The asset management industry has placed much emphasis on capturing new flows from Millennial investors however, questions remain as to whether this generation are even looking to invest their money.

It is suggested one should only start investing once they have no outstanding debt or overdrafts, as the potential return from your investments is very unlikely to exceed that of the interest on the debt.

Therefore, on the surface this would mean 20-30 year olds, which are most likely to incur these debts, are not in the position to start investing, but is this necessarily the case?

In recent years, a flurry of fintech companies have come to market which enable millennials to start saving easily as well as online investment platforms, such as robo advisers, which allow users to start investing from the comfort of their own phone.

Surveys have found that technology has had a negative impact on face-to-face communication. Therefore, robo advisers and online investment platforms will become increasingly more appealing compared to human financial advisers.

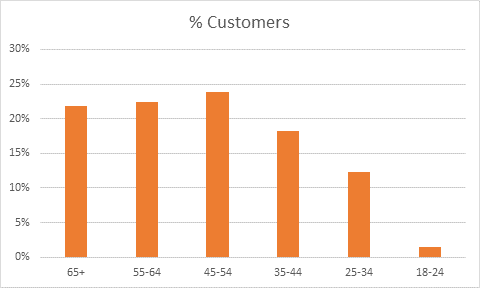

Tiller, a London-based robo adviser, says its largest demographic is 50-60 year olds, accounting for 38% of its total users. 20-30 year olds is significantly less with only 12% of its userbase falling under this category.

Similarly, Interactive Investor, an online investment service, has less than 15% of its users under the age of 35. The most common age of its users is between 45 and 54.

Interactive Investors Users’ age

Source: Interactive Investor

Wealthfront is a robo adviser specifically aimed at Millennials and shows 90% of its users are under the age of 45. In tandem with a younger userbase comes a higher risk preference with its users’ average risk selection being 7 out of 10.

With majority of its userbase in their 50s, Tiller’s most common risk preference is 3 out of 5 with 36%, just ahead of the maximum risk option with 34%. Interestingly, all its investors are risk loving on some level as not a single user selected the risk preference of 1 out of 5, the lowest option.

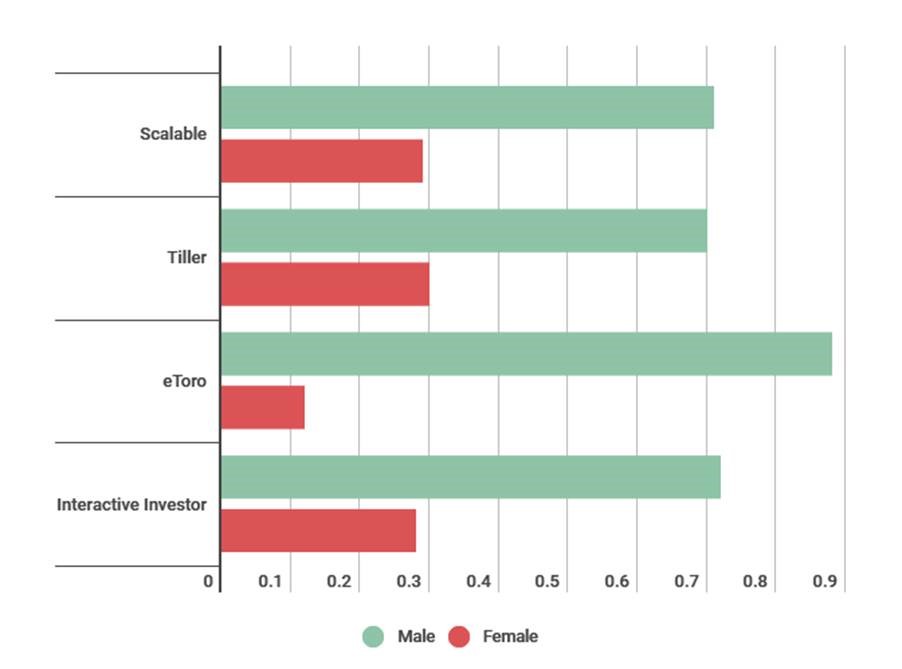

Another reoccurring theme seen is the male dominance among investors. At least 70% of the platforms’ users were male with eToro’s userbase being 88% male.

A reason for eToro’s significant gender tilt could be from the platform’s cryptocurrency offering. Speaking to ETF Stream, eToro CEO Iqbal Gandham said the inclusion of the digital assets brought a large volume of young investors ranging from 22-33 in Q1-Q3 2017, the peak of Bitcoin’s price surge.

Following eToro’s growth with the expanding interest in cryptocurrency, Gandham said a significant number of these users began investing in single stocks. ETFs are new products on eToro’s platform but Gandham believes these investors will perform a similar trend of moving from stocks to advanced products such as ETFs.

“ETFs and mutual funds are investment products that are trickier to understand, so we need to take a step back to introduce people in to the world of investing via the products they do understand”, says Gandham.

“Investors will find out about these products by themselves by investing in individual stocks such as Facebook, Netflix and Google and asking themselves ‘is there an easier way of doing this?’ and will then discover ETFs.”

ETF Insight is a new series brought to you by ETF Stream. Each week, we shine a light on the key issues from across the European ETF industry, analysing and interpreting the latest trends in the space. For last week’s insight, click here.