The ETF industry has hit back at a recent academic paper that warned there are “significant” hidden costs resulting from custom ETF creation baskets in the fixed income space.

The research, titled The hidden cost of corporate bond ETFs, found corporate bond ETFs listed in the US, on average, pay 48 basis points a year in “hidden costs” resulting from custom creation baskets.

The research from Boston College’s Christopher Reilly claimed authorised participants (APs) are including securities in custom creation baskets that are set to “substantially” underperform the ETF’s index that it is aiming to replicate.

Because many APs are large banks, the research said, they can utilise information to forecast future changes in a bond’s value and therefore offload a bond they believe will underperform into a creation basket.

“Corporate bond ETF issuers allow APs to deliver only a subset of the assets in portfolios that ETFs wish to track. These rule modifications embed a hidden cost that ETF investors incur,” the research said.

However, participants from across the European ETF industry have said this is simply not how the relationship between the ETF issuer and the AP works.

In fact, Frank Mohr, global head of ETF sales trading at Société Générale, an AP, stressed it is the issuers which are in control of the bonds they receive in custom ETF creation baskets, rather than the AP. He explained every custom creation basket is a negotiation between the issuer and the AP.

“The process is dictated by the issuers rather than the APs,” Mohr added. “An AP will have a basket to offer in this creation and the issuer can select the bonds they want.”

Mohr’s views were echoed by Ben O’Dwyer, SPDR ETF global capital markets specialist at State Street Global Advisors, who confirmed the custom creation basket negotiation between the issuer and the AP is based on a stratified sample of the underlying bonds in the index.

Stratified sampling is a tool used by ETF issuers when there is a large basket of securities to track and full replication would be too expensive. It is a method that seeks to replicate an index’s main characteristics such as duration, quality and liquidity.

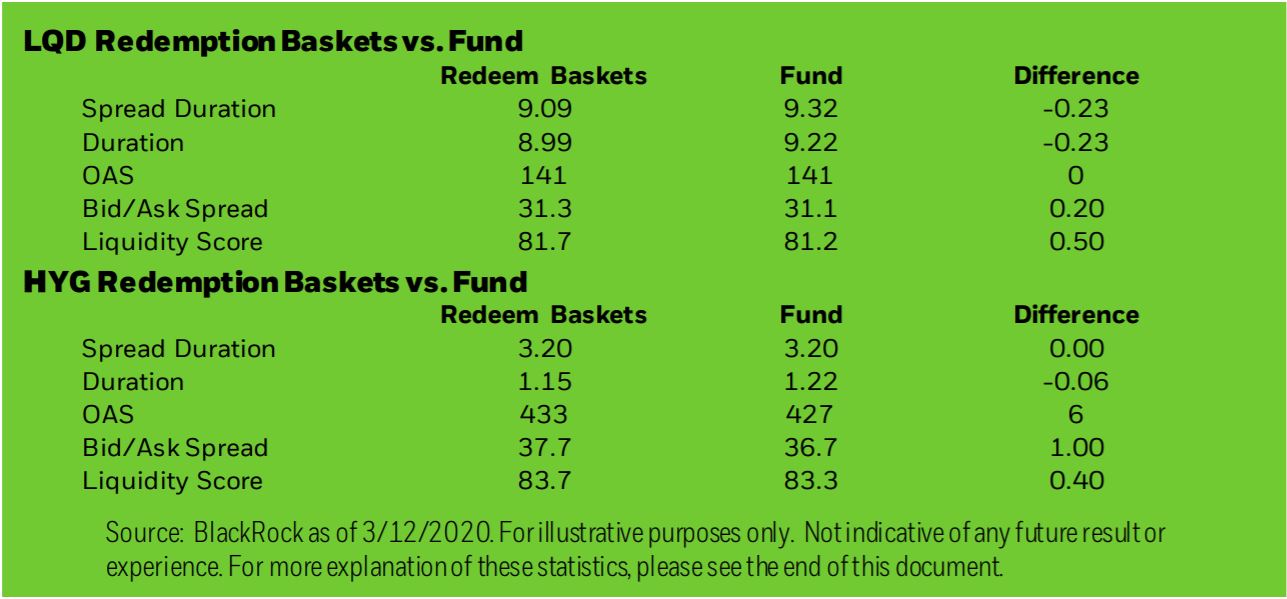

Highlighting this, following the liquidity crunch in March 2020, BlackRock revealed the custom ETF redemption baskets given to APs had very similar characteristics to the ETFs themselves.

“We disagree with the conclusions presented in the paper,” Dwyer continued. “We believe some of the assumptions made do not reflect the reality of creation and redemption basket processes. APs do not have full discretion over the bonds included in a custom basket.”

From the ETF issuer perspective, Keshava Shastry, head of capital markets at DWS, questioned why they would want to damage the reputation of their product by accepting bonds in a creation basket that are set to underperform.

In the latest edition of ETF Insider, he stressed any deviation away from the index – tracking error – will have a negative impact on demand when investors are looking to select which ETF to include within their portfolio.

“From the AP's perspective, owing to their utilisation of ETFs as inventory to both make markets and for hedging purposes, it is not in their interests for index-tracking ETFs to deviate in tracking error and performance,” Shastry added.

“The evidence suggests that the agreement of the ETF issuer to a detrimental basket that is not in the interests of shareholders is, in fact, highly unlikely, and impractical as well as it goes against the objectives of the fund.”

Related articles