No matter what the markets have thrown at us over the last several years, the answer has increasingly come in the form of an ETF.

The consistency of the upward trend in ETF trading volumes set against a market backdrop that has been anything but consistent says a lot about the versatility and flexibility of ETFs as an increasingly important part of the investor tool kit. But it does not explain how, exactly, the ETF market has continued to evolve in response to market trends and investor demand to become the go-to solution for so many different use cases.

As we head further into 2022, there are several factors that have set the stage for this trend to stick, and we expect ETF adoption will remain a key ingredient in the growth of the institutional marketplace in the months to come.

Steady growth in unsteady markets

It is important to remember that, since their first introduction in the early 1990s, ETFs have always been pitched on the virtues of flexibility, intraday liquidity, easy access and low trading costs. While the market has evolved considerably since then, the basic premise that ETFs provide instant exposure to a broad range of securities with lower transaction costs and, in some cases, better overall liquidity than the underlying securities themselves, has been a constant.

That practical foundation has been perfectly aligned with industry megatrends toward reducing trading costs, the rise of multi-asset trading and the relentless pursuit of liquidity. Accordingly, in the first five years of ETF trading on Tradeweb, when volatility was relatively low and institutional investors were laser-focused on efficiency, transparency and reducing trading costs, ETF volume on Tradeweb’s institutional platform amounted to over $650bn. When compared with active and passive mutual funds, ETFs have consistently made it easier for institutional investors to deliver better pricing, improved efficiency, increased transparency and best execution, and volumes naturally followed.

In 2020, these process-driven benefits were suddenly recognised as even more valuable. In March of 2020, as the COVID-19 crisis gripped global markets and everyone held their breath for a liquidity crunch, US ETF volume shot up 242% year-over-year and European ETF volume climbed 190.6% year-over-year on Tradeweb. It was official: ETFs had passed the test, delivering increased liquidity throughout a period of extreme market stress.

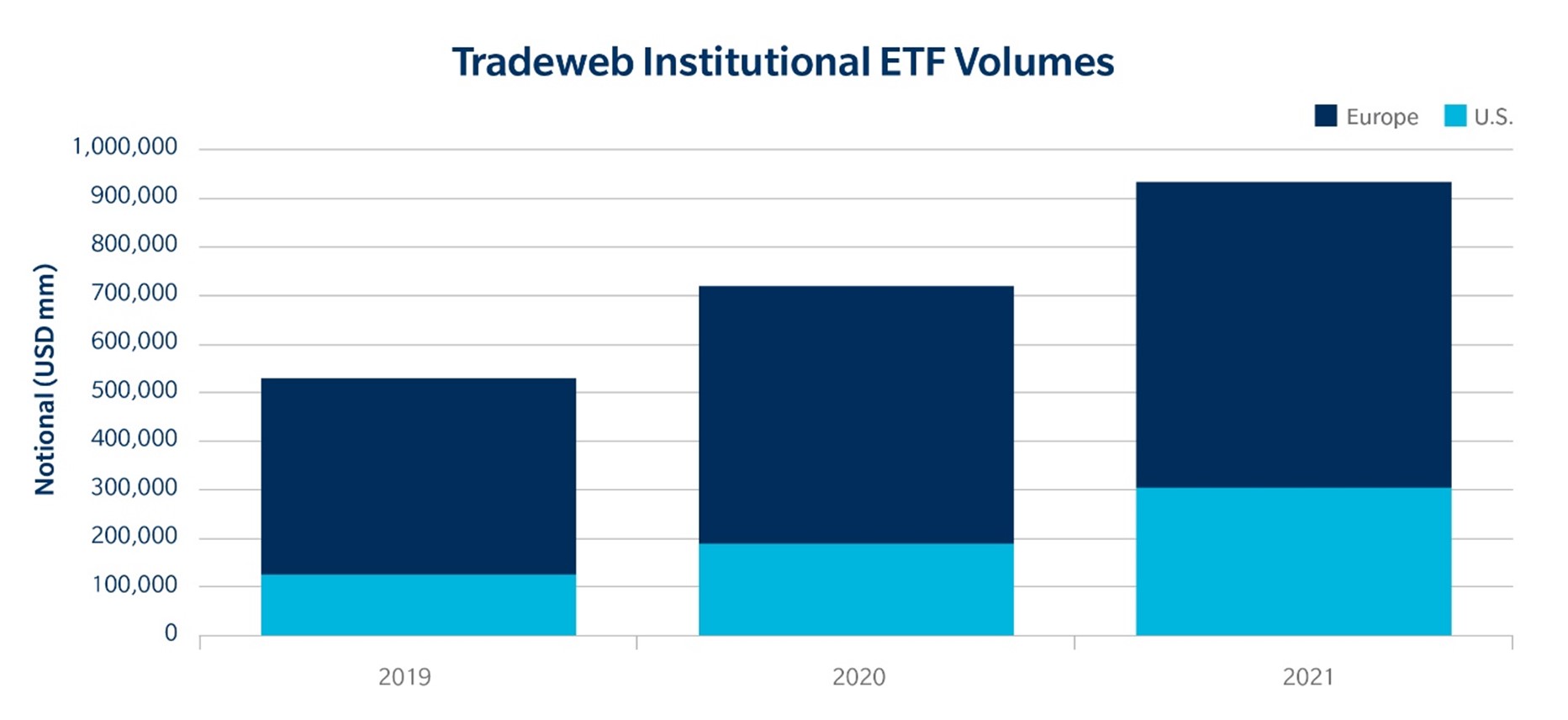

And, over the last year, as we have lived through a stilted, on-again, off-again period of economic and geopolitical uncertainty, the trend has continued. Tradeweb’s total notional ETF volumes rose 62% in the US and 19% in Europe over the course of 2021.

Source: Tradeweb

Technology changes the game for ETF RFQ trading

Another major factor continuing to drive widespread ETF adoption in institutional markets is the growing use of electronic trading protocols and reliance on data to optimise trading decisions. Investors are relying more heavily than ever on pre-trade price transparency to better inform counterparty selection and maximise every trade. This, in turn, incentivises liquidity providers to put their best price forward, creating a virtuous circle of time and cost-efficiency.

We must also not forget that electronic RFQ offers a variety of trading protocols, such as portfolio and list trading. Not only do they add efficiency to the execution process, they also help customers access robust pricing as liquidity providers have set themselves up to send back automated quotes for multiple line items in one go.

By pairing that demand for more informed trading decisions based on real-time data with electronic RFQ execution capabilities, institutional investors have been able to do more with less, gaining access to the exposures and liquidity they need, while managing costs.

The asset management industry has been paying attention to these trends, and – accordingly – they have launched all manner of new ETFs addressing increasingly specialised segments of the market. All told, there were over 200 new ETFs launched in the US in the first half of 2021 alone, roughly double the pace of the previous two years.

That is good news for institutional investors who can now tailor a strategy based on any number of attributes or themes without ever leaving the ETF ecosystem.

The increased specialisation and variety of ETF products, combined with the ease of trading on an electronic RFQ platform has even driven a change in the way institutional market participants behave, allowing for more cross-asset trading. For example, it is now commonplace for a credit ETF RFQ to go to the credit desk and the Treasury ETF RFQ to go to the Treasury desk. That was not how the world worked five years ago. That ETF desk sat on the equity floor. Now, we are seeing a great deal more cross-pollination through the ETF channel as the sell-side evolves into having the people that make markets in the underlying pricing the ETFs.

We are seeing this trend manifest itself in the use of AiEX, our automated execution technology, which makes it possible for market participants to automate trades based on a wide range of pre-determined criteria. In Europe, where the technology has been incredibly popular, we are consistently seeing roughly 75% of our ETF trades via AiEX.

Flexibility wins the day

More and more institutions are converting mutual funds into ETFs, as they represent a cheap and efficient way to focus on the investment strategies that matter to them the most, such as ESG. With inflation at its highest point in over three decades and the pandemic continuing to play a role in our everyday lives, all of these trends have coalesced to make ETFs a buy-side’s investment tool for all seasons.

ETFs have had many different use cases, ranging from cash equitisation and tax management to serving as hedging tools for traders wishing to express short-term tactical views on the market. Institutions leverage ETFs to balance their portfolio, helping them get into and out of markets quickly.

That is a big reason why 66% of respondents to a recent State Street survey of institutional investors said they will prioritise the use of indexing for broad or liquid core fixed-income exposures over the next three years. Furthermore, 71% said they have a “strong” or “very strong” appetite for increasing ETF use for core fixed-income strategies. We are seeing a similar response with our clients; in 2021, the number of fixed income ETFs traded on our platform rose by nearly 33% in the US and 9% in Europe over the previous year. The number of clients trading bond-based ETFs also grew by a respective 15.5% and 7%.

Ultimately, the acceleration of electronic trading, along with the combination of timely, granular data, instant liquidity and flexible, robust trading is what has driven the progression of the ETF market structure. In the case of the last two years of pandemic-driven market volatility, many of the macro trends have helped to amplify the growth of ETFs, but as the asset class gains critical mass, we believe it is becoming more likely that volumes will stay elevated no matter what as electronic trading continues to shape the way our markets operate.

Adam Gould is head of equities at Tradeweb

Related articles