Applying environmental, social and governance (ESG) factors to government bonds is one of the biggest challenges facing investors looking to incorporate sustainable metrics within portfolios.

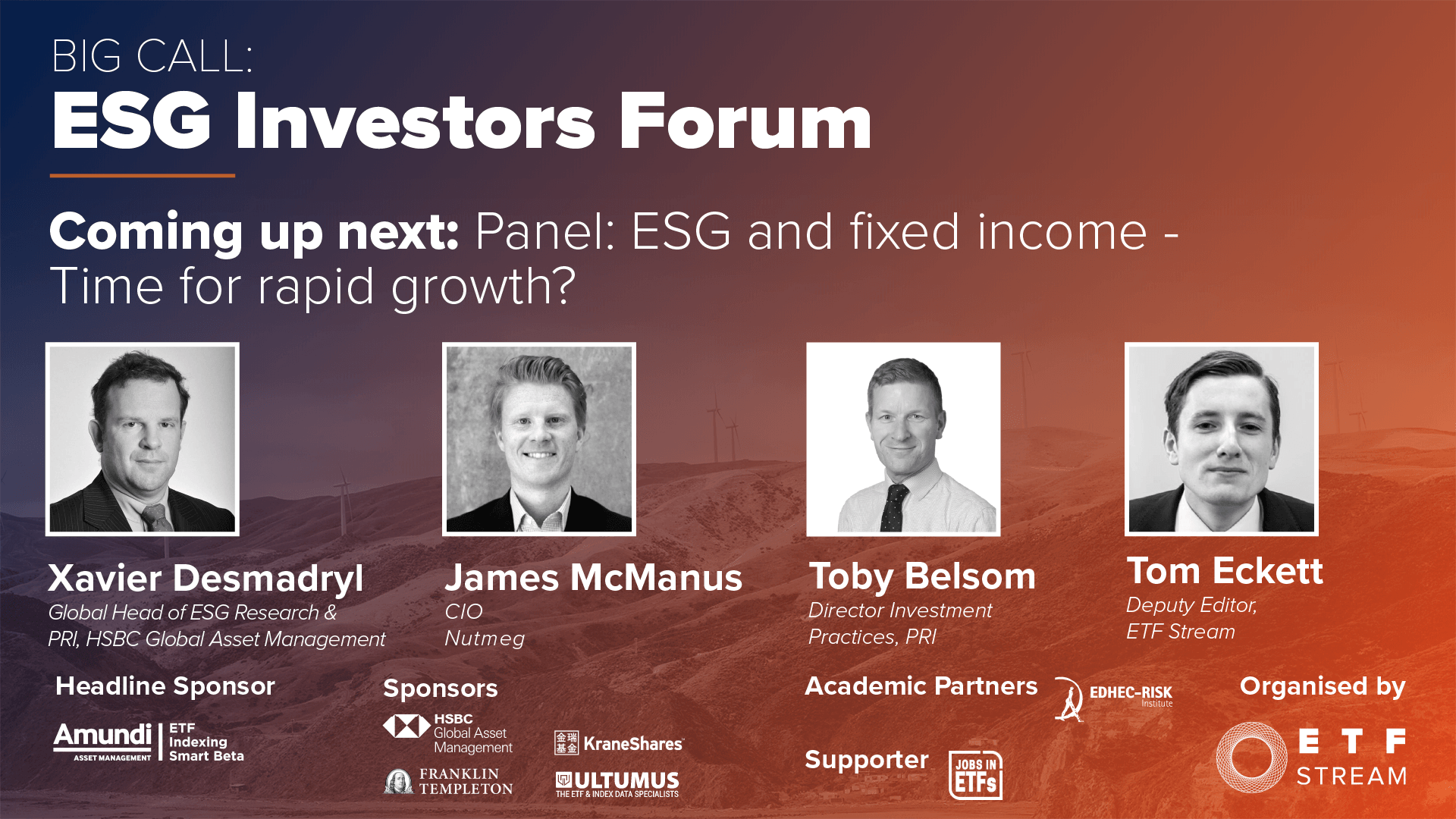

Speaking at ETF Stream’s Big Call: ESG Investors Forum earlier this week, James McManus, CIO at Nutmeg, said it was very hard to distinguish between developed market government bonds such as UK gilts or US Treasuries.

As a result, investors are forced to include government bonds within their ESG portfolios for risk management purposes without clarity on how to separate governments on their ESG performance, especially in the developed market space.

“This is an area of evolution,” McManus said. “Developed market government bonds are always going to be a core part of an investor’s portfolio so we need a consistent approach when incorporating ESG metrics.”

Furthermore, Xavier Desmadryl, global head of ESG research and PRI at HSBC Global Asset Management, added it was almost impossible for institutional investors to engage with governments about their sustainable practices.

While this is very different in the corporate bond space, Desmadryl said there needed to be a clear connection established between the credit quality of a sovereign bond and its ESG performance in order for further development.

Echoing his views, Toby Belsom, director investment practices at the Principles for Responsible Investment (PRI), stressed there are very different interpretations as to how one engages with a government.

Desmadryl continued: “I cannot have a conversation with the US President, for example. There is definitely an issue of incentive for governments when it comes to ESG.”

ESG and ETFs: The superior approach to sustainable investing?

Steps have been taken by ETF issuers to offer ESG solutions in the government bond space. Last month, BlackRock became the first ETF issuer to launch a government bond climate ETF, the iShares € Govt Bond Climate UCITS ETF (SECD).

SECD looks to offer investors exposure to more EU countries with less climate change risk. When compared to the iShares Core € Govt Bond UCITS ETF (SEGA), SECD has a 10% overweight to France, an 11% overweight to Italy while underweighting Germany by 6%.

Deciding that Italy and France are less exposed to climate risks versus Germany certainly remains a major challenge for both index providers and ETF issuers.

In terms of further product development in the government bond ESG ETF space, McManus said he would like to see index construction focused on certain types of issuance. For example, only including bonds issued by governments in order to finance green projects.