Free ETFs are coming, thanks to fund providers turning asset management into Facebook, two Vanderbilt professors argue.

No matter how cheap ETFs get, they somehow manage to get cheaper. In the US, some plain vanilla funds only charge 3 basis points. If current trends continue, plain vanilla ETFs will soon be free. But how can free ETFs be commercially viable?

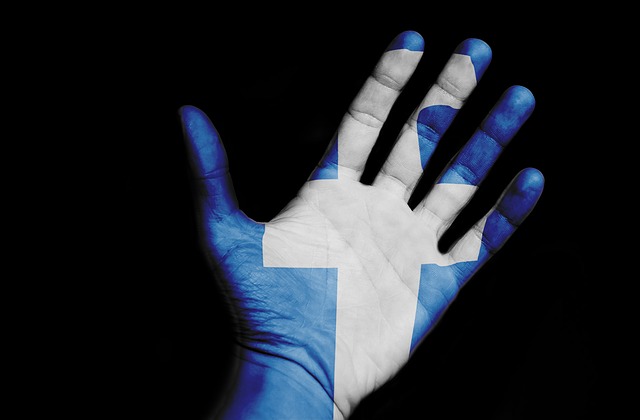

By turning asset management into Facebook, ETFs can be free

One answer is that ETF providers will adopt the Facebook model, which involves turning those who use their products into their products.

This view is laid out by Vanderbilt Professors Jesse Blocher and Robert Whaley, in a recent paper entitled "Two Sided Markets in Asset Management".

Asset management used to be a simple fee for service business, but ETFs have changed that, the professors argue. While passive index mutual funds have been around for decades, only since ETFs have fund providers to been able to offer asset management for free.

This is because ETFs use a "two-sided market model": they attract investors with their tiny management fees in one market, while renting out their investors holdings in another market. In this way, ETFs are like Facebook, which attracts users' with its free product and then rents out its users' personal data to advertisers.

While this dynamic allows ETF providers to provide asset management on the cheap, it also turns investors into fund providers' products.

"ETFs are no different than Facebook in that they operate a two-sided market model that gathers an audience (assets) and then sells advertisements (lends securities) to fully fund their operations and generate profits," the authors conclude.

"Investors in these low cost ETFs are not the customers, they are the product."

Profs Whaley and Blocher see evidence for this in a number of places. The first is in the sheer volume of cash ETF providers can make from securities lending, with the monies made on securities lending exceeding that made from management fees.

"Our sample spans the period January 2009 through December 2013. The results are

striking. While the… annual expense ratio of passive investment funds is 26 bps, ETFs earn 23 to 28 bps per year from securities lending. If firms aggressively optimize their holdings to lend only the most profitable-to-lend securities, revenue can exceed 100 bps per year," the paper concludes.

The second place is that the downward drift on management fees closely correlates with the uptick on securities lending - suggesting that substitution is occurring. The authors argue that this uptick in securities lending is particularly true of the big three issuers. For Vanguard, its first mover fee cutting was enabled by securities lending substitution. For BlackRock and State Street, as they provide their own lending agent services (other issuers have to use external agents to find borrowers for their holdings) they have the most to gain from the practice.

But the more damning evidence of ETF providers using the Facebook model is that what's profitable to lend correlates with what securities an ETF chooses to hold. And securities lending incentives can be determinant.

"ETF managers respond to opportunities to earn securities lending revenues… ETF portfolio weights diverge from the underlying index weights in a manner that over-weights stocks that are more profitable to lend," it said.

ETFs that transparently track famous public indexes, like the S&P, however, are less guilty of these practices. The study found that transparent ETFs tracking famous publicly available indexes make less money from securities lending and tilt their holdings less.

"Less transparent ETFs make more securities lending revenue. On average, the difference in revenue between transparent ETFs and ETFs based on proprietary indexes is 5 to 7 bps, but it can be as much as 13 to 18 bps per year."

Still, it found, there is some evidence that they tilt their holdings towards what can be leant out. The findings contrast with issuers' claims that they tilt their holdings based on liquidity, the authors note.

The report concludes with a call for greater transparency on securities lending and for a discussion on who gets the spoils. They also call for great closure on collateral and counterparties as a physical ETF that lends out a large proportion of its holdings will "essentially be a swap contract".