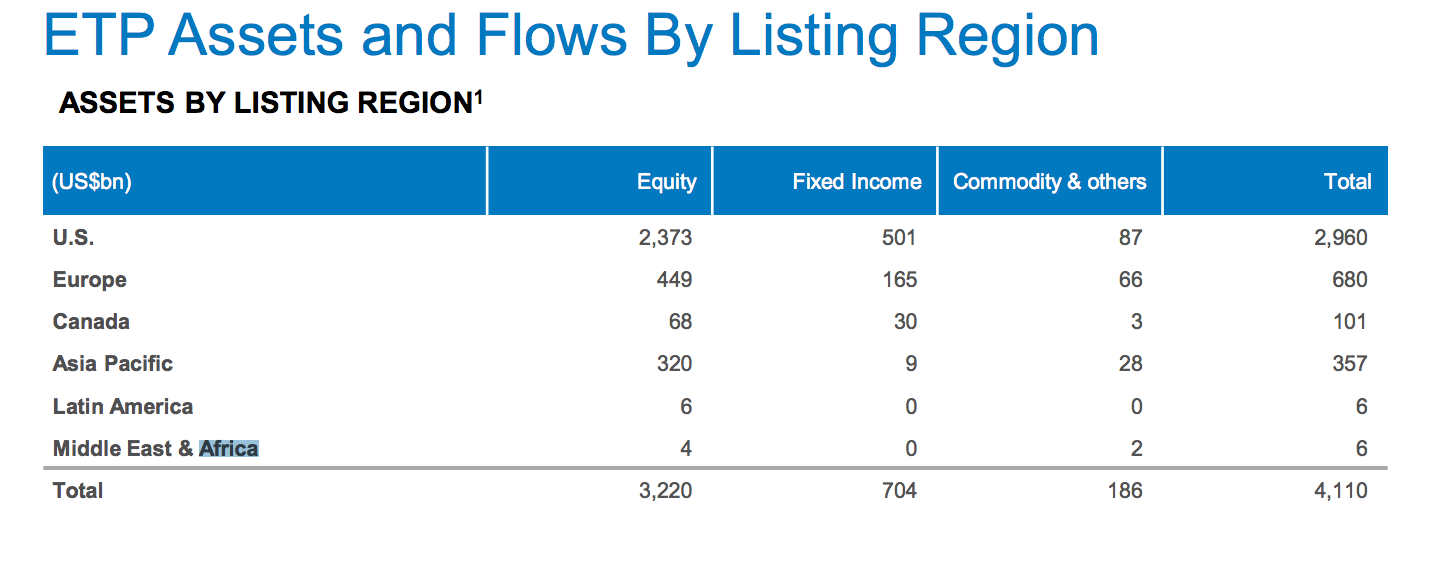

[caption id="attachment_1283" align="alignnone" width="627"] Source: BlackRock ETP Landscape, August 2017[/caption]

How big are ETFs in Africa?

Africa has the smallest ETF market of any continent - besides Antarctica. According to BlackRock's August ETP Landscape report, the Middle East and Africa's entire ETF market is worth roughly $6bn. Putting this in perspective, in the UK about this much sits in the iShares Core FTSE 100 UCITS ETF (ISF) alone.

There are good reasons for this.

African stock exchanges have fewer listings. (Rwanda, for example, has only nine listed companies). Businesses are often family-run and rarely have an eye to listing stocks, despite pressure from exchanges. This makes compiling indexes a challenge in many parts of Africa.

There are also liquidity issues. What shares are listed on African exchanges rarely change hands. According to The Economist, annual turnover is less than 10 percent of market capitalisation outside South Africa. Meaning that even if there were more indexes and listed companies, there are few financial institutions to help turn them into ETFs.

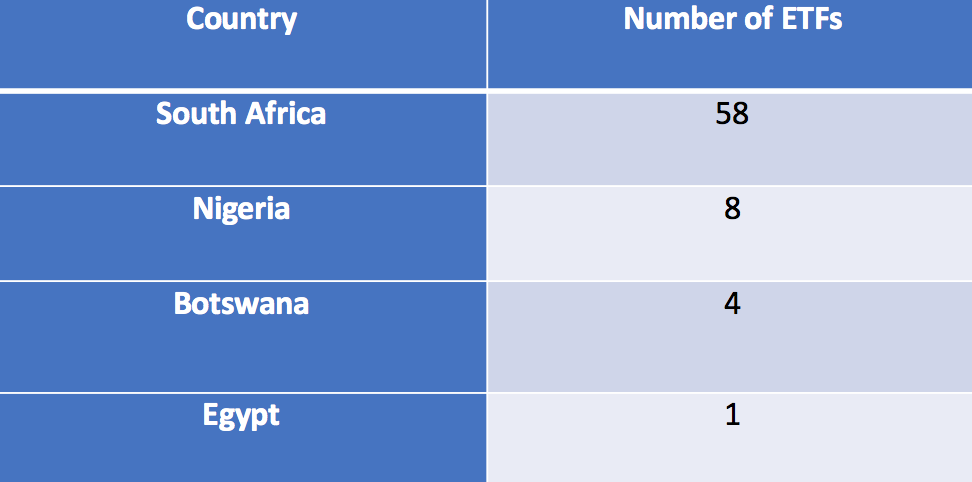

The African ETF market, such as it is, has its home in Johannesburg. The Johannesburg stock exchange, the largest exchange in Africa, has 59 ETFs - far more than any other African country.

South Africa is also largely responsible for bringing ETFs to other sub-Saharan countries. For example, Namibia, Ghana, Kenya and Botswana have ETFs trading on their exchanges. But in each of these countries, their ETFs are cross-listed from South Africa.

What do African ETFs track?

North American and European ETFs mostly track equities. But in Africa most of the products track precious metals, especially gold. In fact, of the $6bn in African ETFs, almost $2.5bn of that is a single gold tracker: NewGold by Absa Capital (an affiliate of Barclays).

There is nothing necessarily unusual about this.

Gold ETFs were among the first stones to roll in many countries, including the US, where the World Gold Council helped launch GLD. Gold ETFs can be easier for ETF providers to explain to the uninitiated investors and regulators as they only track one thing.

So if the African ETFs are gold focussed for now, as they appear to be, then it is not altogether different from how other countries got their start. Nor is it necessarily different from other countries new to ETFs like India, whose ETF market is also gold-focussed.

All-African index trackers are coming

In what may be a sign of things to come, green shoots are emerging in Nigeria, which has listed several ETFs that look like those in New York and London.

Local issuer Vetiva, for example, has listed ETFs tracking sectors of the Nigerian economy. The Vetiva Industrial ETF tracks, for example, Nigerian industrial companies and the Vetiva Banking ETF does the same but for Nigerian banks.

Yet these, as critics point out, are not as transparent as those that trade in western financial capitals.

"They don't make easily available the details of the underlying companies -- percentage holding, number of stocks, value of each stock position and other useful details I easily get for the foreign ETFs. And I don't know why," said Michael Olafusi, Managing Director of Lagos-based research firm UrBizEdge.

Despite these concerns, local ETF issuers are pushing the boundaries in terms of innovation - and novel underlying indices.

In April, Johannesburg got its first ETF tracking an all-African index that excludes South Africa: the AMI Big 50 ex-SA ETF (AMIB50), listed by Cloud Atlas Investing.

AMIB50 tracks 50 blue chip African companies, mostly in Egypt, Morocco, Nigeria and Kenya. The index is then mostly made up of African telecoms and banks, but also cement companies and - curiously - a lot of breweries.

There could be more to come. Stock exchanges across the continent are launching ETF education campaigns, with the goal of generating more listings. If these succeed then African financial services may follow a similar geometry to elsewhere.